Independent Contractor Agreement For Owner Operators In Nassau

Description

Form popularity

FAQ

Entities provide a Form 1099-Misc to independent contractors and Form W-2 to employees. See this article on worker classification for more information. However, there may be instances where a worker may be serving as an independent contractor and an employee for the same entity.

Submit a paper Report of Independent Contractor(s) (DE 542) using one of the following options: Downloading a fill-in DE 542 (PDF). Ordering the form to be mailed to you through our Online Forms and Publications. Printing your data directly from your computer to the DE 542 by following the Print Specifications (PDF).

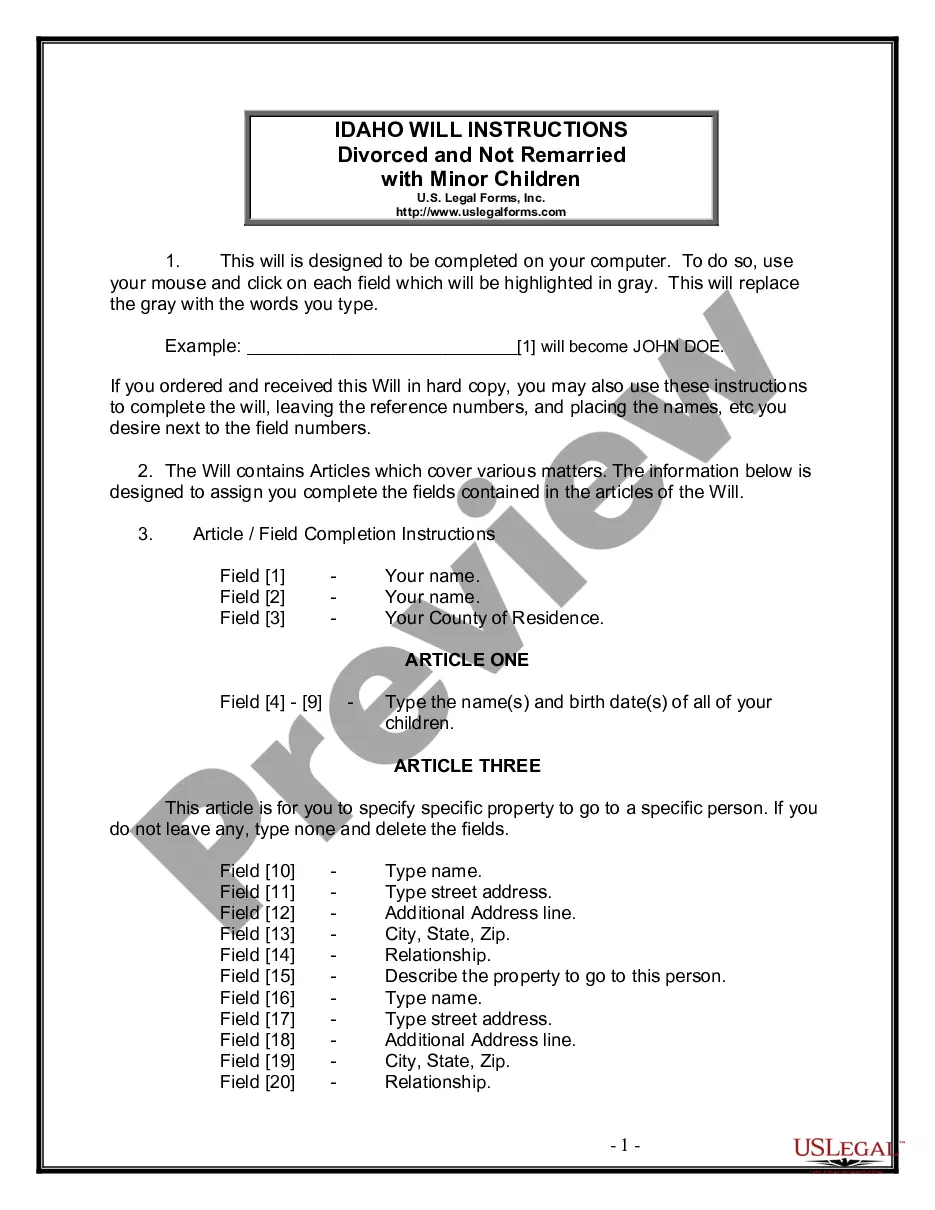

Form W-9. If you've made the determination that the person you're paying is an independent contractor, the first step is to have the contractor complete Form W-9, Request for Taxpayer Identification Number and Certification.

