Single Member Llc Resolution Template For Open Bank Account In Massachusetts

Description

Form popularity

FAQ

The largest drawback of operating a single-member LLC in California is the hefty $800 franchise tax, and additional LLC fees on high income brackets. ing to Business Initiative, 10.34% of businesses in the United States are sole proprietorships.

Personal identification and information: When opening a business bank account for your LLC, you will need to provide personal identification and details such as your driver's license or passport, your home mailing address, date of birth, personal phone number, your email address, and also your Social Security number.

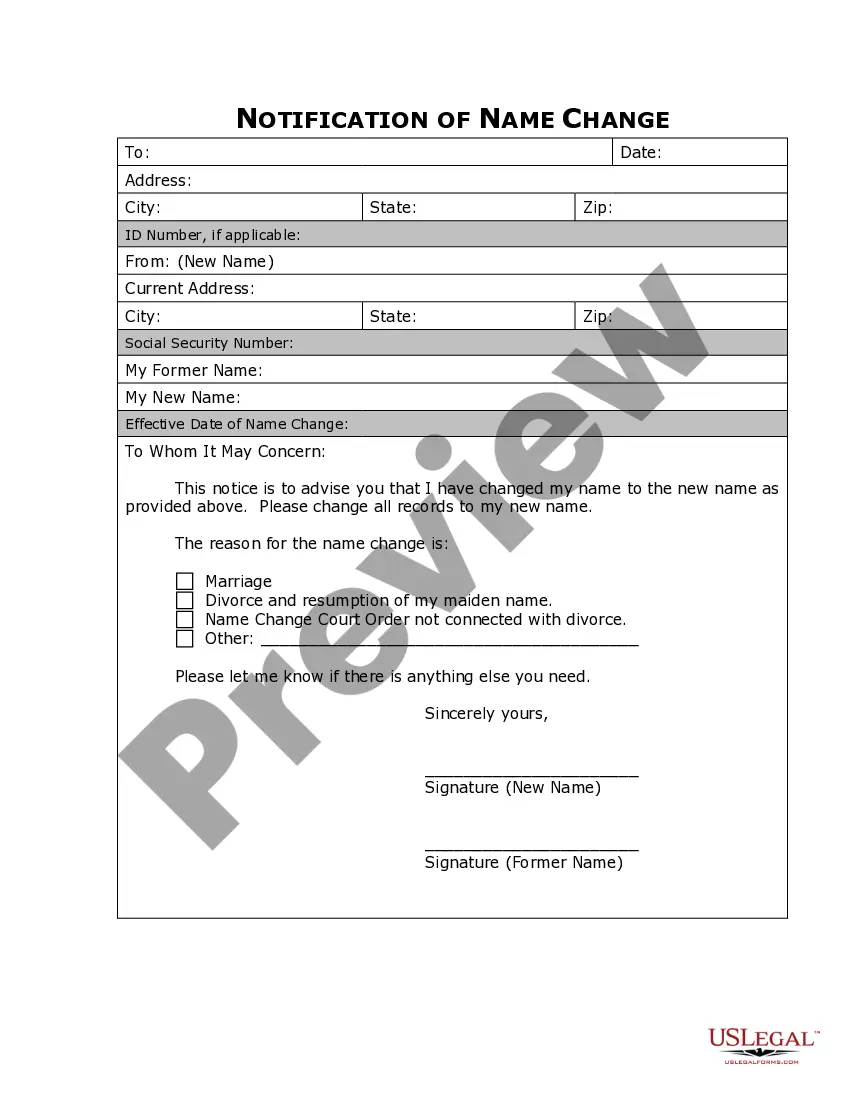

What should a resolution to open a bank account include? LLC name and address. Bank name and address. Bank account number. Date of meeting when resolution was adopted. Certifying signature and date.

