Letter For Loan Payoff In Arizona

Description

Form popularity

FAQ

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

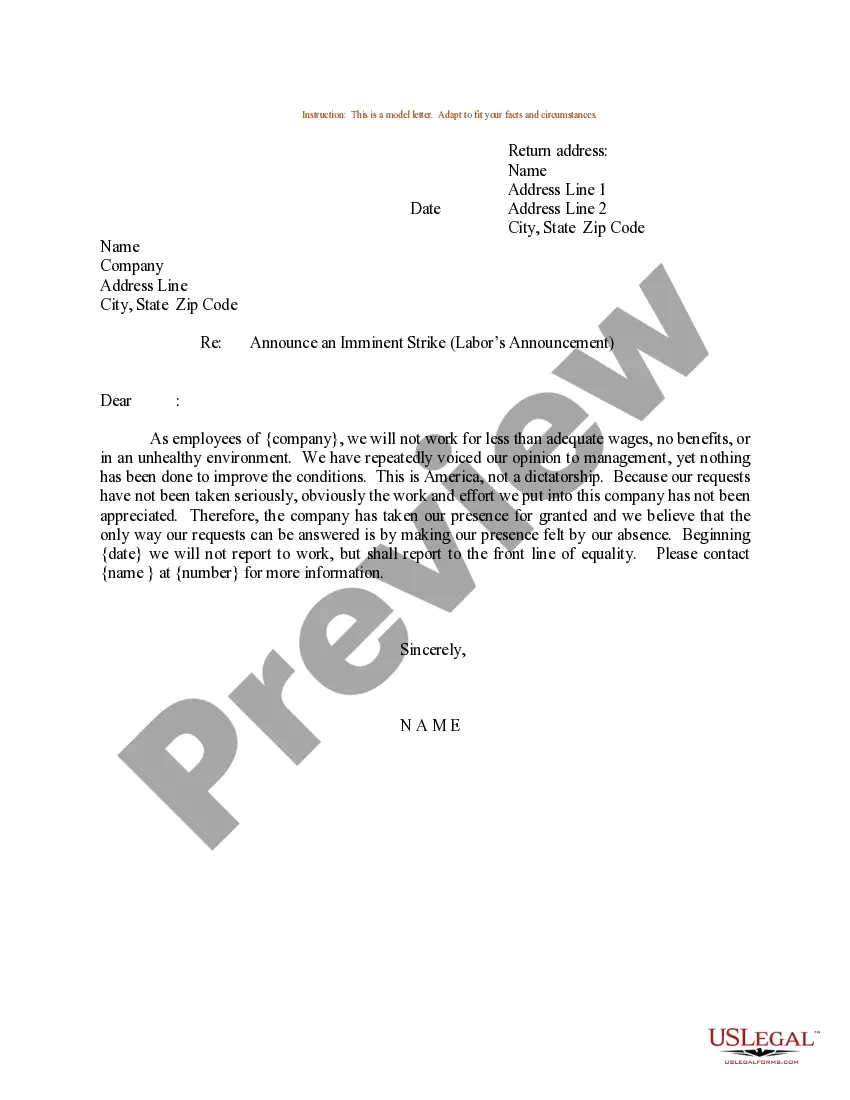

Below is a step-by-step guide on how to write a letter requesting payment of overdue invoices: Step 1- Start with a polite greeting. Step 2 – Clearly state the purpose. Step 3 – Provide relevant details. Step 4 – Express understanding. Step 5 – Set clear expectations. Step 6 – Offer assistance:

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

A bank confirmation letter serves to assure all concerned parties in a business transaction that the bank's customer (the borrower) has, or has available, the necessary financial resources to conclude the transaction.

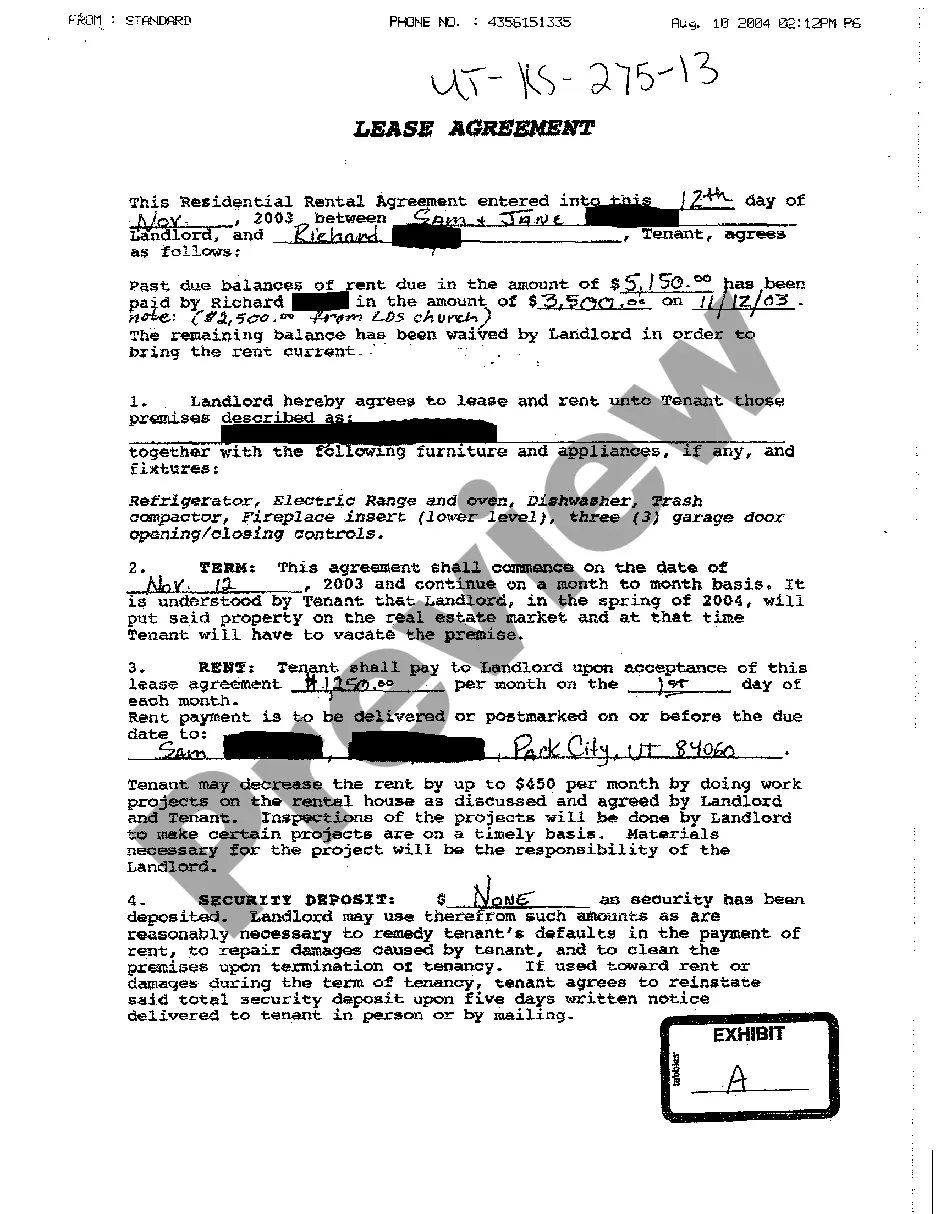

All parties to the original debt instrument normally execute a Payoff Letter before it becomes binding. The final version of the document often reflects specifics of the parties' negotiations. Payoff Letters provide detailed terms and procedures regarding the payoff process.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.