Erisa Law And Severance In Minnesota

Description

Form popularity

FAQ

A severance package is not legally required by federal or state law in the United States, and employers are not required to provide severance packages in most circumstances.

In general, ERISA does not cover plans established or maintained by governmental entities, churches for their employees, or plans which are maintained solely to comply with applicable workers compensation, unemployment or disability laws.

Some but not all employer severance arrangements fall under ERISA's oversight. As a federal law, ERISA aims to regulate employer-sponsored group benefit plans, such as health insurance, disability, and pensions. However, certain severance packages can also fall under ERISA's definition of an “employee benefit plan.”

Some but not all employer severance arrangements fall under ERISA's oversight. As a federal law, ERISA aims to regulate employer-sponsored group benefit plans, such as health insurance, disability, and pensions. However, certain severance packages can also fall under ERISA's definition of an “employee benefit plan.”

Most termination clauses are an agreement between the employer and the employee that in the event the employer elects to dismiss the employee without cause, the employee will only receive what they are entitled to under the Employment Standards Code.

“If any term of this Agreement is to any extent invalid, illegal, or incapable of being enforced, such term shall be excluded to the extent of such invalidity, illegality, or unenforceability; all other terms hereof shall remain in full force and effect.”

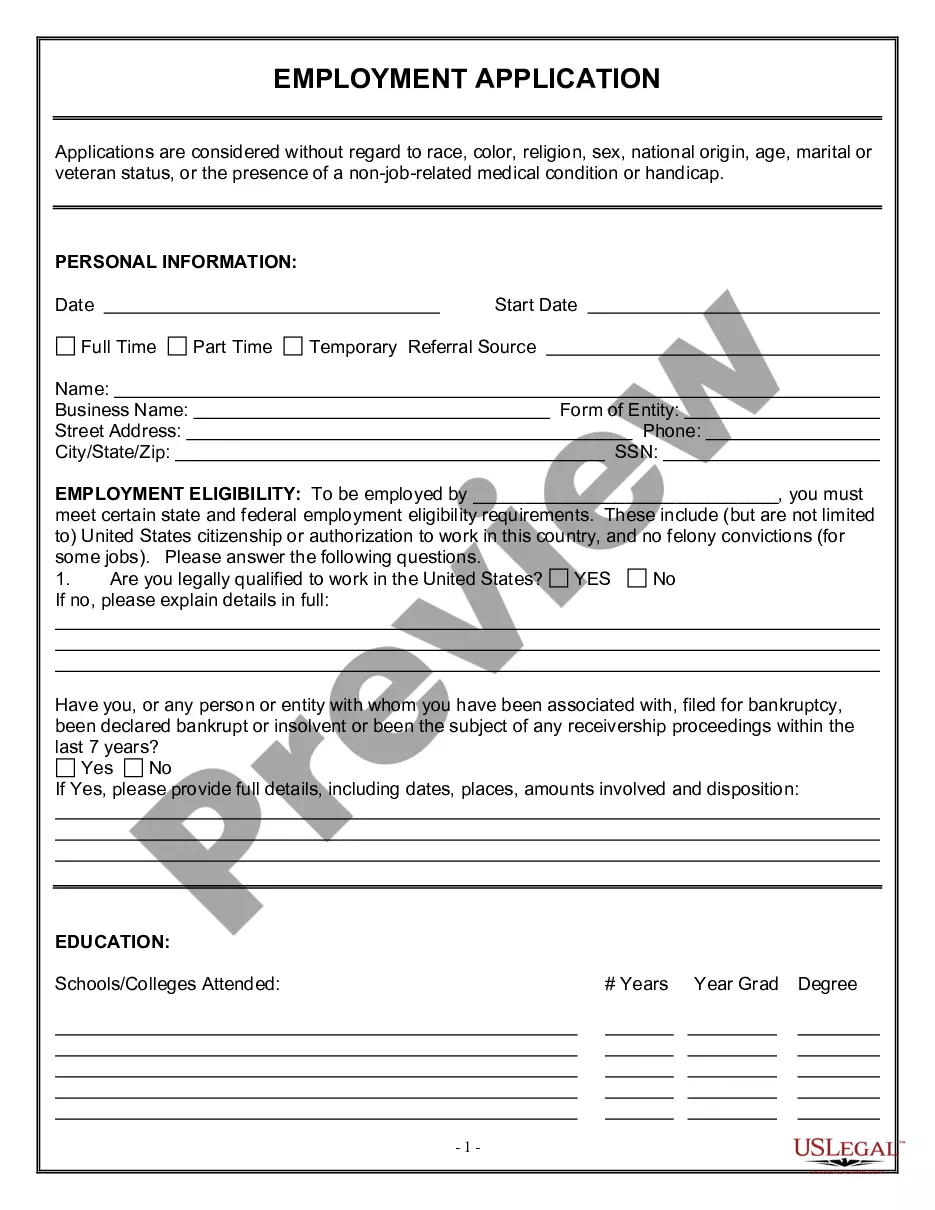

How to Structure a Severance Agreement Determine Eligibility: Decide which employees will be offered a severance agreement based on company policy or specific circumstances. Consult Legal Counsel: Work with an attorney to draft the agreement to ensure compliance with federal and state laws.

In general, ERISA does not cover plans established or maintained by governmental entities, churches for their employees, or plans which are maintained solely to comply with applicable workers compensation, unemployment or disability laws.