Hiring Overseas Contractor For Government In Middlesex

Description

Form popularity

FAQ

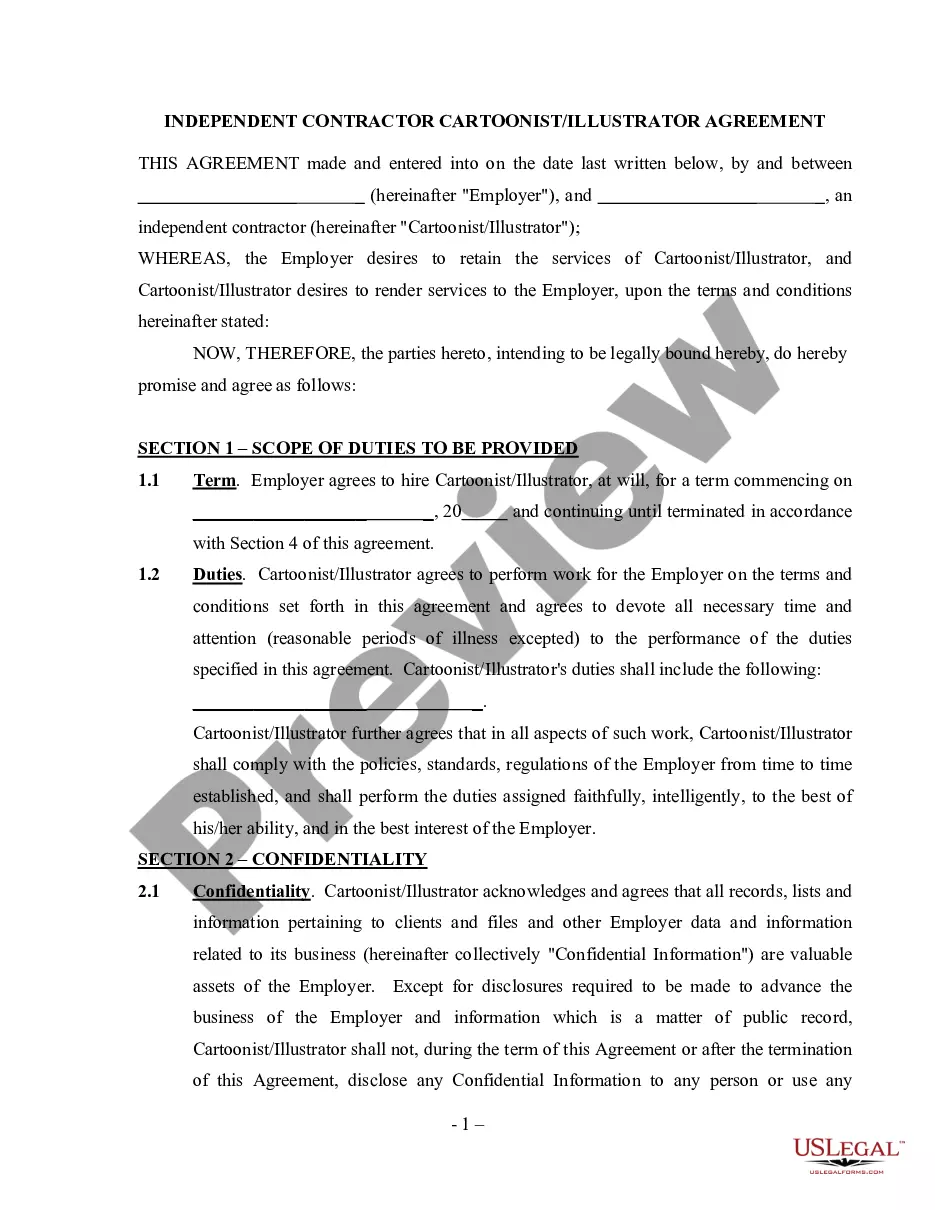

Compensation: Overseas contractors typically earn competitive salaries, with averages ranging from $80,000 to $140,000 per year, along with allowances for Meals & Incidentals (M&IE) and potential tax benefits.

