Judgment Against Property With Notice To Garnishee In Nassau

Description

Form popularity

FAQ

New York is one of the few states that protects your bank account by requiring the judgment creditor and the bank to take certain steps before your bank account can be levied or restrained.

The CCPA allows up to 50% or 60% of disposable earnings to be garnished for this purpose. A garnishment order for the collection of a defaulted consumer debt is also served on the employer.

In case the debt collector prevails in a court of law, it would get a judgment against you. That's when it could place a judgment lien on your house. In New York, a judgment is valid for 20 years, ing to Legal Assistance of Western New York.

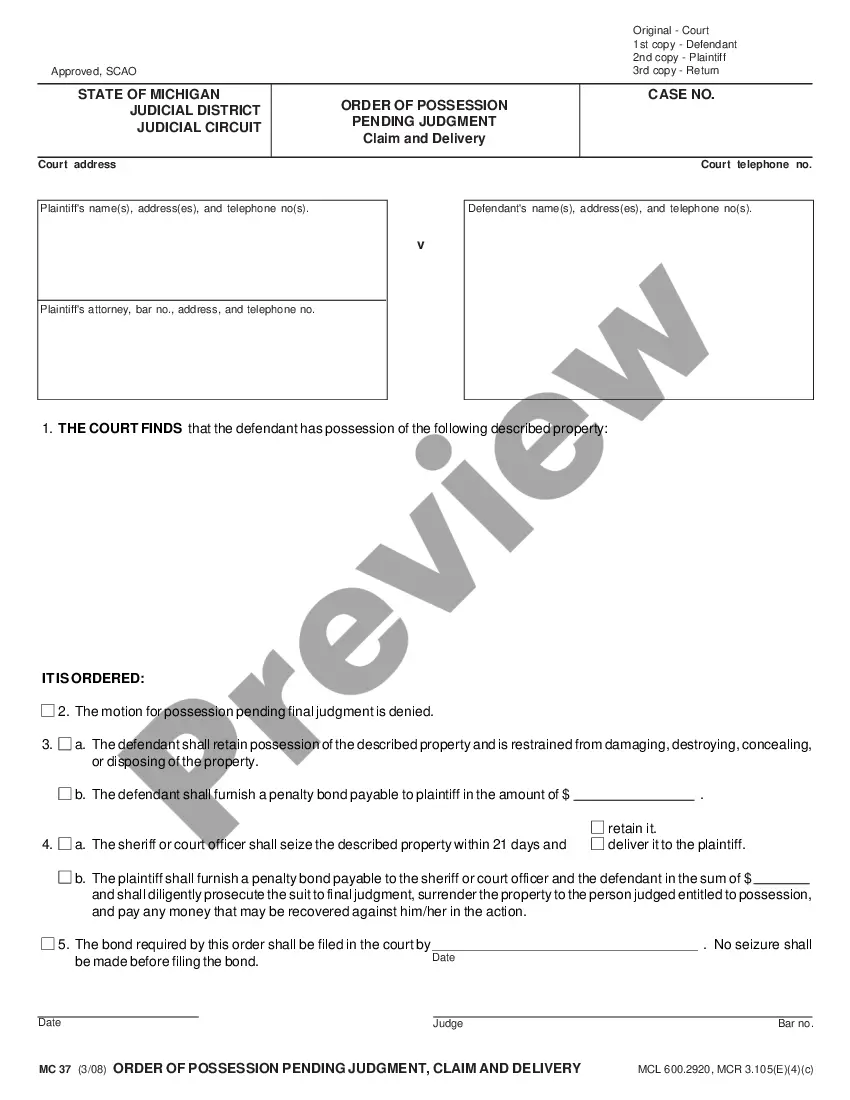

Bank accounts, including bank names, account numbers, and account type (savings or checking) Brokerage accounts and securities holdings, including company names and account numbers. Real estate holdings, including addresses. Vehicles owned, including the makes, models, years, and license plate numbers.

The out-of-state judgment also cannot be based on a confession of judgment.To turn that judgment into a NY State judgment we just need an exemplified copy of the judgment from the clerk of the court that awarded you a judgment, and information regarding whether any payments have been made on the judgment, whether there ...

You should contact an enforcement officer in the county where the judgment debtor has property. If you do not know where the judgment debtor has property, then contact an enforcement officer in the county where the judgment debtor resides.

A judgment lien is valid for ten years. N.Y. C.P.L.R. § 5203.

All judgments and court records are filed in the County Clerk Office in the County where the lawsuit was filed. You can go in person to the County Clerk Office in the County where you live to ask if a judgment has been entered against you. Most counties also allow you to search online.