Installment Loan Contract With Bad Credit In Bronx

Category:

State:

Multi-State

County:

Bronx

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

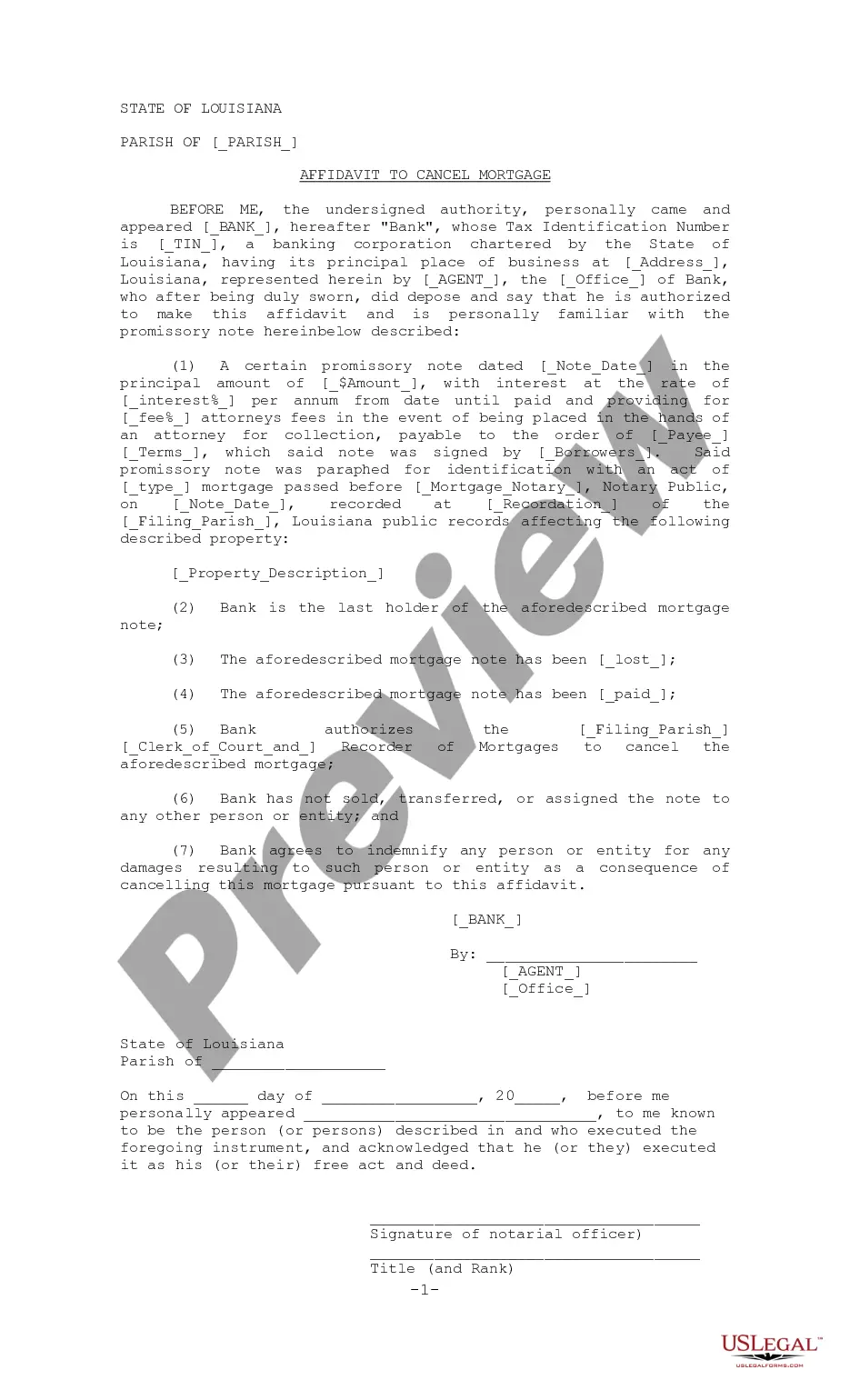

The Installment Loan Contract with Bad Credit in Bronx is a legal document designed for individuals looking to acquire financing despite poor credit histories. This agreement outlines critical components such as the total purchase price, applicable interest rates, payment terms, and potential late fees. Key features include specifying installment amounts, due dates, and stipulations regarding late payments and default conditions. It is structured to protect both the seller's and purchaser's rights, detailing remedies available to the seller in the event of default. Completing this form requires clear information on loan amounts, interest, and collateral to secure the loan. The agreement serves a useful purpose for attorneys, partners, owners, associates, paralegals, and legal assistants, providing a framework for advising clients on borrowing options and protecting their interests. It also emphasizes the importance of clear communication regarding obligations, which is essential for both parties to avoid misunderstandings. Users can edit the template as needed to fit specific loan situations and ensure compliance with local laws.

Free preview

Form popularity

FAQ

Credit Score Required for Personal Installment Loans by Lender LenderMin. Credit ScoreLoan Amounts LendingClub 600 $1,000 - $40,000 FreedomPlus 620 $5,000 - $50,000 Best Egg 640 $2,000 - $50,000 LightStream 660 $5,000 - $100,0003 more rows •