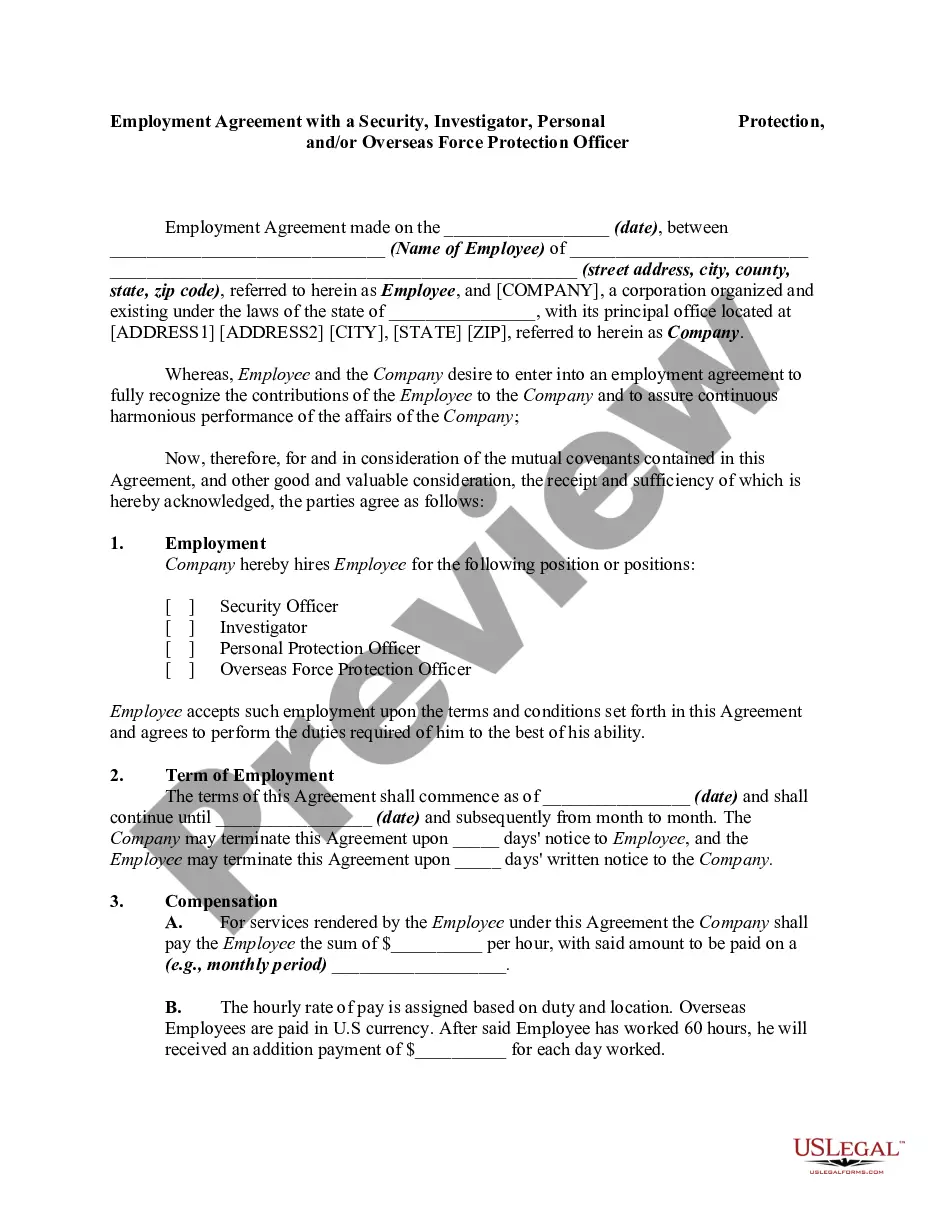

The agreement should have an introductory paragraph outlining who is the client and who is the service provider. It should contain the legal names of both parties, the date, and the physical addresses of each party.

An owner-operator lease agreement is a contract that outlines specific terms when a trucking company leases services from independent truck drivers. This agreement is necessary because the owner-operator isn't an employee and is providing a hauling services to the company for a specific job.

Passed in 2019, AB-5 implemented a stricter test for classifying workers as contractors in California. It led to thousands of truck drivers being classified as employees entitled to minimum wage, benefits and job protections.

