Installment Contract Agreement With Seller In Tarrant

Description

Form popularity

FAQ

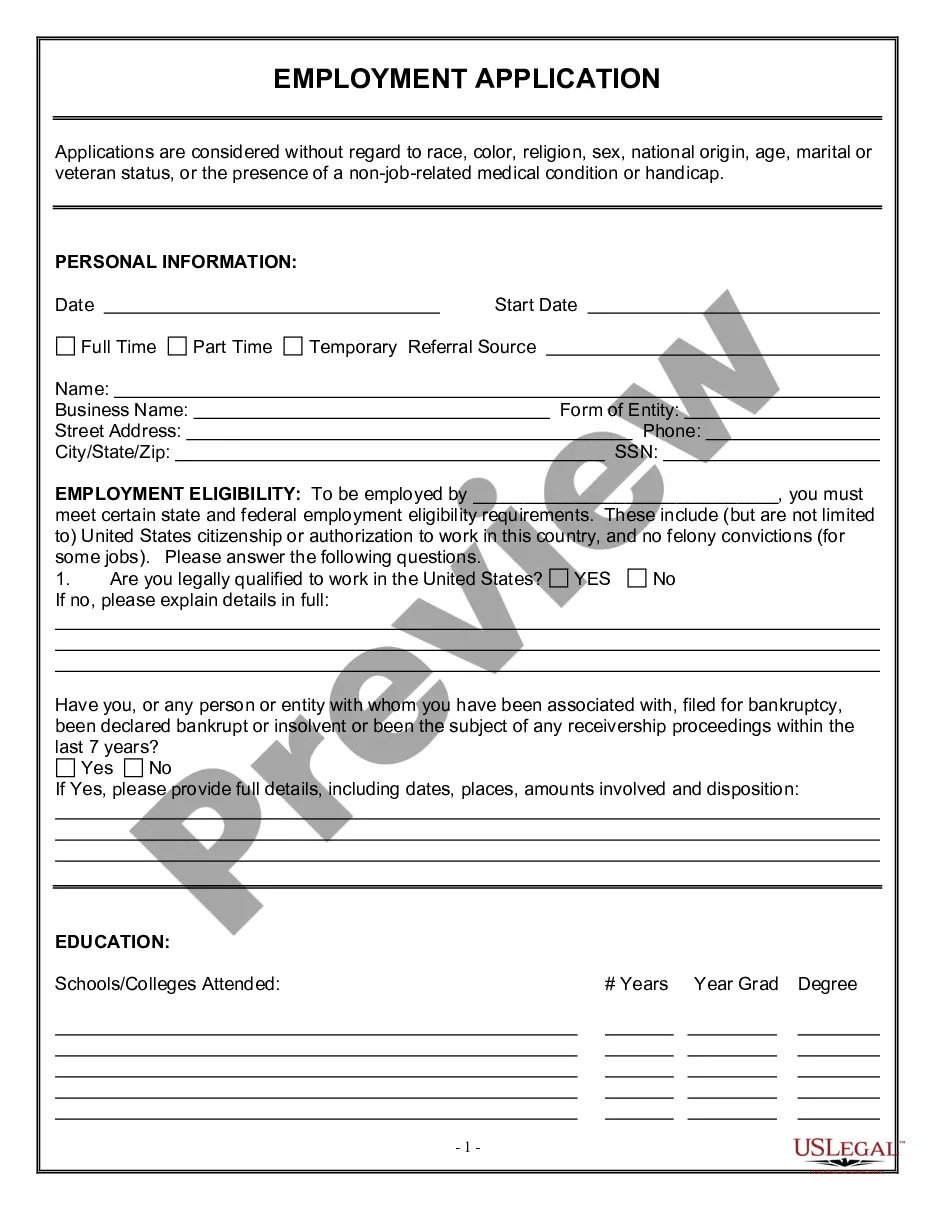

The enforceability of a Texas contract relies on several factors. The first one being mutual agreement between the parties, where they both accept and understand the definite terms stated in an offer. If both parties do not completely agree on the terms, then the contract is considered invalid.

A contract is void if one party forces the other to agree using physical, emotional, or financial threats or coercion.

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time.

Texas contract cancellation laws provide consumer protections, including the three-day right of rescission for sales made outside a seller's primary place of business. The three-day cancellation window applies to door-to-door sales and similar transactions, but not to purchases under $25 or to real estate transactions.

Contract Formation in Texas Offer and acceptance: One party must make a clear offer, which the other party must accept. Consideration: There must be a valuable exchange between the parties. Capacity: All parties involved must be legally competent to enter into a binding agreement.

