Donation For Land In San Jose

Description

Form popularity

FAQ

About Form 8283, Noncash Charitable Contributions. Internal Revenue Service.

As mentioned above, to claim a charitable donation, you need to itemize your deductions using Form 1040, Schedule A as part of your tax preparation. Schedule A reports your itemized deductions, including charitable contributions. Fill out this form carefully to ensure accurate information about your donations.

If you give property to a qualified organization, you can generally deduct the fair market value (FMV) of the property at the time of the contribution.

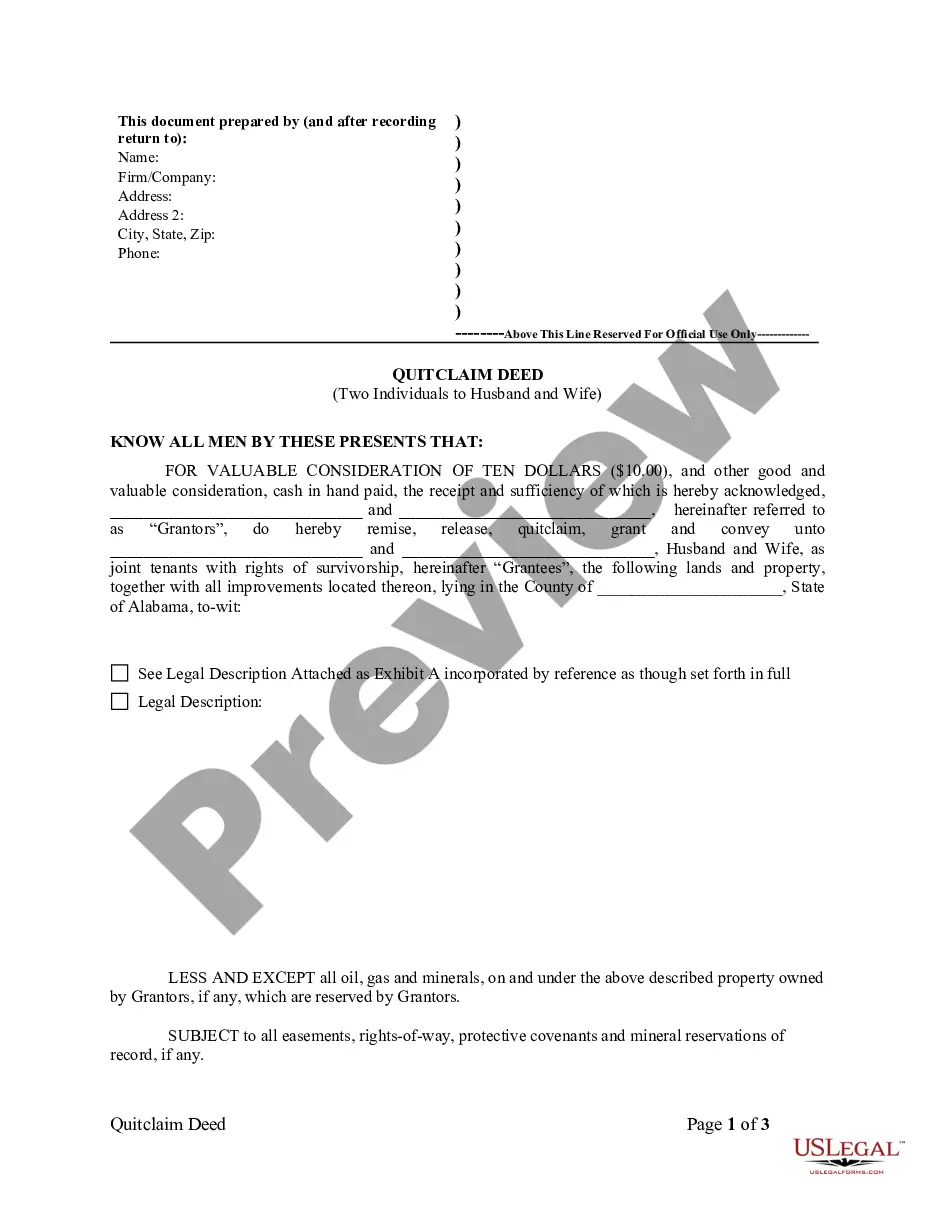

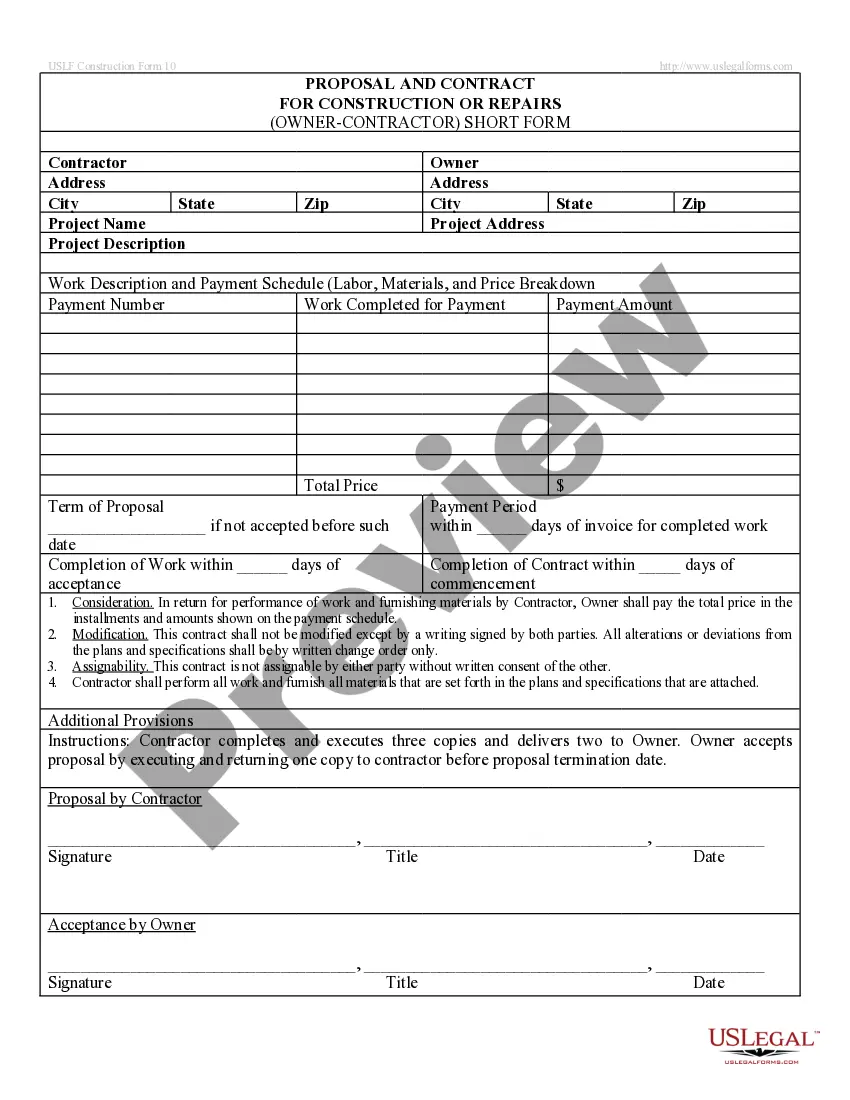

It involves drafting key legal paperwork, having your land appraised, finding an eligible land trust or nonprofit to enforce the easement, and consulting with a CPA to maximize your tax deduction. Fortunately, Giving Property specializes in working with donors to make the process as easy as possible.

Michigan Property Donation – The Process Contact Real Estate with Causes; either choose your property type and complete the online donation form or call (888)-228-7320 and a professional volunteer representative will help you donate.

In general, a person can get title to land owned by someone else by using the land exclusively, out in the open, without permission by the owner, and continuously and without interruption for the time period contained in state law for 15 years.

It involves drafting key legal paperwork, having your land appraised, finding an eligible land trust or nonprofit to enforce the easement, and consulting with a CPA to maximize your tax deduction. Fortunately, Giving Property specializes in working with donors to make the process as easy as possible.

A land trust is a legal entity that assumes control over property and other real estate assets at the behest of the property's owner. It's a living trust, which is generally revocable, meaning the terms of the trust can be changed or terminated at any time.