Corporate Resolution To Sell Real Estate Without A License In Palm Beach

Description

Form popularity

FAQ

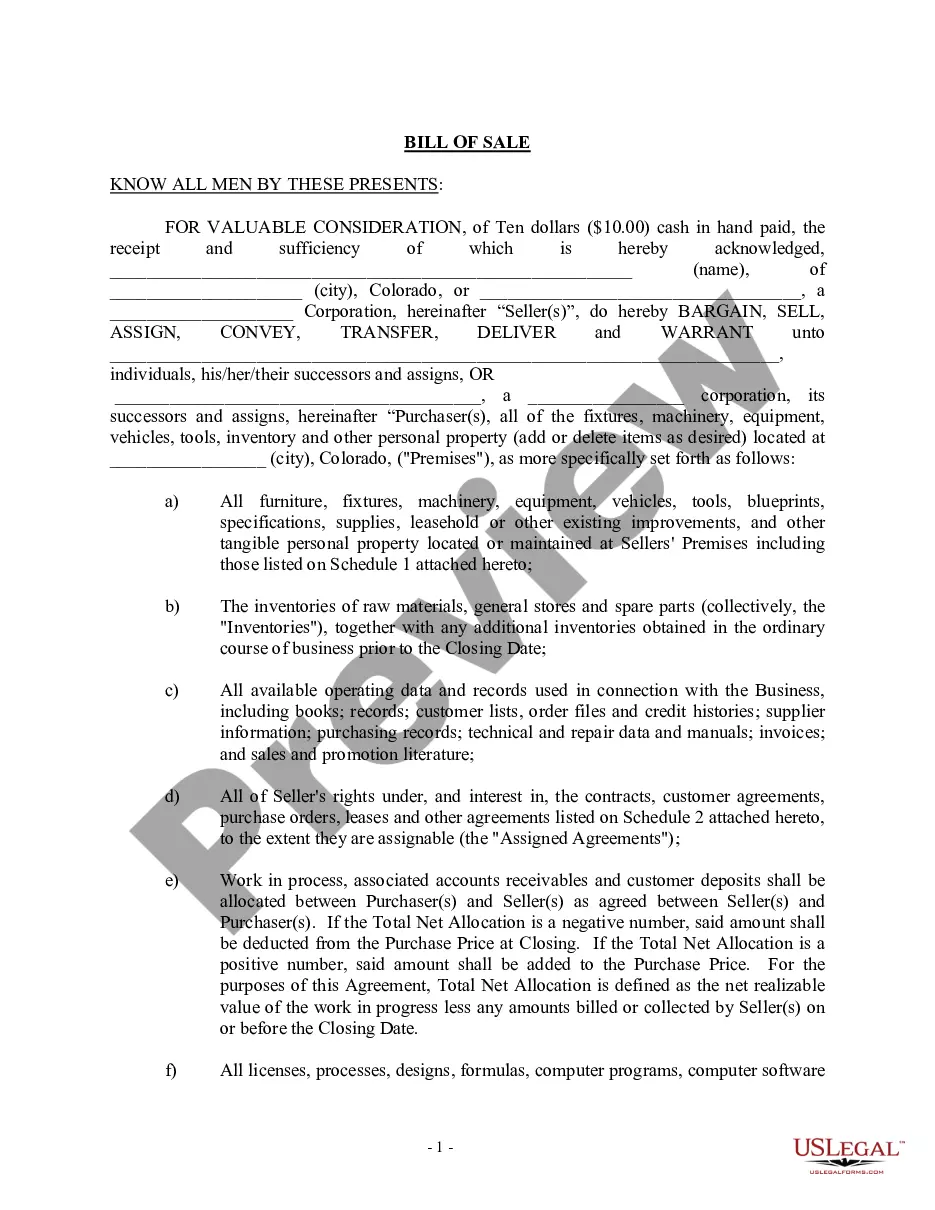

Resolutions of the board of directors authorizing the sale of all or substantially all of the assets of a corporation. These resolutions are drafted as standard clauses and should be inserted into board minutes or a form of unanimous written consent.

No, corporate resolutions do not require notarization. They become legally binding upon the signatures of authorized board members or shareholders.

In the event that a company decides to sell its property, it will require a corporate resolution to sell real estate. This is a straightforward document that cites the name of the buyer and the location of the company's property. The location of the real estate sold may be at a street address, section, block, or lot.

A corporate resolution generally involves major decisions such as the changing of ownership structure, voting in of new board members, or the sale of company shares. A corporate resolution is also generally used to authorize people to access corporate funds, sign checks and acquire loans on behalf of the corporation.

The only exemption is someone with a 4 year degree, or higher, in real estate. To obtain this exemption you must submit your original transcripts to: Division of Real Estate – Education Section – 400 West Robinson Street, Suite N801, Orlando, Florida 32801.

Yes, In the State of Florida, there is a singular license for real estate agents with no distinction between commercial and residential.

As long as you're marketing the contract instead of marketing the property itself, wholesaling is completely legal in Florida without a license. This is a common legal stipulation that is observed by many other states in regard to wholesaling real estate, and one that wholesalers should never forget.

Yes, business brokers in Florida must be licensed. In Florida, state law defines “real estate” to include any business enterprises or business opportunities.

The following states require a license to practice as a business broker: Arizona, California, Colorado, Florida, Georgia, Idaho, Illinois (registration only), Minnesota, Nebraska, Nevada, Oregon (only if real estate transfer is part of the transaction), Rhode Island, South Dakota, Utah, Wisconsin, and Wyoming.