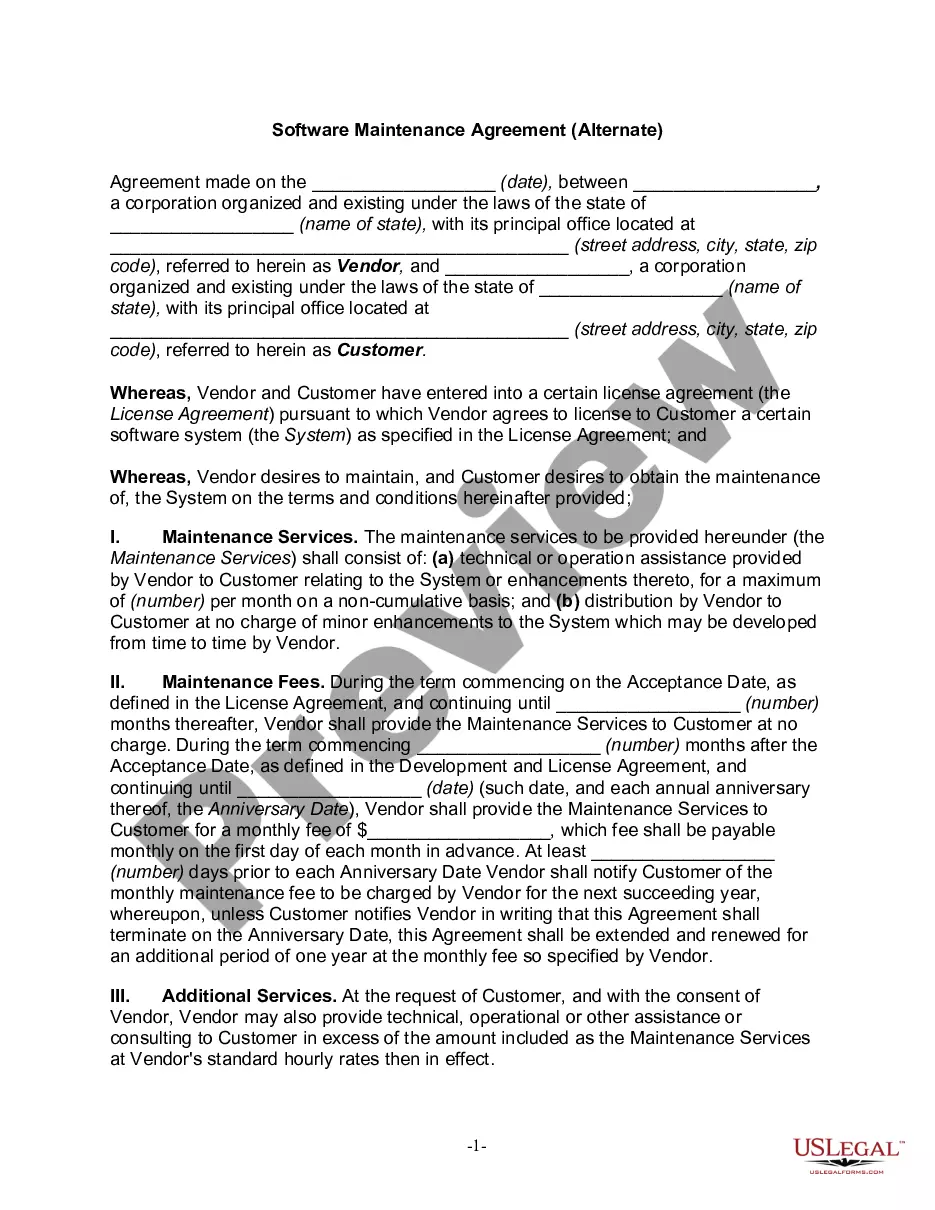

Ing to Boundy (2012), typically, a written contract will include: Date of agreement. Names of parties to the agreement. Preliminary clauses. Defined terms. Main contract clauses. Schedules/appendices and signature provisions (para. 5).

Prepare a contract Provide details of the parties. Describe services or results. Set out payment details. Assign intellectual property rights. Explain how to treat confidential information. Identify who is liable – indemnity. Provide insurance obligations. Outline any subcontracting agreements.

The creditor should sign the Letter in the space provided before sending it to the debtor. If the debtor agrees to the repayment plan set out in the Letter Accepting Payments in Instalments, they should countersign the Letter in the space provided. This makes the Letter a binding agreement between the parties.

Typically, an owner finance transaction is set up using three documents. A promissory note outlining the terms of payment, a Warranty Deed with Vendor's Lien conveying title in the property to the buyer, and a Deed of Trust giving the seller the right to foreclose on the property if the buyer stops making payments.