Corporate Resolution Bank Account With Opening A New In Wayne

Description

Form popularity

FAQ

Get documents you need to open a business bank account Employer Identification Number (EIN) (or a Social Security number, if you're a sole proprietorship) Your business's formation documents. Ownership agreements. Business license.

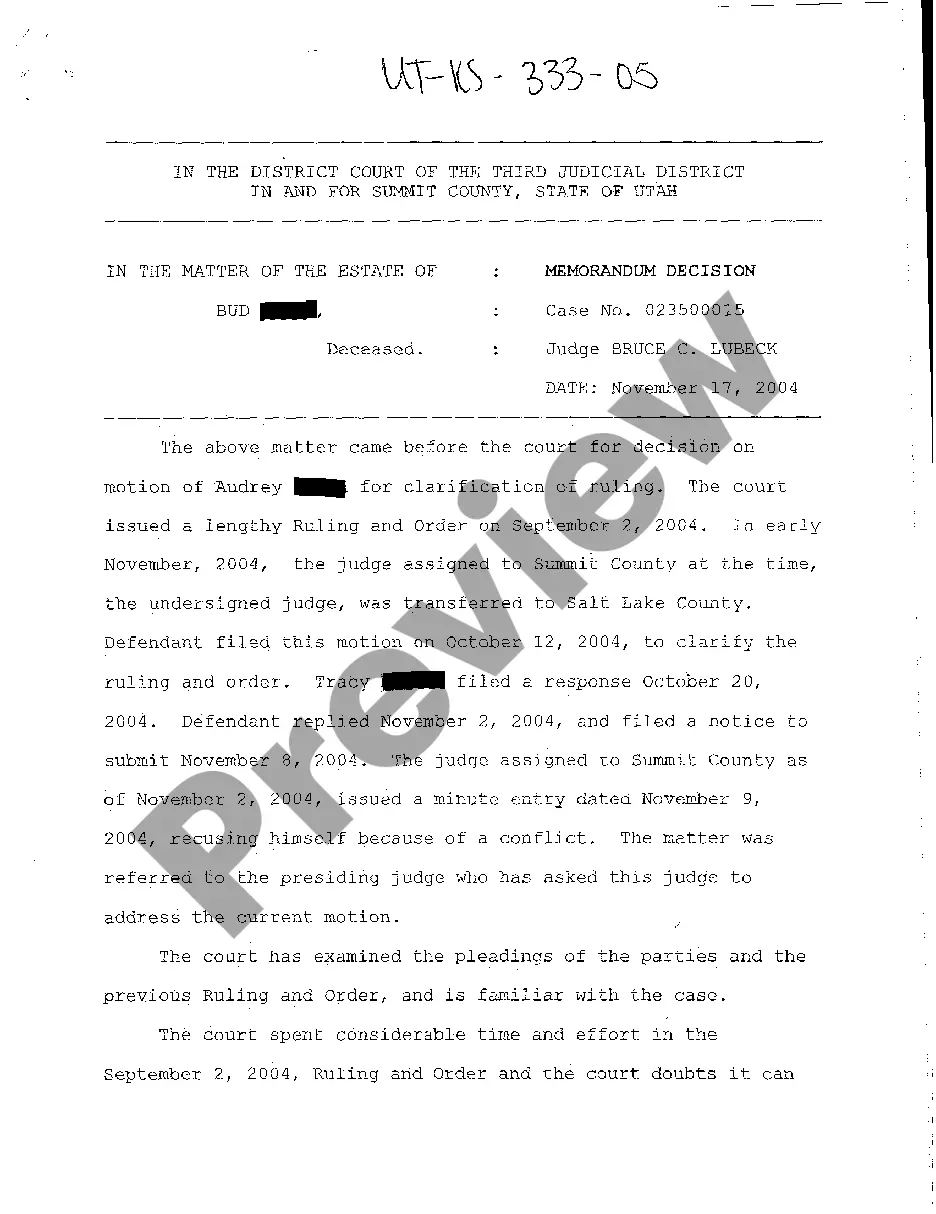

Since corporate bank accounts are more formal, they can only be operated by a list of authorized signatories. The corporation holding the account can appoint the signatories by passing relevant board resolutions.

In the small business world, it's perfectly normal for someone like your spouse or family member to need access to the business financials if they help manage the business. Other stakeholders who might need access to financials include your: Bookkeeper.

HMRC can check your bank accounts without your explicit permission. While this may sound alarming, there are safeguards in place to protect your information. But if HMRC feel they have probable cause to investigate, they can check documents like your bank records directly with the third-party.

