Payoff Letter For Promissory Note In San Diego

Description

Form popularity

FAQ

Secured Promissory Notes If a borrower defaults on a secured promissory note, the lender has the legal right to seize the designated collateral to recoup their losses.

How to Enforce a Promissory Note (5 Steps) Step 1: Inform Borrower. Start by arranging a meeting with the borrower via traceable means such as email or chat apps to discuss the debt repayment. Step 2: Enlist Collection Agency. Step 3: Collect Evidence. Step 4: File a Lawsuit. Step 5: Get Legal Remedies.

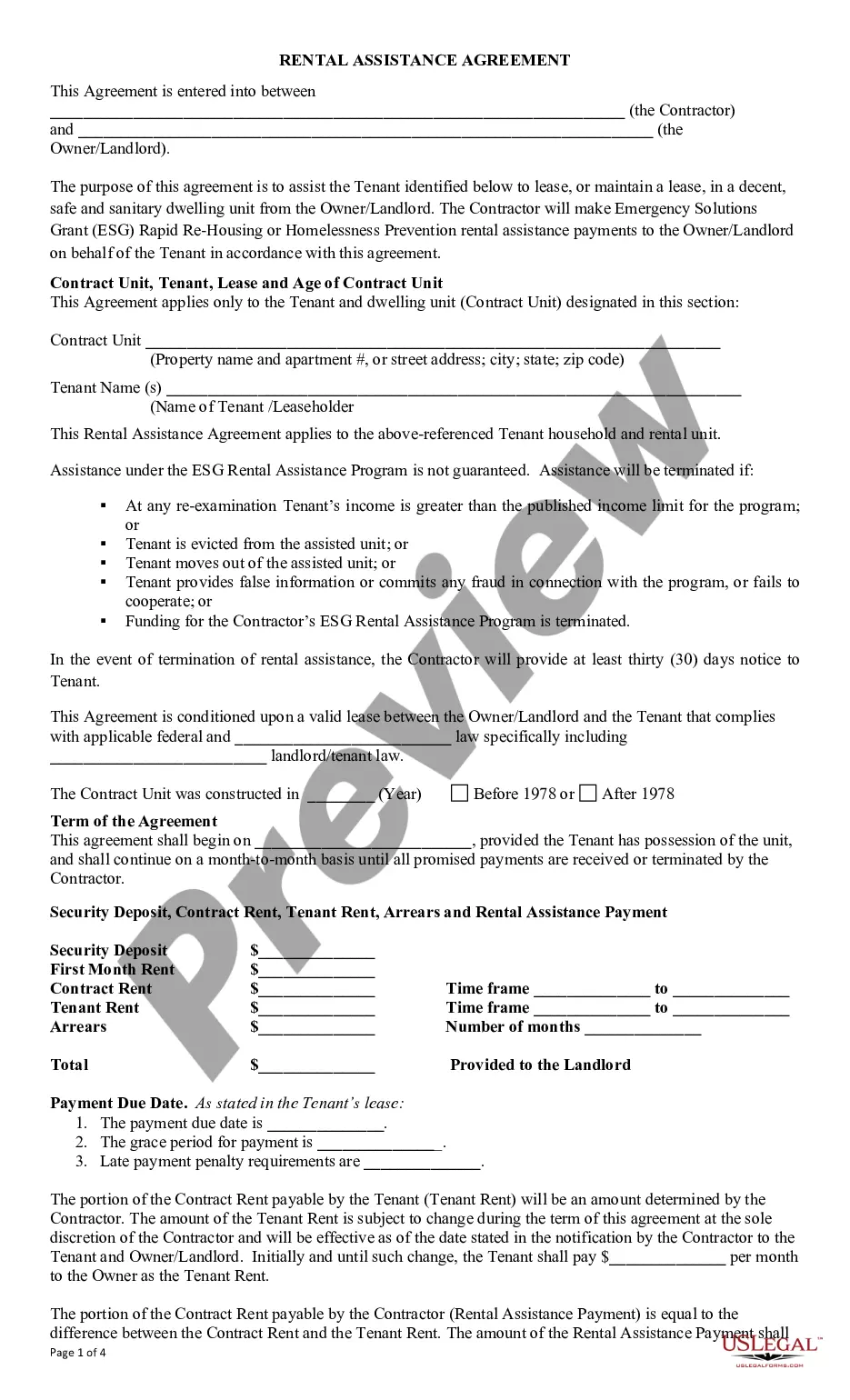

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Yes, a properly executed promissory note is legally binding. As long as the note contains all necessary elements, is signed by the involved parties, and complies with applicable laws, it's enforceable in court if the borrower defaults or fails to meet their obligations.