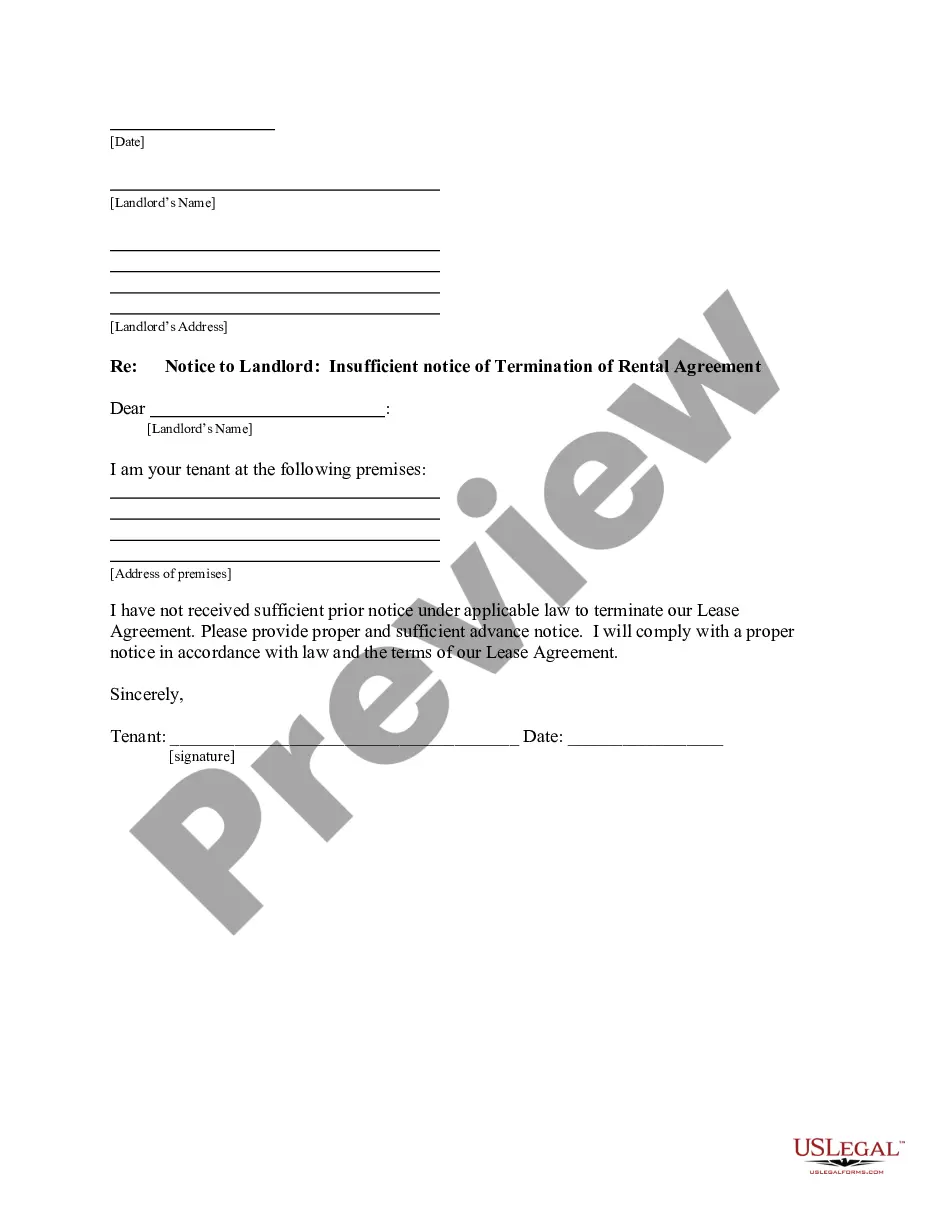

This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter Payoff Mortgage Form For Taxes In Michigan

Description

Form popularity

FAQ

And check for any outstanding mortgages. To learn more check out these links which you can click inMoreAnd check for any outstanding mortgages. To learn more check out these links which you can click in the description below.

You may obtain copies of previously filed returns using self-service. Include your full name, complete current mailing address and the tax year with your request.

205.29 Taxes, interest, and penalties as lien. The lien shall attach to the property from and after the date that any report or return on which the tax is levied is required to be filed with the department and shall continue for 7 years after the date of attachment.

Homeowners Property Exemption (HOPE) Homeowners may be granted a full (100%) or partial (50%) exemption from their property taxes. Each applicant must own and occupy the property as his/her primary homestead as of December 31, 2021, and meet specific income requirements.

The Uniform Commercial Code (UCC) Online Service is available 24 hours a day for the filing and searching of financing statements, federal tax liens, state tax liens and unemployment liens.

Interested parties can perform a tax lien search in Michigan by querying local Recorder of Deeds offices. These offices maintain records for the different types of liens, including tax liens, affixed on real estate within their jurisdiction.

2809. (1) Unless subsection (2) or (3) applies, a judgment lien expires 5 years after the date it is recorded. (2) Unless subsection (3) applies, if a judgment lien is rerecorded under subsection (4), the judgment lien expires 5 years after the date it is rerecorded.

Mortgage principal refers to the outstanding balance of your mortgage. Mortgage Principal is the amount borrowed from the lender, minus the amounts repaid to the lender, and which have been applied to the reduction of principal. As monthly mortgage payments are made, the mortgage principal is reduced.

The Authorized Representative Declaration (Form 151) empowers individuals or entities to act on behalf of taxpayers in communications with the Michigan Department of Treasury. This form allows for the designation of a representative, revocation of previous authorizations, and requests for copies of tax-related notices.

Outstanding Mortgage Principal. Enter the amount of outstanding principal on the mortgage as of January 1, of the current year. If you originated the mortgage in the current year, enter the mortgage principal as of the date of origination.