Corporate Resolution Bank Account With Closing In Washington

Description

Form popularity

FAQ

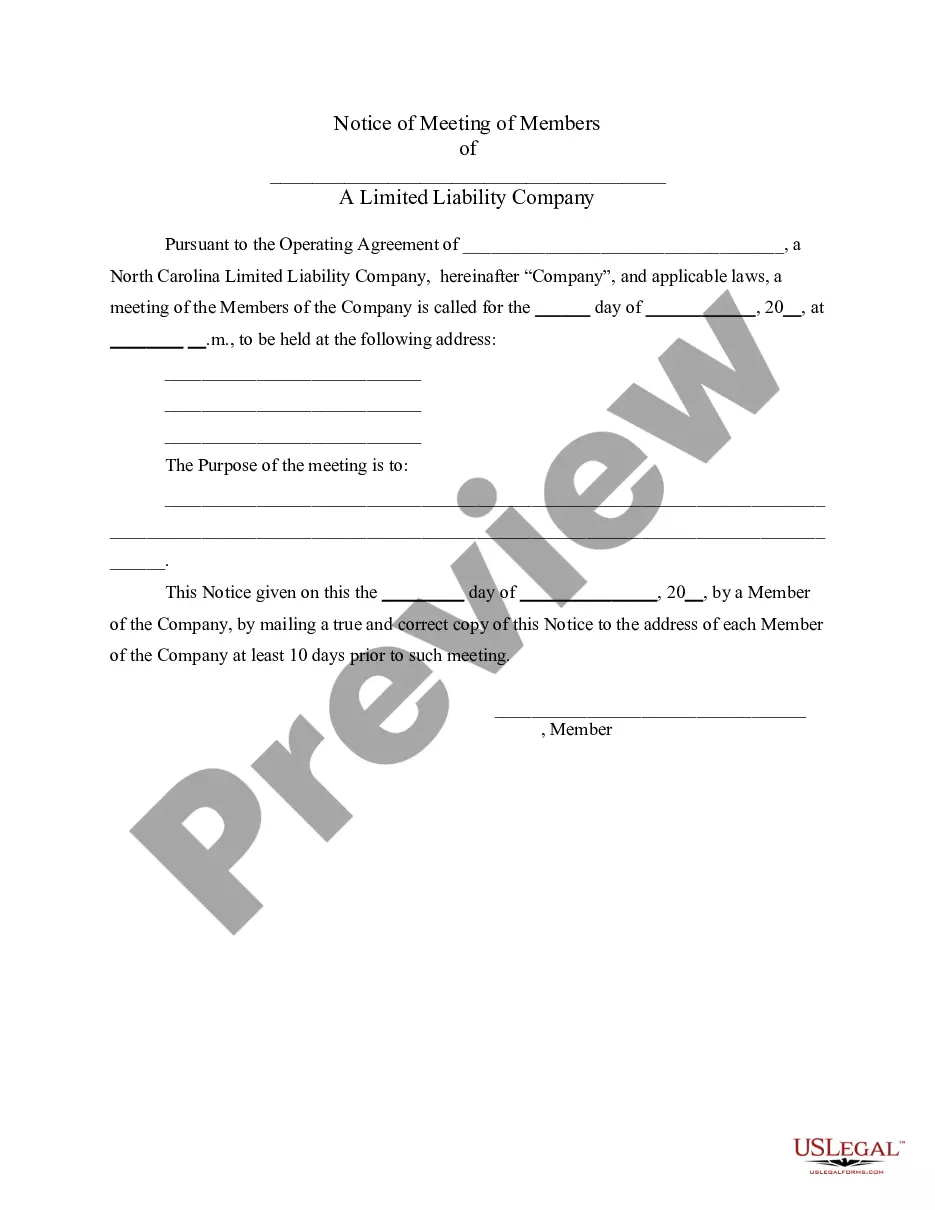

LLCs are not required to create banking resolutions by law. But their operating agreement might require a banking resolution. Even if an LLC's operating agreement does not require a banking resolution, it can be helpful to have one.

Resolution is a way to manage the failure of a bank, building society, or central counterparty. We use it to minimise the impact on depositors, the financial system and public finances.

