Donation Receipt For Stock Donation In Wayne

Description

Form popularity

FAQ

Providing Receipts As soon as the donation is in your brokerage account, send the donor a nonprofit stock acknowledgment letter that includes a tax receipt for it.

A gift of stock is a donation of property. If a charity receives a gift of publicly traded stock, the charity should send the donor an acknowledgement letter that describes the stock (i.e., “Thank you for your donation of 100 shares of XYZ Corporation”) but does not place a monetary value on the shares.

Record the Donation For accounting purposes, publicly traded stock should be counted at the average of the high and low selling prices on the gift date (the date you receive it).

Once a donation of stock has been received, a thank you letter should be sent to the donor. This letter should acknowledge the gift of stock, such as the name and number of shares. It should not list the value of the stock received since the organization is not in the business of valuing stock.

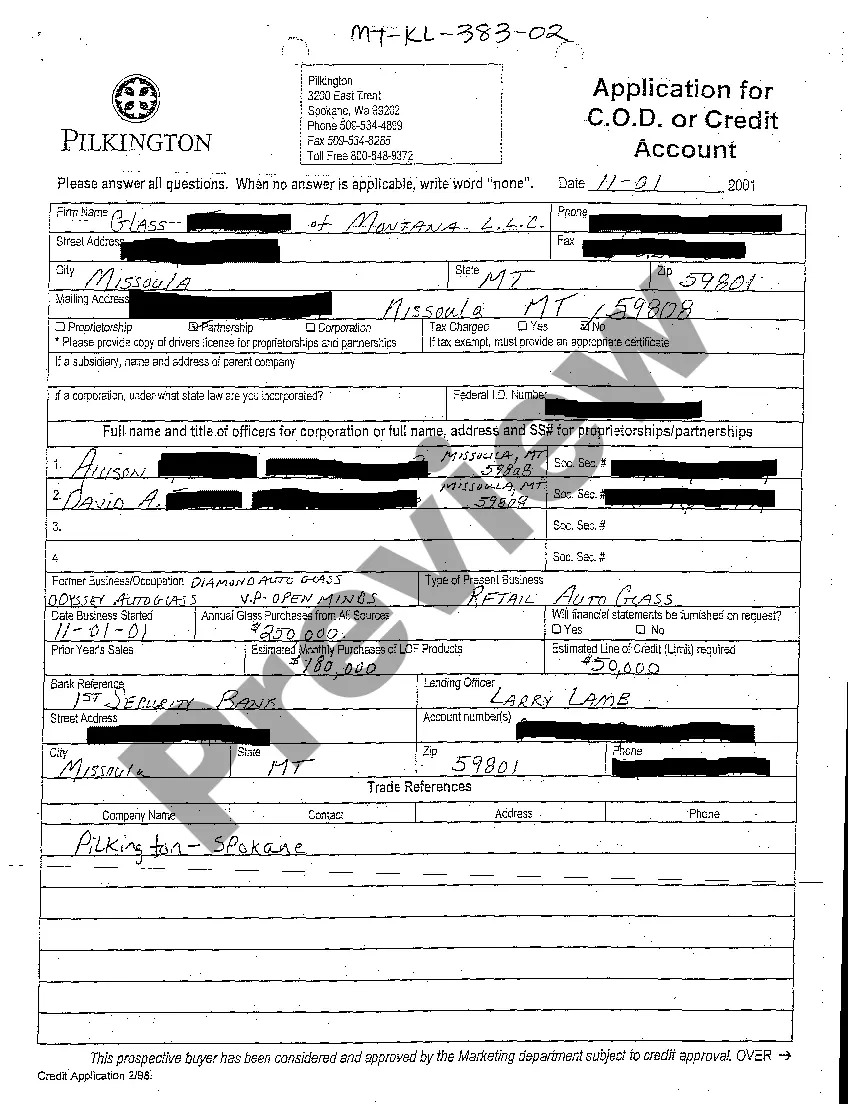

The same applies to stock gifts/donations. In this case, you should send a donation receipt comprising details such as the ticker symbol, the number of shares, and the donation date. Mentioning the value of the stock is not necessary since a nonprofit is not supposed to be assigning value to stocks or gifts.

Ing to the IRS, any kind of donation above $250 should require a donation receipt. The same applies to stock gifts/donations.

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

Write in the total fair market value of your donation. This value is determined by you, the donor. Goodwill provides a donation value guide to help determine fair market value. Please note: Goodwill employees cannot help determine fair market value.

When you donate stock directly to a charity, you are eligible for a charitable deduction equal to the fair market value of the donated stock (up to 30% of your adjusted gross income (AGI) for the tax year). This allows you to reduce your taxable income and save on taxes.