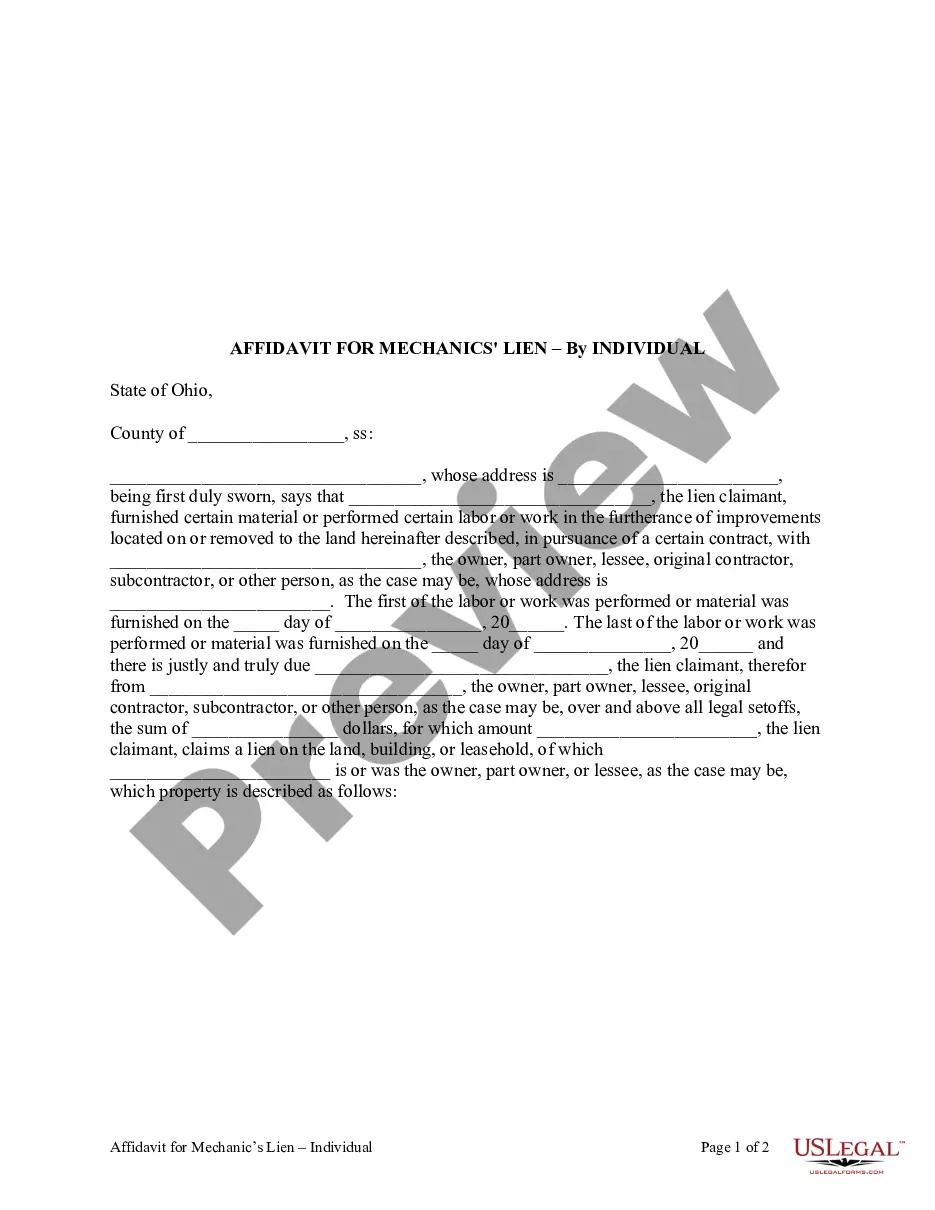

Banks often require banking resolutions from companies. They serve as proof that the person opening a business bank account is authorized to do so. Some banks have a standard form that companies must use for their banking resolution.

For the purpose of Corporate Internet Banking, any non-individual customer, whether it is a single man enterprise, small business enterprise, firm, trust, institution, Government organization or large conglomerate is treated as a Corporate.

A banking resolution is a formal document passed by a corporation or LLC's board of directors authorizing specific individuals to manage the company's bank accounts. This includes the ability to open accounts, sign checks, and handle other banking tasks.

An authorized signer is a person who has access to your business bank account and can conduct transactions on behalf of the business. For example, an authorized signer may be able to take the following actions: Deposit checks. Sign checks.

Limited/Private Company Certificate of incorporation original and one (1) copy of the same. Original and photocopy of Memarts or CR 1,2,8,12 and statement of nominal capital. Directors Resolutions to open an account with a signing mandate. Company PIN certificate. Directors KRA PIN. Directors copies of IDs.

You Only Need to Prepare: Completely filled out RCBC account opening forms. One (1) valid photo-bearing government issued identification card of each authorized signatories and corporate secretaries. Certificate of Registration issued by DTI, SEC, BSP. Articles of Incorporation/Partnerships or Association and By-Laws.