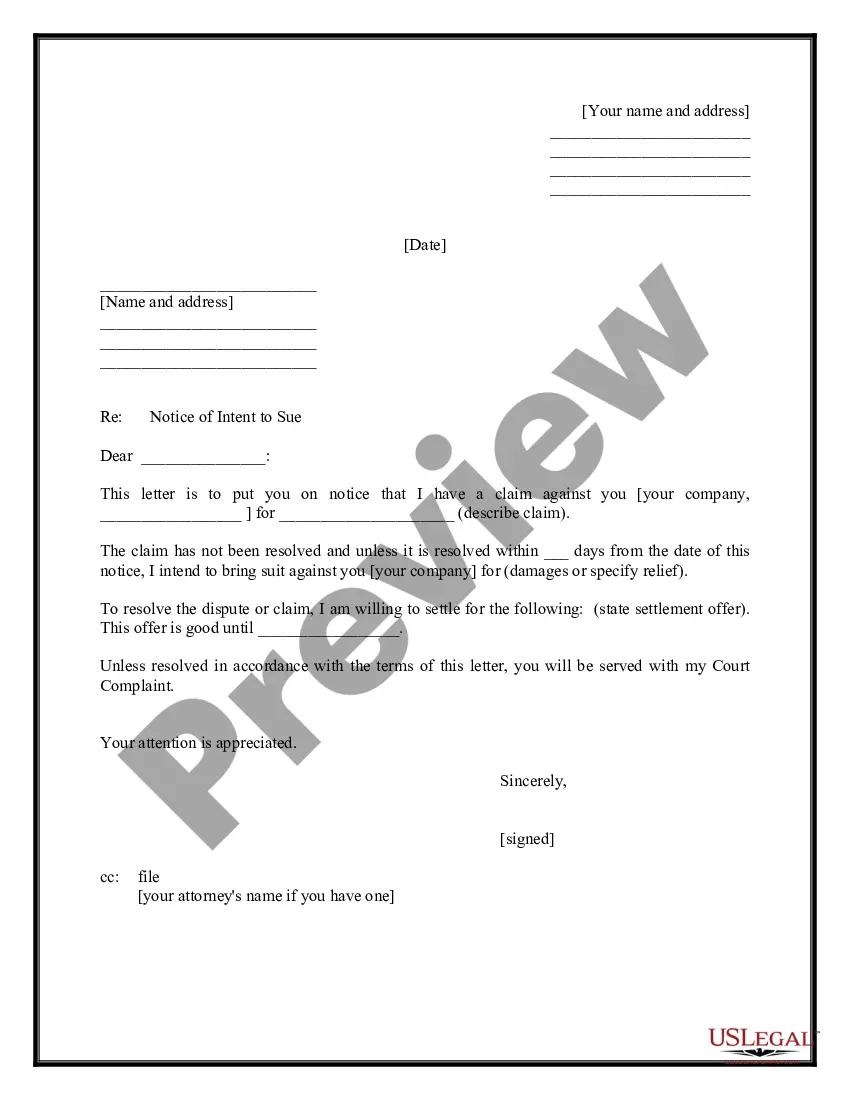

Many contracts now include clauses requiring team members to be U.S. citizens, but not always. If you're involved in work requiring a secret or top-secret clearance, it's a no-go for non-U.S. citizens. Even if you have multiple passports, you might be asked to give up the non-U.S. ones.

