Installment Contract Agreement With Credit Card In North Carolina

Description

Form popularity

FAQ

North Carolina Consumer Protection Act (NCCPA): The cornerstone of consumer protection in North Carolina is the North Carolina Consumer Protection Act (NCCPA). This legislative act prohibits unfair and deceptive trade practices, such as false advertising, fraudulent schemes, and deceptive business practices.

CONSUMER CREDIT PROTECTION ACT - PUBLIC LAW 90-321, APPROVED MAY 29, 1968 (82 STAT. 146, 15 U.S.C. 1601) THE ACT, WHICH SAFEGUARDS CONSUMERS BY REQUIRING FULL DISCLOSURE OF THE TERMS AND CONDITIONS OF FINANCE CHARGES IN CREDIT TRANSACTIONS OR IN OFFERS TO EXTEND CREDIT, IS PRESENTED AS AMENDED THROUGH MARCH 1976.

The Consumer Credit Act gives you the right to withdraw from any regulated credit agreement, whether it was arranged in person, by phone, by post or online. You typically have 14 days after signing the agreement (or receiving a copy of the agreement) to withdraw, although this can vary.

North Carolina Consumer Protection Act (NCCPA): This legislative act prohibits unfair and deceptive trade practices, such as false advertising, fraudulent schemes, and deceptive business practices.

§ 24‑1. Legal rate is eight percent. Except as otherwise provided in G.S. 136‑113, the legal rate of interest shall be eight percent (8%) per annum for such time as interest may accrue, and no more.

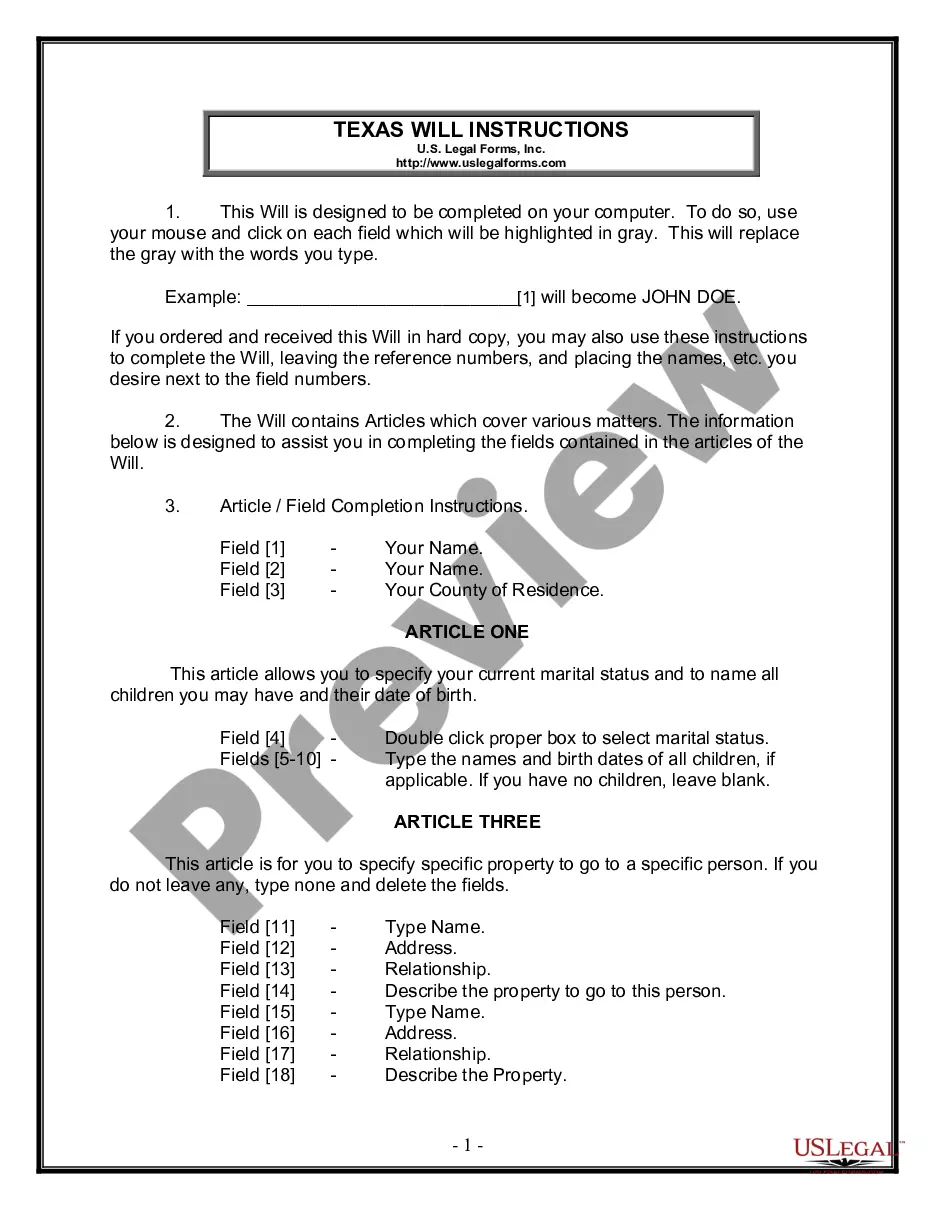

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.