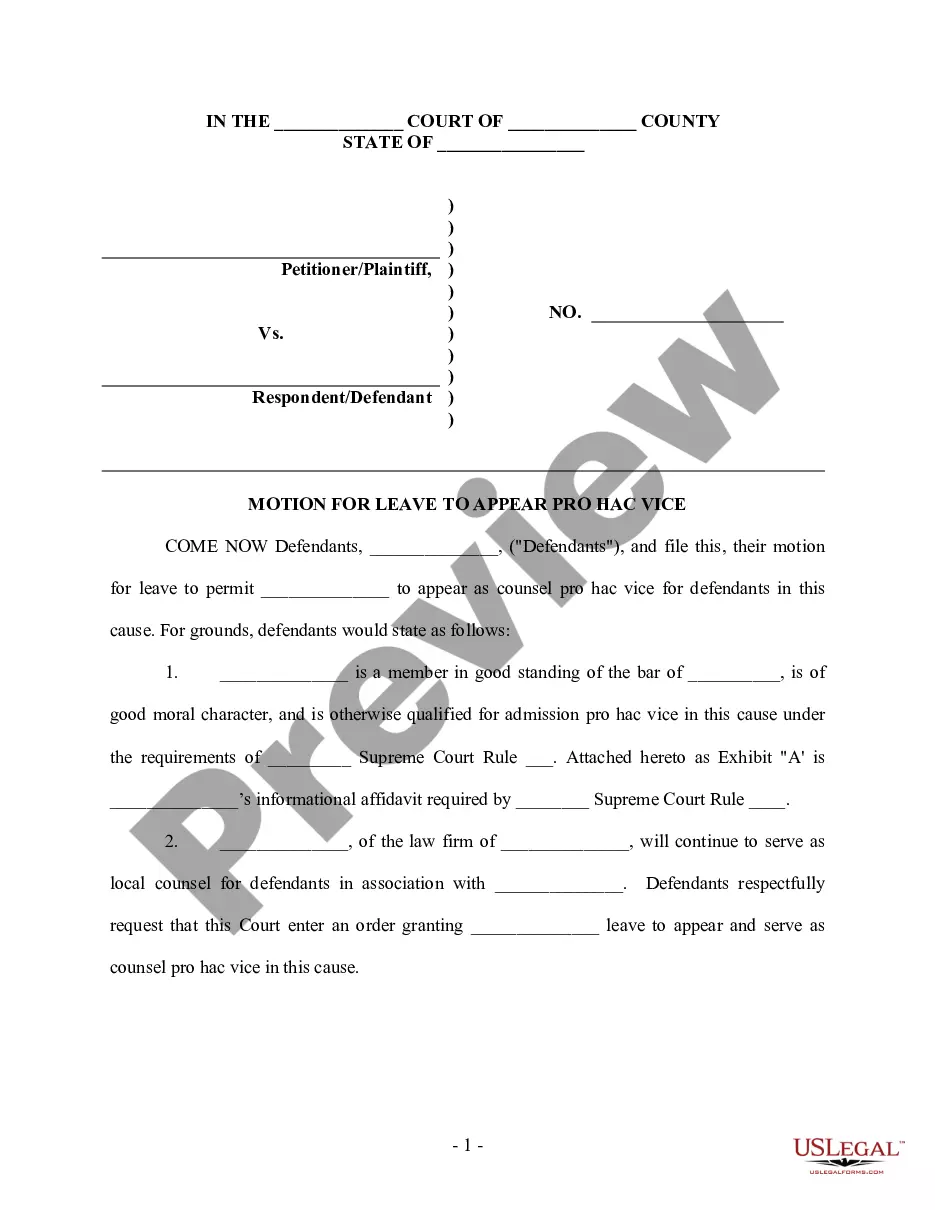

“RESOLVED THAT a Current Account in the name of the Company be opened with ____________ Bank, _____________ , for the operations of the activities of the Company and the said Bank be and is hereby authorized to honour all cheques, drafts, bills of exchange, promissory notes and other negotiable instrument, signed drawn ...

Social Security Number (SSN) Single-member LLCs with no employees and aren't liable for excise tax can use their SSN to open a business bank account. You can find your social security number on your SSN card or W-2 wage and tax statement.

Best LLC business bank accounts American Express® Business Checking. Axos Bank. ® Business Advantage Fundamentals™ Banking. Bluevine Business Checking. Chase Business Complete Banking® ... Found Small Business Banking. Grasshopper Innovator Business Checking Account. LendingClub Tailored Checking.

Personal identification and information: When opening a business bank account for your LLC, you will need to provide personal identification and details such as your driver's license or passport, your home mailing address, date of birth, personal phone number, your email address, and also your Social Security number.

When you create a resolution to open a bank account, you need to include the following information: The legal name of the corporation. The name of the bank where the account will be created. The state where the business is formed. Information about the directors/members.

How to Open an LLC Bank Account Name and address of business. Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in the following 9-digit format XX-X, or, if the LLC is a single member LLC, the EIN of the company or the Social Security Number (SSN) of the single member.