Payoff Form Statement With Per Diem In Utah

Description

Form popularity

FAQ

Instead, you have to get a 10-day payoff estimate from your current lender, which includes the amount you owe, as well as any interest that might accrue on the principal balance in the next 10 days.

Per Diem Formula To calculate a per diem amount, divide the annual rate by 365, then multiply the result by the principal amount.

Claim these expenses on Form 2106, Employee Business Expenses and report them on Form 1040, Form 1040-SR, or Form 1040-NR as an adjustment to income. Good records are essential.

Federal per diem rates consist of a maximum lodging allowance component and a meals and incidental expenses (M&IE) component. The standard rate of $178 ($110 lodging, $68 M&IE) applies to most of CONUS.

A per diem travel expense is intended to simplify the reimbursement process by providing a fixed amount for daily expenses, such as meals and incidental expenses, without requiring detailed (itemized) receipts for each transaction – though there may be some exceptions.

A: A per diem employee is an employee who works on an as-needed basis for their employer. They don't have a set schedule, and they may work minimal hours. Due to the minimal hours, they may not qualify for certain benefits like health insurance or retirement.

What does per diem cover? There is a per diem rate for combined lodging and meal costs, and a per diem rate for meal costs alone. An employer may use either per diem method for reimbursing employee travel expenses. A self-employed person can only use per diem for the meal costs.

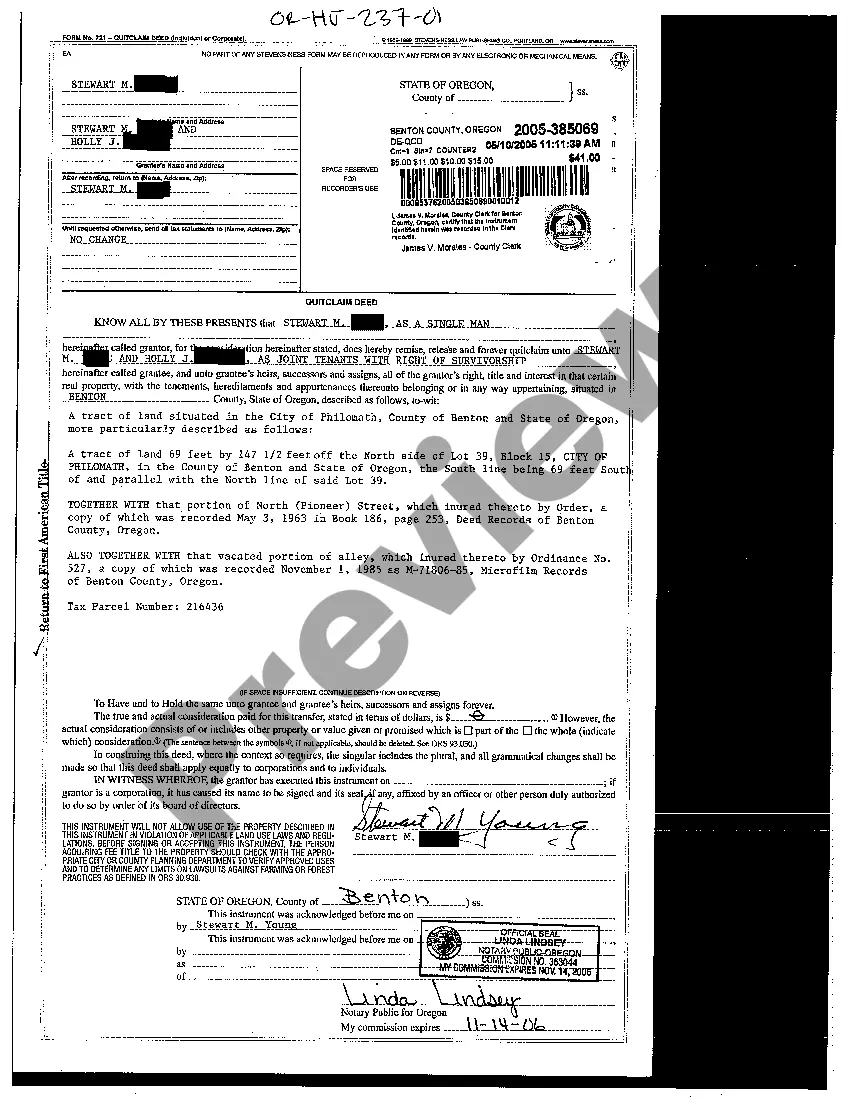

By including a per diem amount in the letter, the parties will not have to execute another payoff letter if the termination date is delayed.

If you're traveling to a city in Utah without a specified per diem rate, the standard federal rates of $110 for lodging and $68 per day for meals and incidentals will apply. These rates are effective from October 2024 to September 2025.