Donation Receipt Example In Harris

Category:

State:

Multi-State

County:

Harris

Control #:

US-0020LR

Format:

Word;

Rich Text

Instant download

Description

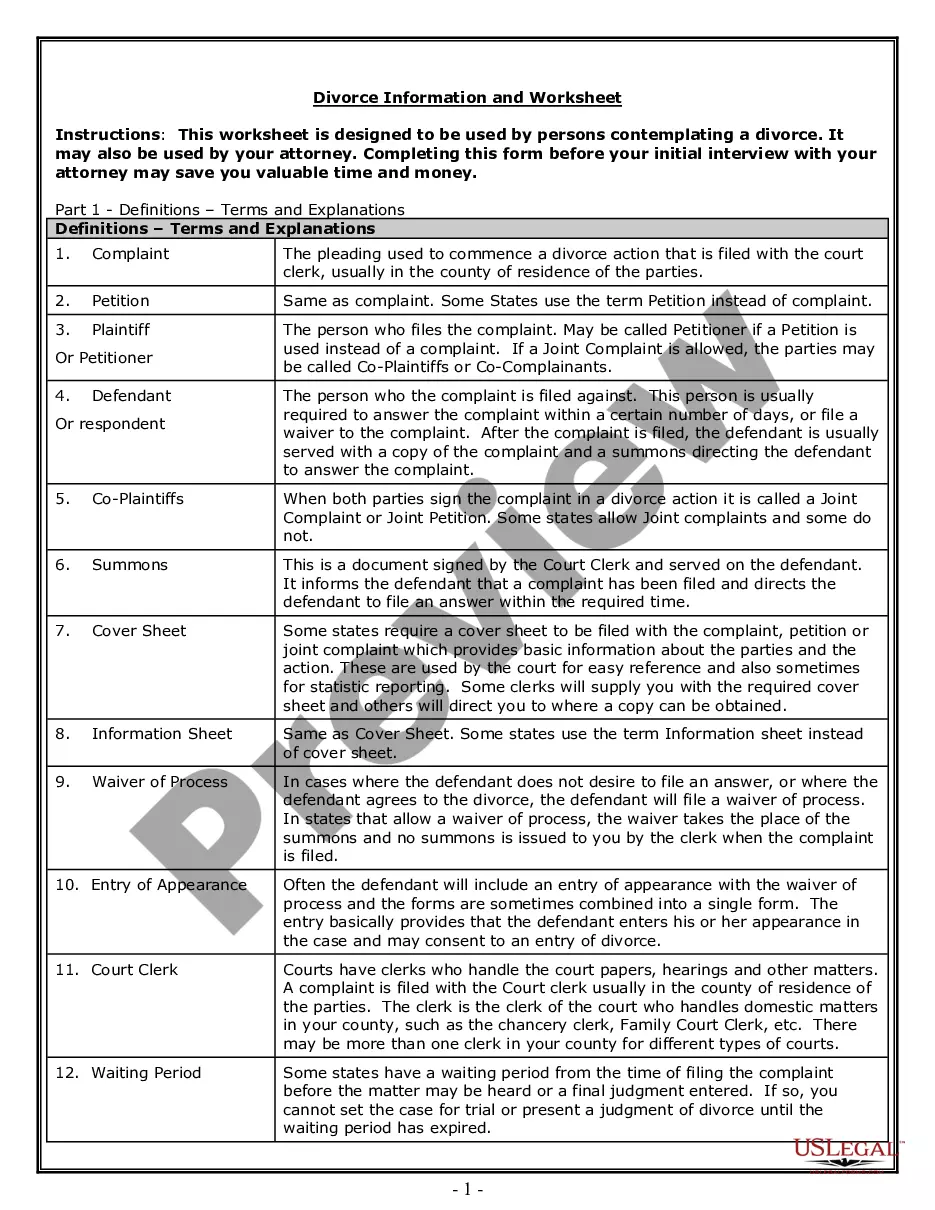

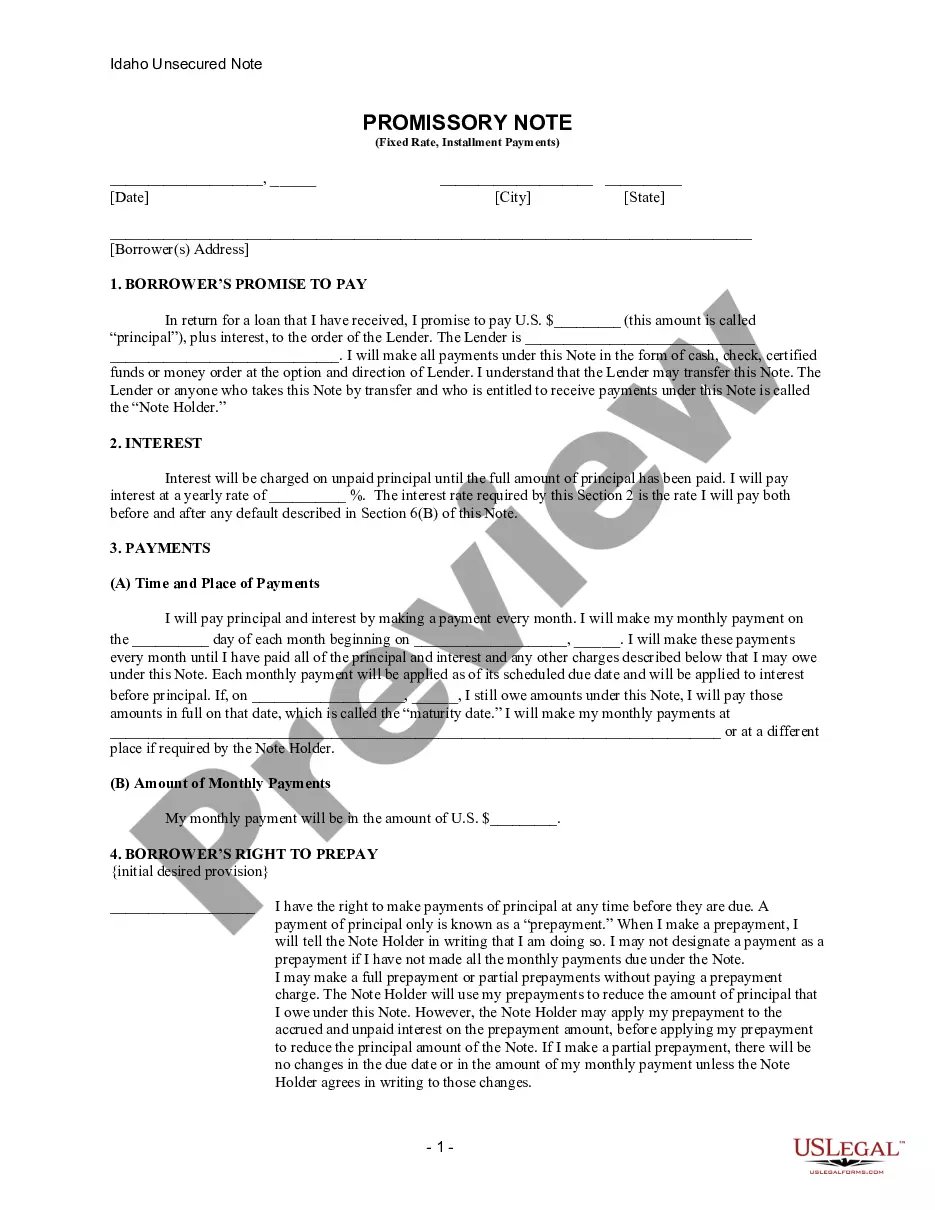

The Donation Receipt Example in Harris serves as a model letter designed to acknowledge the receipt of gifts or donations to a charity, organization, or institution. This document features essential components such as the sender's and recipient's addresses, the date, and a personalized message expressing gratitude for the donation. Users can easily fill in specific details such as names and addresses, and customize the letter to suit their particular circumstances. The form emphasizes professionalism while maintaining a warm tone, making it suitable for a wide range of organizations. Attorneys, partners, owners, associates, paralegals, and legal assistants can utilize this form to streamline their acknowledgment processes, ensuring compliance with legal requirements for documentation of charitable contributions. It is particularly useful in situations where formal recognition of donations is necessary for tax reporting or donor relations. The straightforward format enhances clarity and supports effective communication between the organization and the donor.

Form popularity

FAQ

Typically, these are recorded under the charitable contributions category, and deductions may range from 20% to 60% of your adjusted gross income, depending on the donation type and recipient.