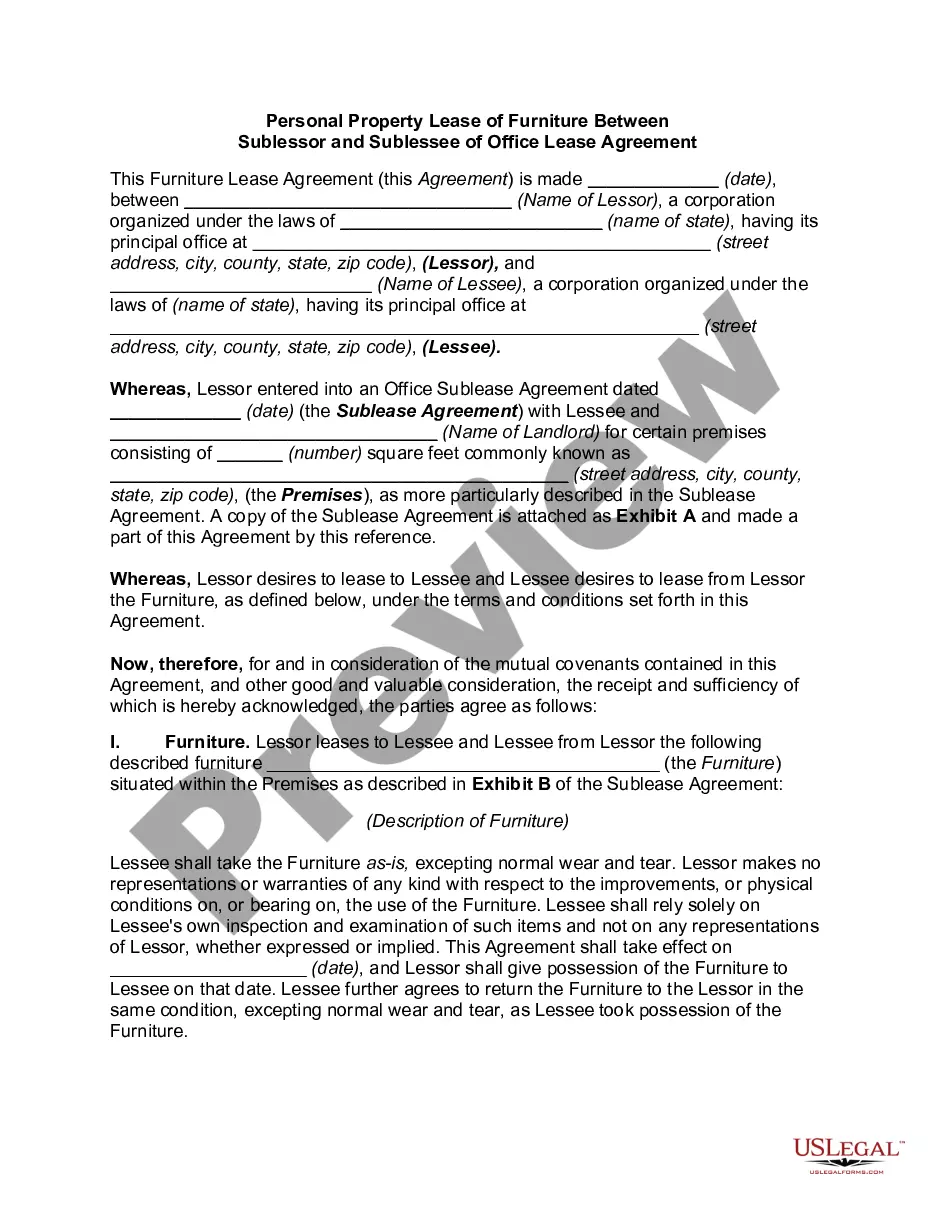

The average PMC salary in the US is $115,909 annually-an average of $9,659/mo. (San Jose, CA has the highest average salary total of $228,849- which is 97% greater than the US average- reflecting San Jose's very high living costs).

Five Tips for Landing a Government Job Overseas Speak the Primary Language. Showcase Your Cultural Experience of the Desired Destination. Demonstrate Contracting Experience in the Desired Destination. Highlight Any Military Service or Deployment in the Desired Destination. Determine What Makes You Stand Out.