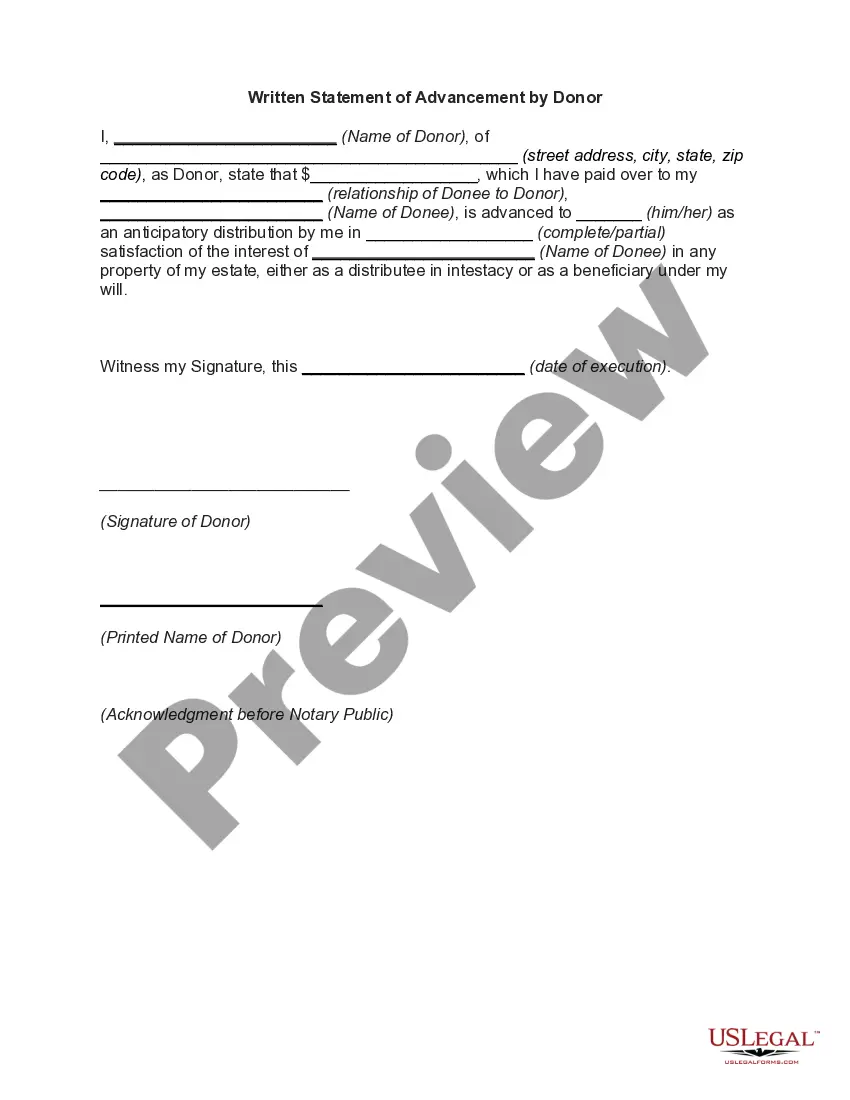

Banking resolutions are generally part of the process for opening a bank account for your company. Check with your bank to see what their requirements are. To authenticate it as a stand-alone document, the banking resolution is signed by the corporate secretary and stamped with the corporation's corporate seal.

When you create a resolution to open a bank account, you need to include the following information: The legal name of the corporation. The name of the bank where the account will be created. The state where the business is formed. Information about the directors/members.

What should a resolution to open a corporate bank account include? Corporation name and address. Bank name and address. Bank account number. Date of resolution. Certifying signatures and dates. Corporate seal.

How Do You Close a Business Bank Account? Step 1: Review Your Account. Step 2: Transfer or Close Linked Services. Step 3: Withdraw or Transfer Funds. Step 4: Contact Your Bank. Step 5: Formally Close the Account.

“RESOLVED THAT the Bank Account No. __________, ___________Branch with __________ Bank Limited, be and is hereby closed with immediate effect and aforesaid Bank be and is hereby requested to transfer the remaining balance in the another existing Bank wit Account No.

Board members of a corporation usually draft a banking resolution at their first board meeting. A Limited liability company (LLC) should also have a banking resolution. This simplifies the process of opening a bank account. Banks often require banking resolutions from companies.

How to close your account Email: uifiles@esd.wa. Mail: Employment Security Department. P.O. Box 9046. Olympia, WA 98507-9046. Fax: 800-794-7657.

Dissolve a Washington Corporation Submit Revenue Clearance Certificate Application. You must begin the dissolution process by filing a Revenue Clearance Certificate Application to the Washington Department of Revenue. Await Processing. File Articles of Dissolution. Wait for Processing. Contact Your Registered Agent.