Structure payments on a per-project basis, and require the contractor to submit invoices. Avoid salary payments, hourly payments, or any guaranteed “retainer” that is not tracked to performance. Specify the conditions for termination of the relationship—and do not make the arrangement terminable at will.

Independent contractors generally report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if your net earnings from self-employment are $400 or more.

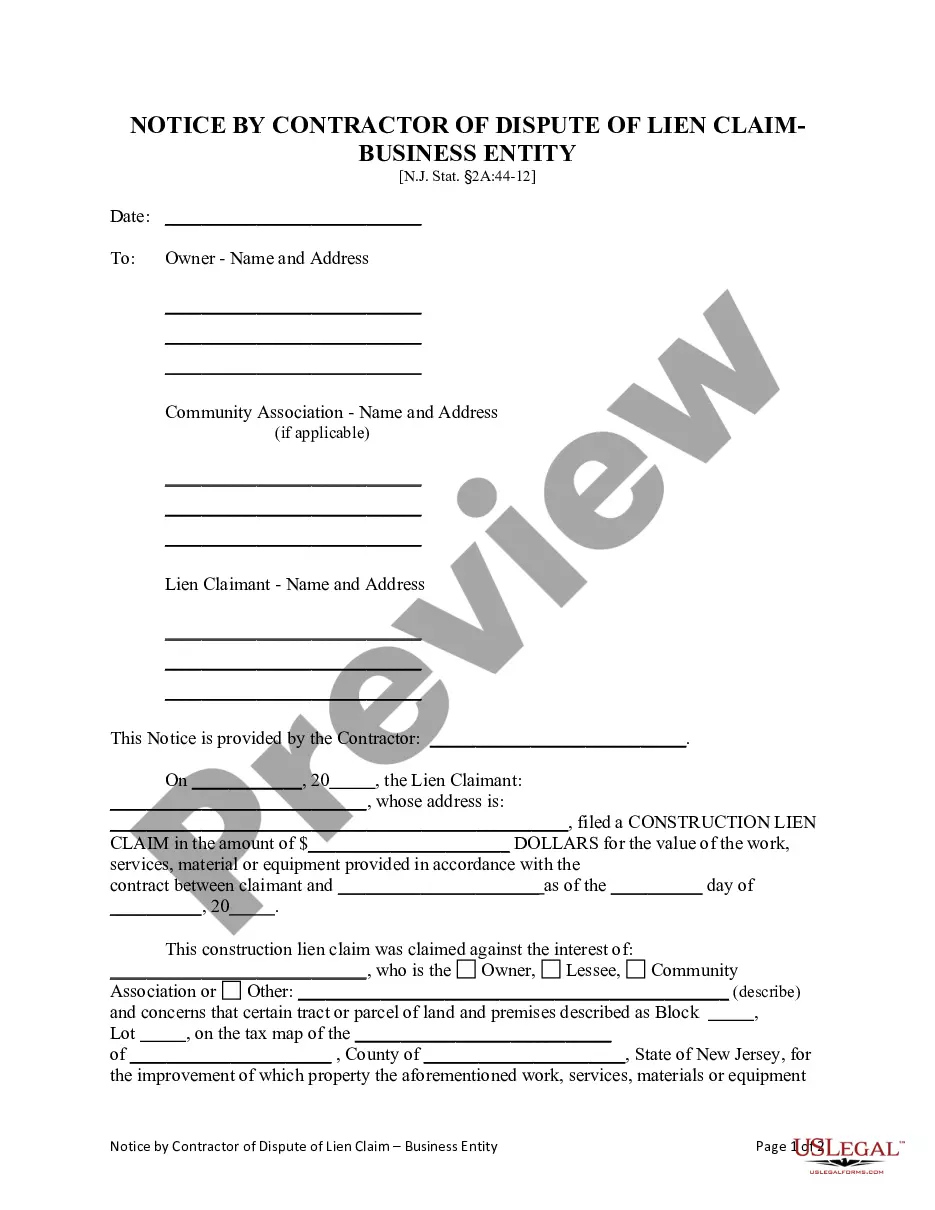

This contract provides general conditions and rights, responsibilities, and relationships of the owner, contractor, construction manager, and architect when the construction manager is an adviser.

Factors that show you are an independent contractor include working with multiple clients instead of just one, not receiving detailed instructions from hiring firms, paying your own business expenses such as office and equipment expenses, setting your own schedule, marketing your services to the public, having all ...