Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Apply For Homestead Exemption In Georgia In Dallas

Description

Form popularity

FAQ

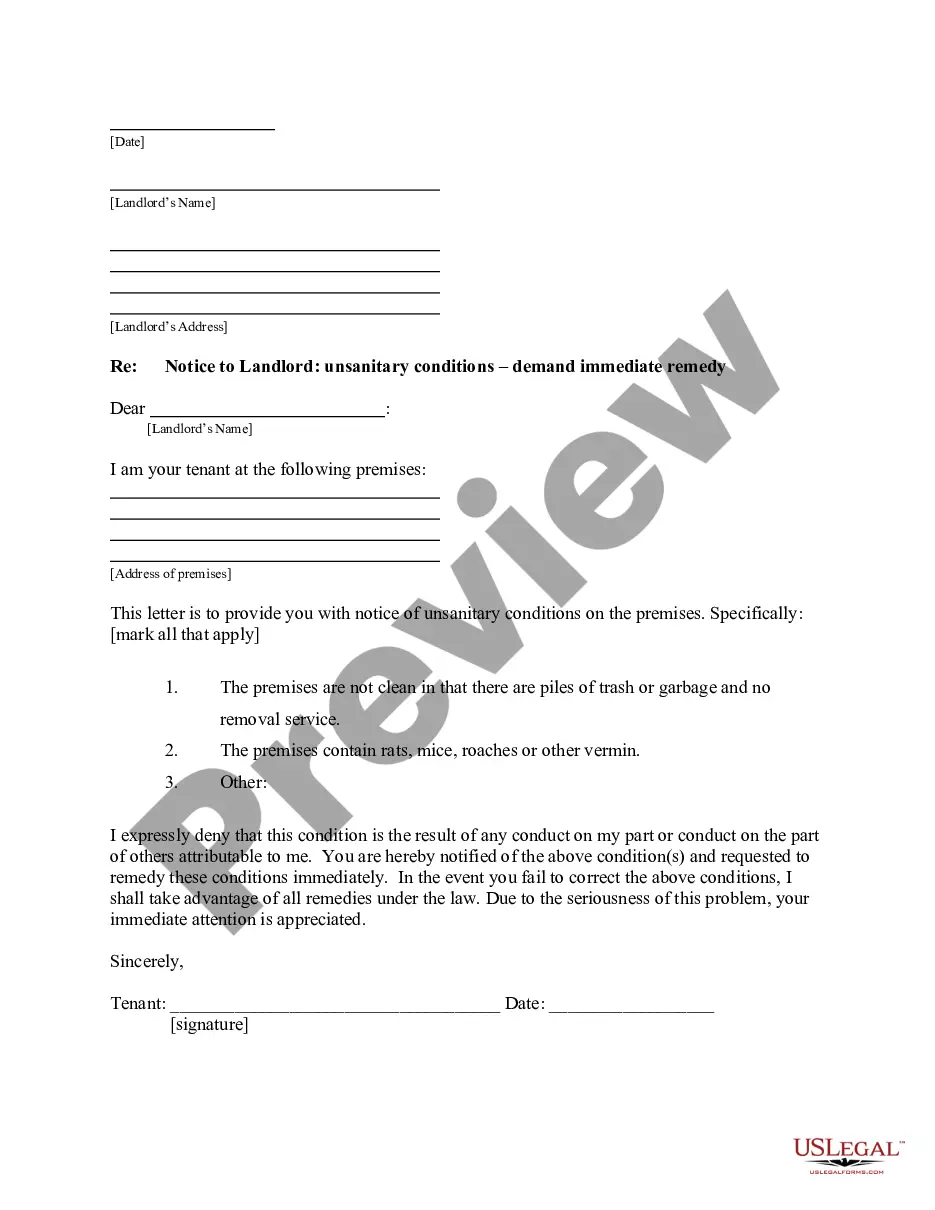

If you qualify for one of the other homestead exemptions listed and are age 65 or older as of January 1, you also qualify for an exemption from the State portion of ad valorem taxes in an amount equal to 100% of the value of your home and up to 10 acres of land.

