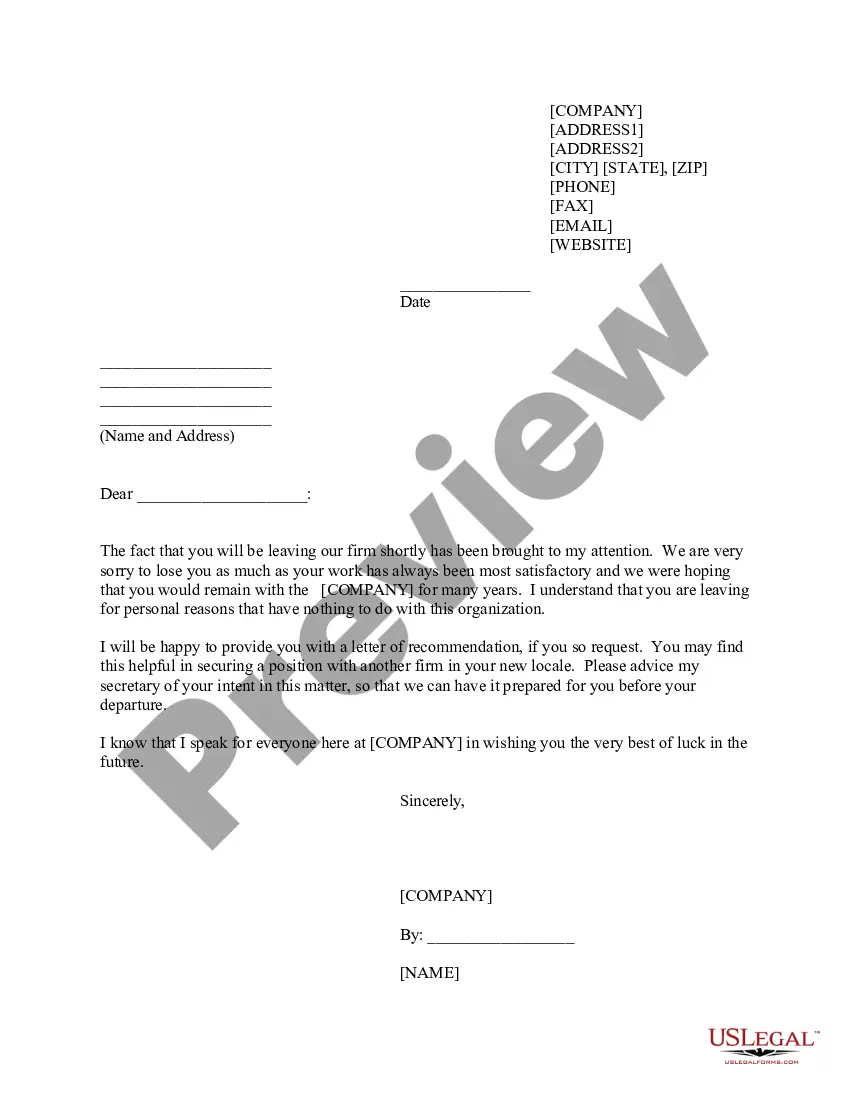

This form is a sample letter in Word format covering the subject matter of the title of the form.

Donation Receipt For Sponsorship In Broward

Description

Form popularity

FAQ

The goal of fundraising is to generate funds to support the organization's mission or goals. Sponsorship, on the other hand, involves partnering with a company or organization that provides financial support in exchange for exposure or promotional benefits.

Determine your needs. The first step to asking for sponsorship is determining what you actually need. Outline what you have to offer. Create a one-pager. Create a list of prospects. Try to get in touch with an individual, if at all possible. Keep it short and sweet! ... Follow Up. If at first you don't succeed, try again.

Donations directly support the financial needs of an organization—funding essential programs, operational costs, or helping to expand services. A sponsorship, on the other hand, often covers specific expenses related to fundraising activities, such as event costs, promotional materials, or venue fees.

A lot of different donations are called “sponsorships” in the nonprofit space. From sponsoring meals, families, animals, or events, there are many opportunities to make a donation that is labeled as a sponsorship, but not all sponsorships are considered charitable donations in the eyes of the IRS.

A donation receipt is a written acknowledgment of a donor's contribution to a charitable organization. It helps supporters and nonprofits keep good records of gifts and offers an opportunity for nonprofits to express their appreciation.

From sponsoring meals, families, animals, or events, there are many opportunities to make a donation that is labeled as a sponsorship, but not all sponsorships are considered charitable donations in the eyes of the IRS.

Is a Sponsorship a Donation? While both are important types of support nonprofits can receive, the main difference between sponsorships and donations is that sponsorships typically include the giver receiving something in return.

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

From sponsoring meals, families, animals, or events, there are many opportunities to make a donation that is labeled as a sponsorship, but not all sponsorships are considered charitable donations in the eyes of the IRS.

Ing to the IRS, donation tax receipts should include the following information: The name of the organization. A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number. The date the donation was made.