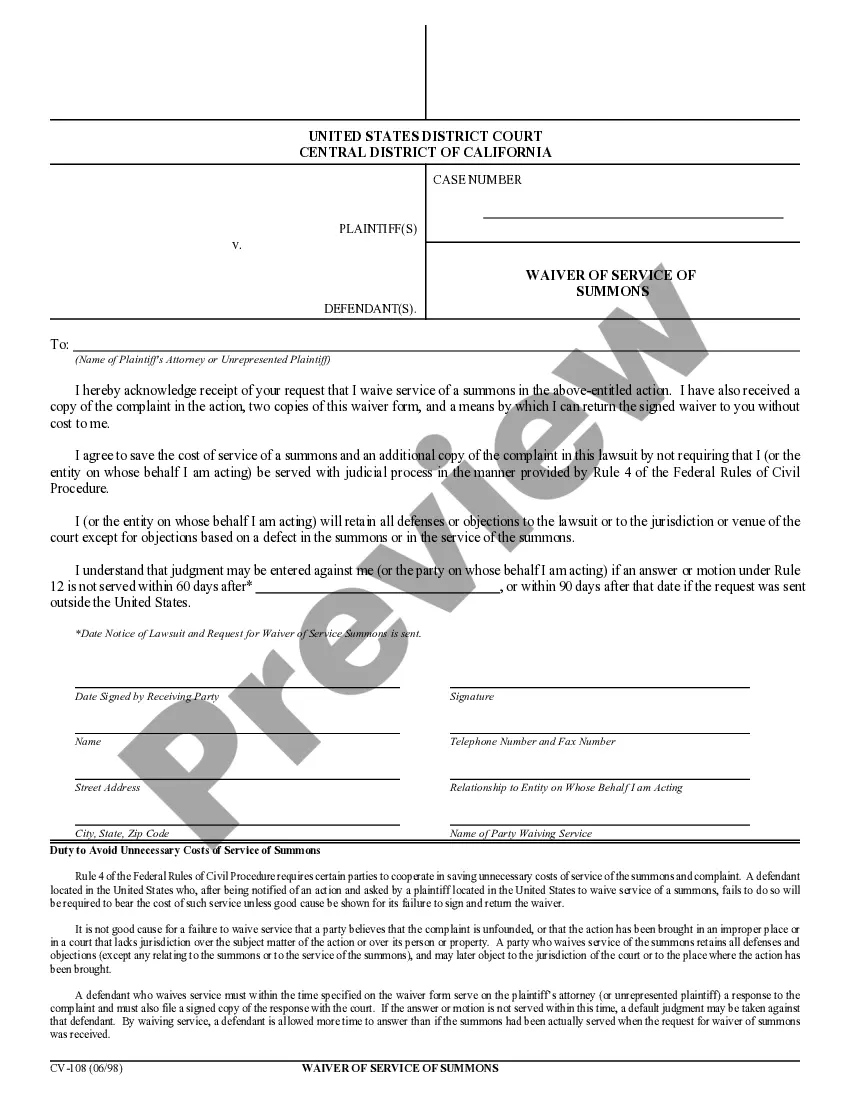

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Tax Exemptions For Seniors In Washington

Description

Form popularity

FAQ

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

At least 61 years of age or older. Retired from regular gainful employment due to a disability. Veteran of the armed forces of the United States receiving compensation from the United States Department of Veterans Affairs at one of the following: Combined service-connected evaluation rating of 80% or higher.

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

Who qualifies for a senior property tax exemption? he eligibility criteria for senior property tax exemptions vary by location. Generally, they are available to homeowners who are at least a certain age (often 65 or older) and meet specific income or property value requirements.

First-time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference (Portability) can file online.

How to claim exempt status on a W-4. To claim an exemption, you must complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. (In Box 7, write “EXEMPT”. Writing this will guarantee that withholdings are not taken from your future paychecks.)

Washington is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are not taxed. Wages are taxed at normal rates, and your marginal state tax rate is 0.0%.

To be eligible for the exemption, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer's Certificate of Exemption, Form DR-14) from the Florida Department of Revenue.