Receipt Donation Document With Iphone In San Diego

Description

Form popularity

FAQ

How do I fill this out? Enter the donation date and your contact details. List each item you donated along with a brief description. Assign an estimated dollar value to each item. Complete the section for the Goodwill employee's name. Keep this receipt for your records when filing taxes.

Ing to the IRS, any kind of donation above $250 should require a donation receipt. The same applies to stock gifts/donations.

Write in the total fair market value of your donation. This value is determined by you, the donor. Goodwill provides a donation value guide to help determine fair market value. Please note: Goodwill employees cannot help determine fair market value.

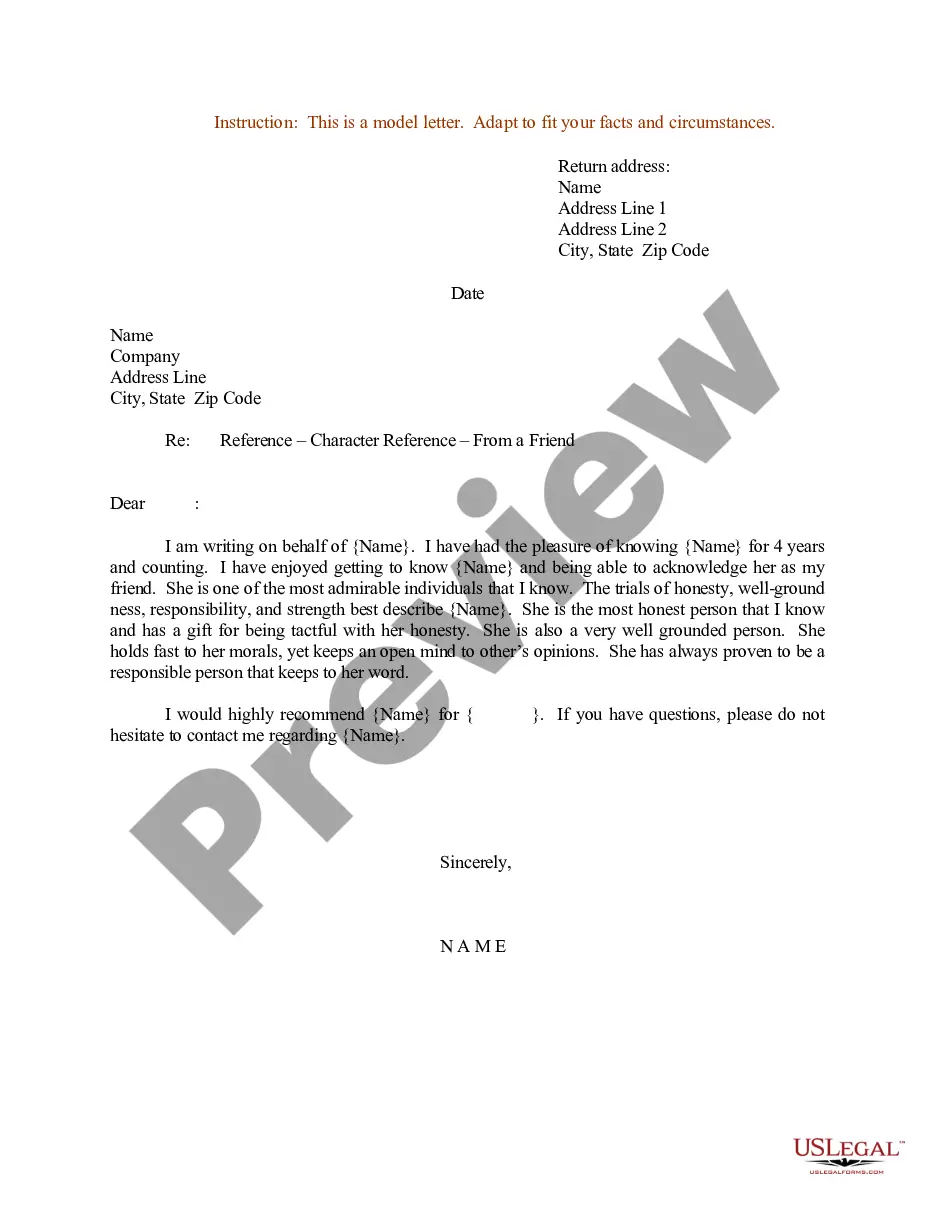

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

While it's best practice to always send a donation receipt for every gift your organization receives, there are circumstances where a donation receipt is required by the IRS and must meet IRS guidelines, including: When single donations are greater than $250.

Nonprofit or charitable organizations typically create donation invoices after they've processed incoming donations. These organizations then send the donation invoices back to their donors.

How do I fill this out? Enter the donation date and your contact details. List each item you donated along with a brief description. Assign an estimated dollar value to each item. Complete the section for the Goodwill employee's name. Keep this receipt for your records when filing taxes.

In that case, all you need to provide in the donation receipt is the name and EIN of the organization, date of donation, and a description of the donated item. You should also add a note stating that the valuation of the item is the donor's income tax responsibility.

Givebutter automatically issues emailed receipts after every transaction, including offline donations and auction item purchases. Receipts can be customized with a message at both the account and campaign levels to include tax-pertinent information, show your appreciation, and provide next steps for engaging further.

In that case, all you need to provide in the donation receipt is the name and EIN of the organization, date of donation, and a description of the donated item. You should also add a note stating that the valuation of the item is the donor's income tax responsibility.