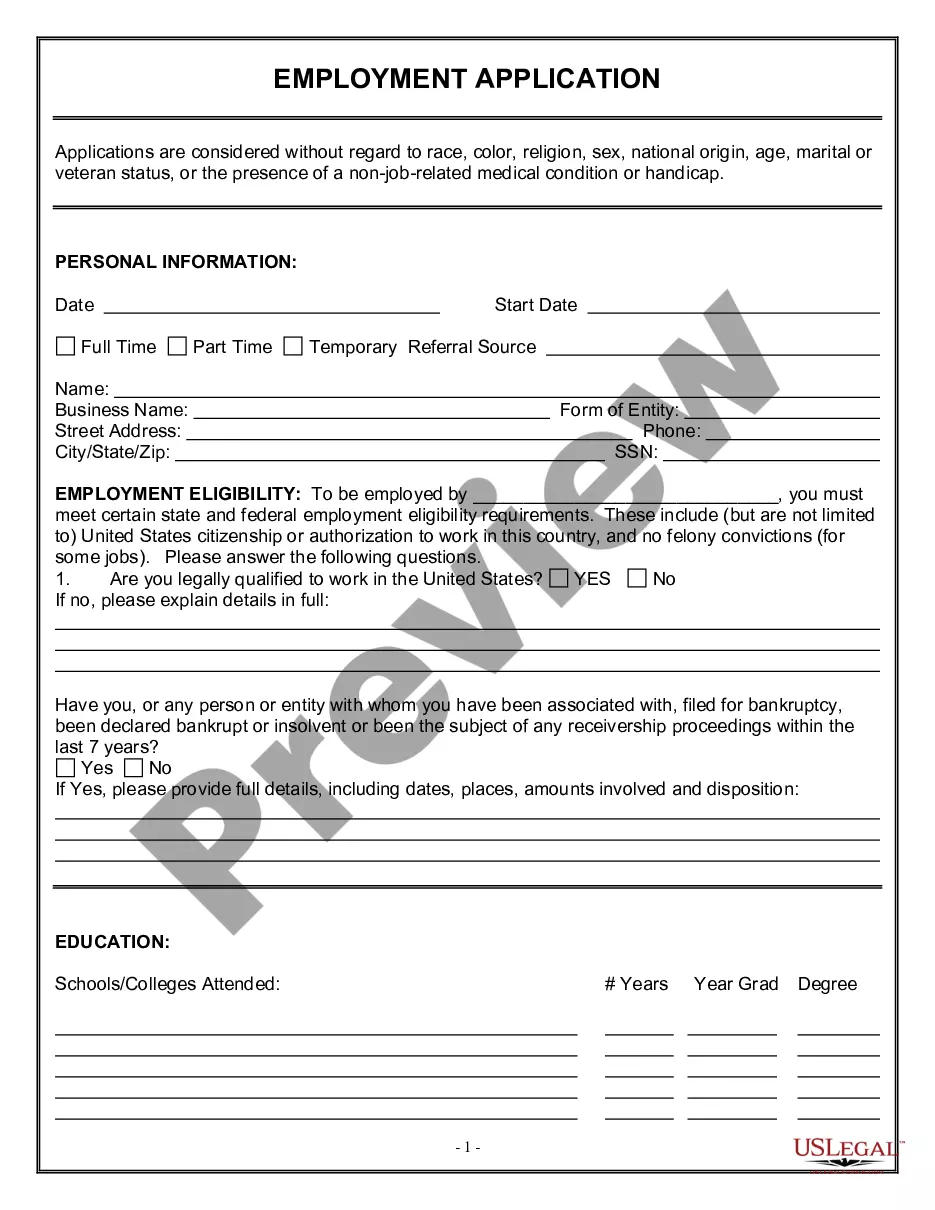

Foreign independent contractors must submit IRS Form W-8BEN or W-8BEN-E to certify their foreign status and claim any applicable tax treaty benefits. The US company may also need to file Form 1099-NEC if certain conditions are met, though this is more common for domestic contractors.

Compensation: Overseas contractors typically earn competitive salaries, with averages ranging from $80,000 to $140,000 per year, along with allowances for Meals & Incidentals (M&IE) and potential tax benefits.

Many contracts now include clauses requiring team members to be U.S. citizens, but not always. If you're involved in work requiring a secret or top-secret clearance, it's a no-go for non-U.S. citizens.

(g) Each individual employed under the contract shall be a citizen of the United States of America, or an alien who has been lawfully admitted for permanent residence as evidenced by a Permanent Resident Card (USCIS I-551). Any exceptions must be approved by the Department's Chief Security Officer or designee.