Foreign Independent Contractor Agreement Template For Massage Therapist In Utah

Description

Form popularity

FAQ

Yes, massage therapists can be 1099s (independent contractors) in California, but it's important to understand that the classification is subject to strict rules under California law, primarily due to Assembly Bill 5 (AB5).

Session Rates and Annual Income $75 per session: Having around 5.3 sessions each day could earn you just under $100,000 a year after 1,332 sessions. $100 per session: Four sessions a day. That's about $100,800 a year from 1,008 sessions.

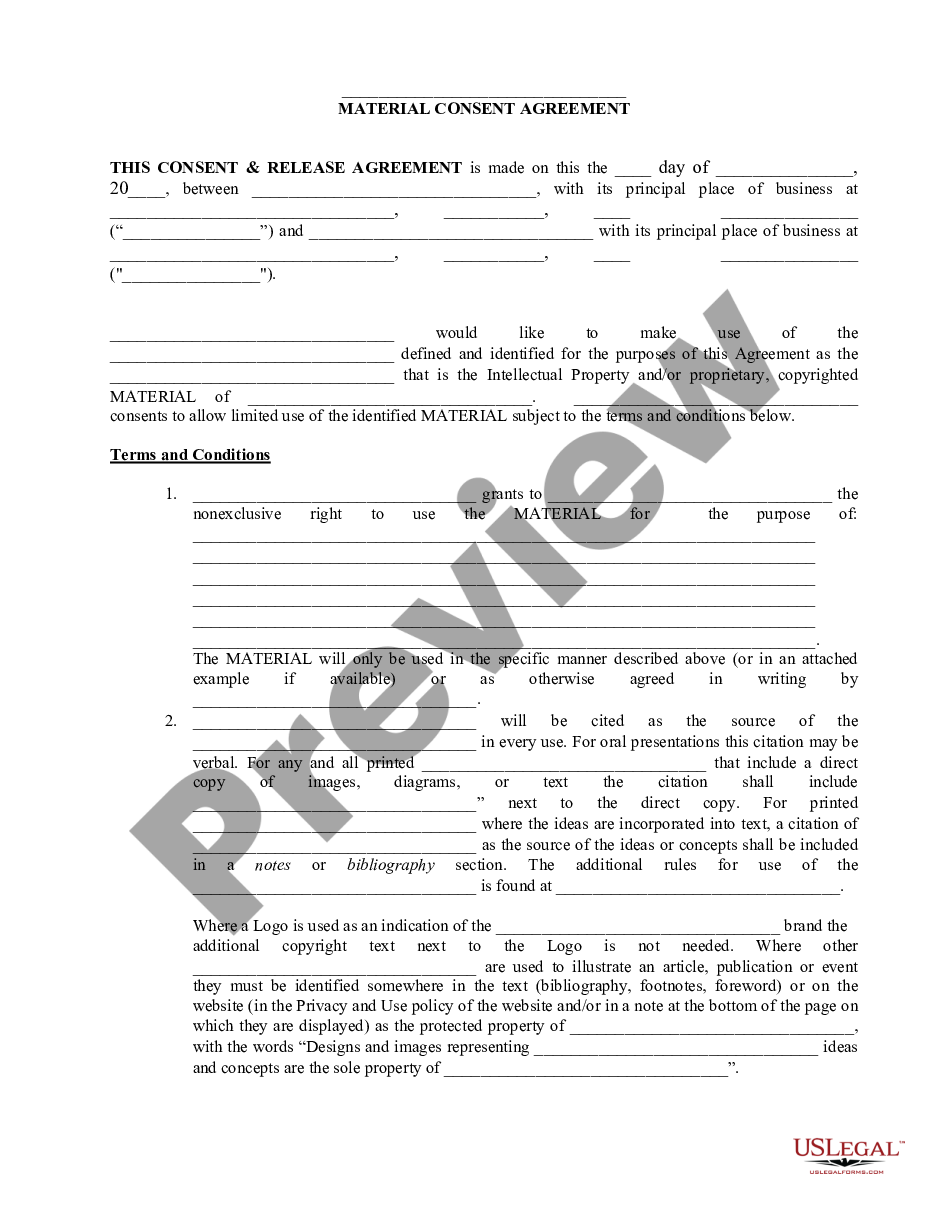

Below are eight important points to consider including in an independent contractor agreement. Define a Scope of Work. Set a Timeline for the Project. Specify Payment Terms. State Desired Results and Agree on Performance Measurement. Detail Insurance Requirements. Include a Statement of Independent Contractor Relationship.

