Florida Homestead Exemption Explained In Suffolk

Category:

State:

Multi-State

County:

Suffolk

Control #:

US-0032LTR

Format:

Word;

Rich Text

Instant download

Description

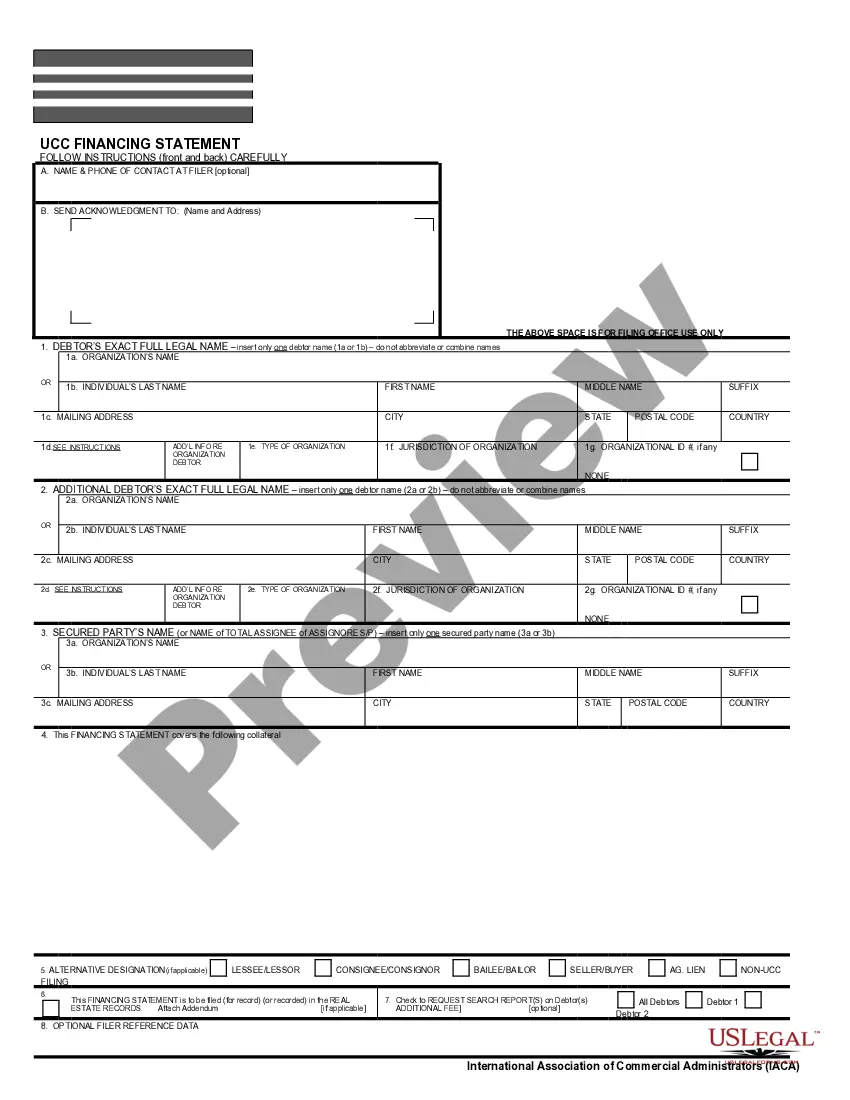

The Florida homestead exemption explained in Suffolk provides homeowners with property tax relief by exempting a portion of the assessed value of their primary residence from taxation. This summary highlights the benefits of the exemption, including potential savings on property taxes, which can be significant based on the property's value. To qualify, applicants must file specific forms and provide required documentation, such as proof of residency and, if applicable, copies of their homestead exemption. The utility of this exemption extends to various legal professionals, including attorneys, partners, owners, associates, paralegals, and legal assistants, as it allows them to advise clients effectively on tax planning and property ownership strategies. Proper filling and editing of forms are essential for successful applications, and the target audience should be aware of deadlines and local filing requirements. The form serves as a valuable tool for legal professionals working with clients who own property in Suffolk, facilitating understanding and navigation through the benefits of the homestead exemption.