To receive the benefit of the homestead exemption, the taxpayer must file an initial application. The application is filed with the Paulding County Tax Assessor's Office. First time homeowners need to bring a copy of their warranty deed to insure their application is filed correctly.

Check the Status of Your Application We strive to process exemptions as quickly as possible, but at times processing could take up to 90 days to process, per Texas Property Tax Code Section 11.45. Please allow at least 90 days to lapse before contacting our office to check when your application will be processed.

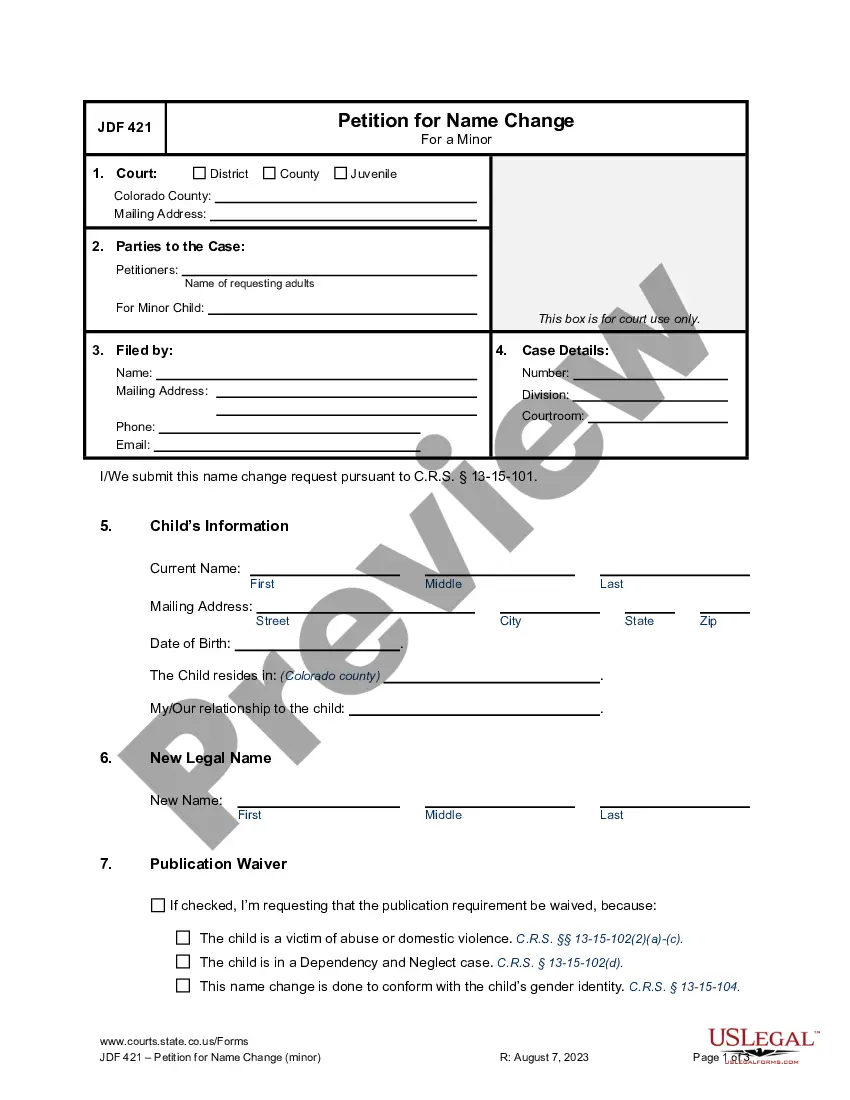

Dallas County Go to .dallascad. Select forms under navigation links on the left-hand side. Select Residential Homestead Exemption Application. Enter your address and follow the directions on the screen.

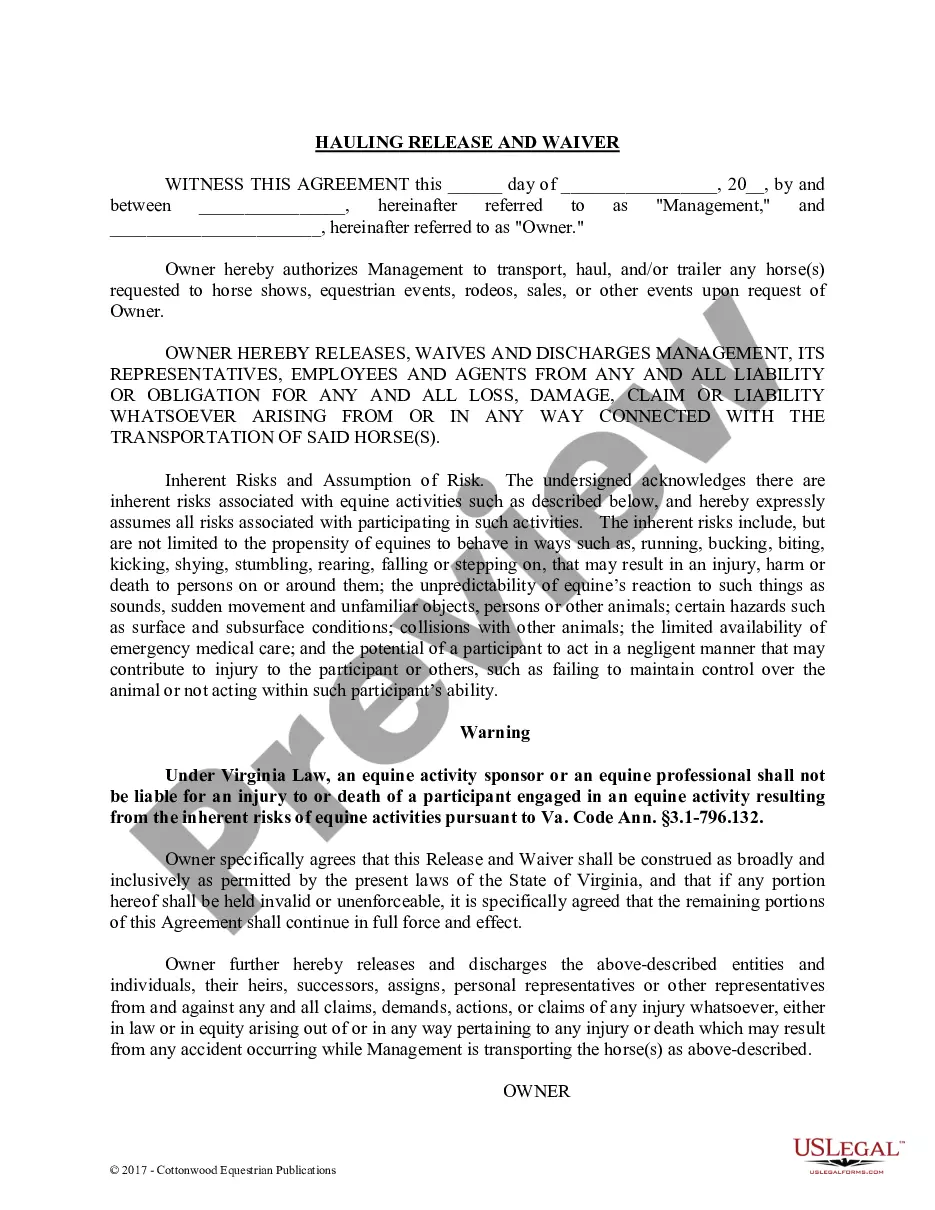

Texas offers several types of Homestead Exemptions: Standard Homestead Exemption: Provides a $100,000 reduction in the appraised value for school district taxes. For example, a home appraised at $300,000 would have its taxable value reduced to $200,000, saving homeowners hundreds of dollars annually.

To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership interest in the property and use the property as the individual's principal residence.

There are multiple ways to file a Homestead Exemption application Form 50-114, however the online option is the fastest, and details are provided in the transcript below.

Exemption Requirements In order to qualify for a homestead exemption, the applicant's name must appear on the deed to the property and they must own, occupy and claim the property as their legal residence on January 1 to be eligible for any exemption for that tax year.

If you are 62 by January 1 you can file for additional reduction of your assessed value towards school tax. Once you have applied and been approved for one of these age exemptions, the exemption will continue to increase at 65, 68 and 70. If you become ineligible or move you must reapply.