Yes! It's true that many self-employed individuals, especially those who work from home, never get a business license in Utah. But if your local government finds out that you're running an unlicensed business, you might be fined, or even be prevented from doing business until you obtain the license.

The current self-employment tax rate is 15.3%. You'll be able to deduct some of your business expenses from your income when calculating how much self-employment tax you owe.

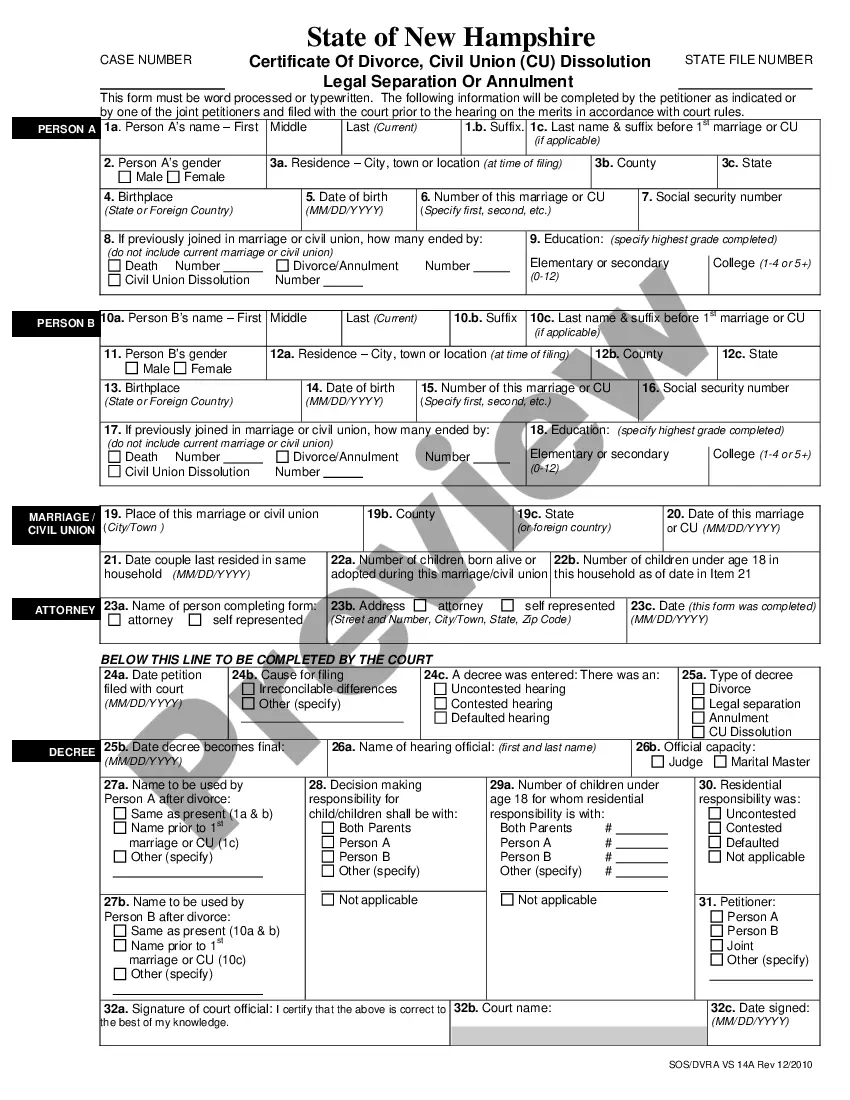

There is no single established definition of independent contrac- tor under Utah law. Different tests are applied depending on the circumstances to determine whether an individual is an employee or an independent contractor for purposes of: ∎ Workers' compensation. ∎ Unemployment insurance.

Contractor agreement is a contract between a company and a contractor hired by them. A contractor performs specific project/tasks. It defines the overall terms and conditions regarding the work undertaken by the contractor as well as their role, duties, and obligations.

Form W-9. The IRS requires contractors to fill out a Form W-9, a request for a Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity ...