Single Member Llc Resolution Template With Signature Required In Sacramento

Description

Form popularity

FAQ

Single-member LLCs do not need resolutions, but they can still come in handy in certain situations, like if the company must defend itself in court. Documenting changes or actions not covered in the original bylaws or articles of incorporation can help an LLC protect itself from lawsuits or judicial investigations.

As mentioned, any LLC member can propose a resolution, but all members have to vote on it. The majority of LLC members must vote in favor of the resolution to pass it, but every LLC can have its own voting rules. For example, some LLCs may assign different values to different member votes.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

Your Initial Resolutions are a legal document stating who has control over your LLC, which can be used to prove LLC ownership. This document needs to be signed by the organizer of your LLC (the person who signed the Articles of Organization).

LLC resolutions should be signed by all members or authorized representatives of the LLC who are involved in the decision or action being documented in the resolution.

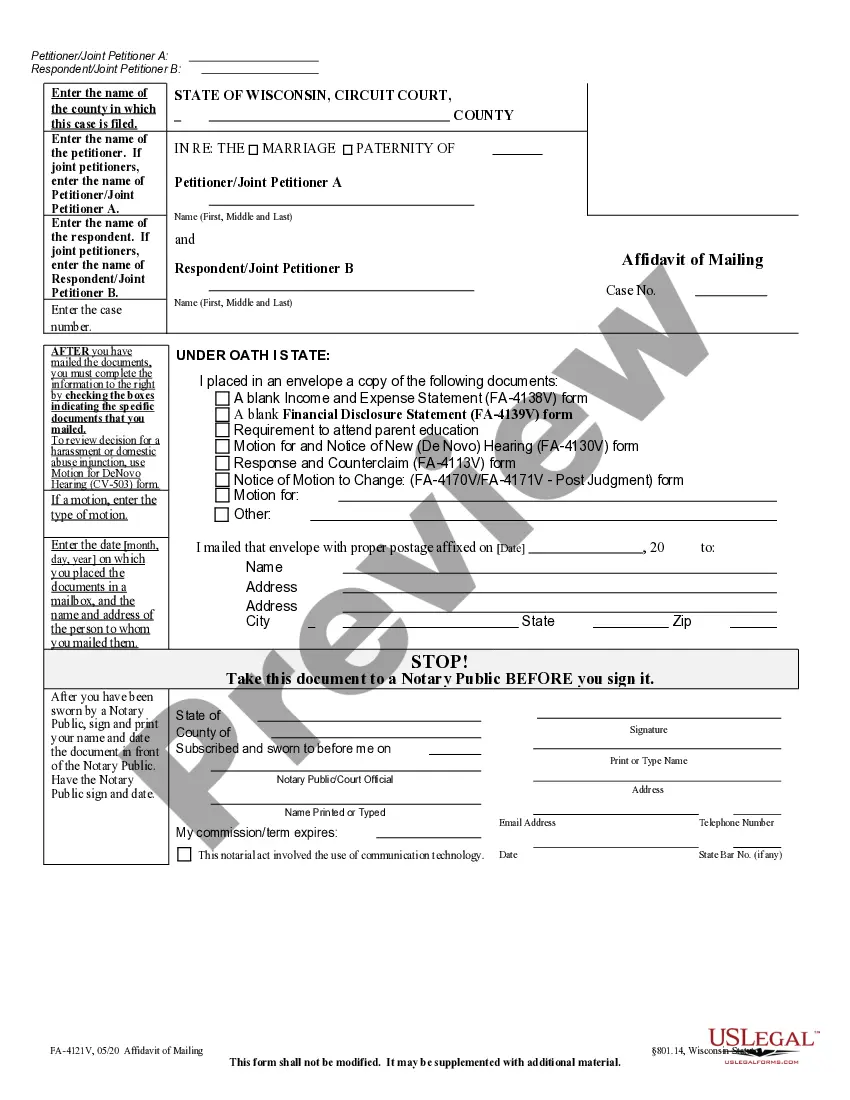

The law does not require an LLC Resolution to be notarized or witnessed by any third parties. In concept, there could be a requirement within a certain limited liability company which does require it – but that would be uncommon.

Board Resolution Granting Signing Authority BE IT RESOLVED, that the board of directors hereunder authorizes Authorized Individual's Name, Position, to sign, execute, and endorse on behalf of Company Name for all financial transactions, legal documents, and other official agreements.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

While a single member LLC does not file California Form 565, they must file California Form 568 which provides details about the LLC. Per the CA FTB Limited Liability Company (LLC) website: If your LLC has one owner, you're a single member limited liability company (SMLLC).

Voting Resolutions: Voting resolutions are used to make important decisions in the LLC. Voting resolutions require the approval of a certain number of members for the resolution to pass. Consent Resolutions: Consent resolutions are used when all members of the LLC agree to a certain action or decision.