Letter Donation Form Sample With Non-profit Organization In Georgia

Description

Form popularity

FAQ

1. The Basic Donation Letter Format Salutation. Greet your potential donor with a friendly opening, and personalize it with their name whenever possible. Explanation of your mission. Your project, event, or needs. Compelling details. A specific request. A call-to-action.

Here are a few tips to help you write donation messages that convert. Be clear, concise, and to the point. Text messages are inherently short, so you must be concise yet clear. Make it easy to donate. You want to make it simple for contacts to donate to your cause.

I'm writing to ask you to support me and my cause/project/etc.. Just a small donation of amount can help me accomplish task/reach a goal/etc.. Your donation will go toward describe exactly what the contribution will be used for. When possible, add a personal connection to tie the donor to the cause.

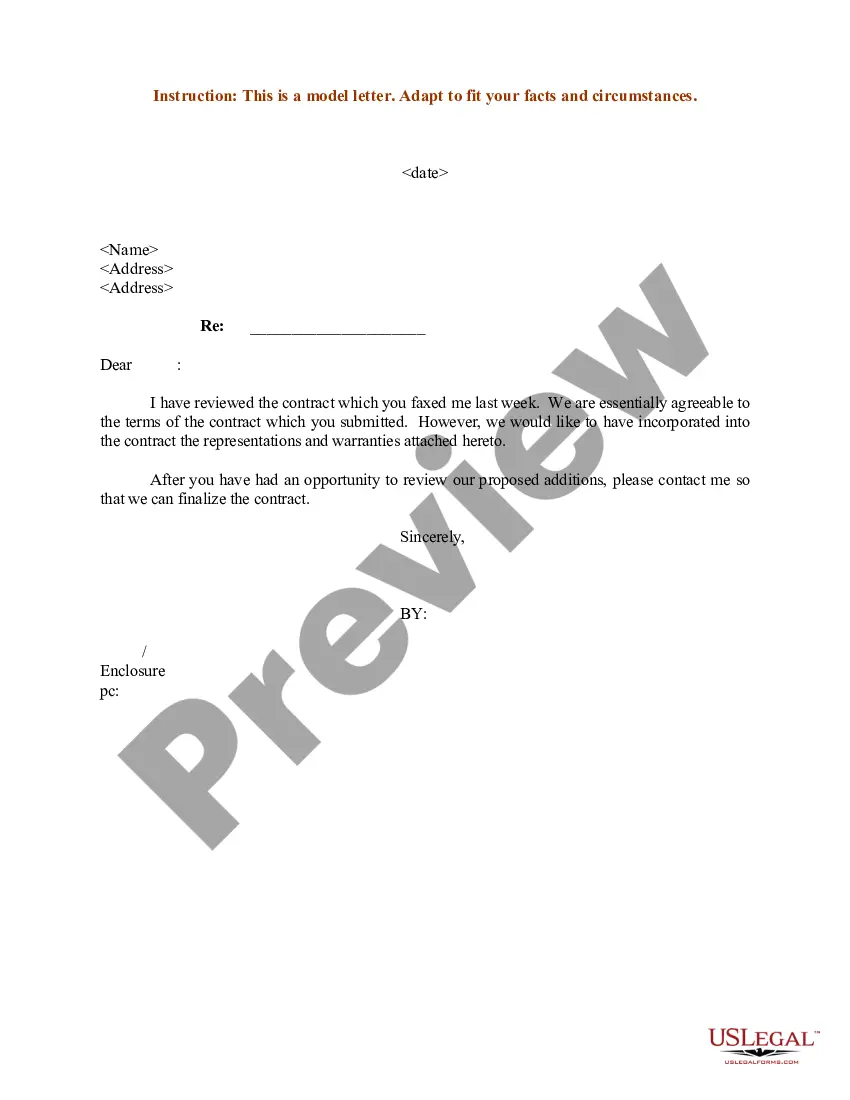

Most letters have three parts: an opening statement that identifies the project/program where funds are being sought, one or two middle paragraphs that indicate the relationship of the writer to the effort seeking funding, and a closing statement. Be sure all your supporters address the same person at the same address.

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

Start with a clear statement of purpose. Explain the specific need or cause you are fundraising for, and why it is important. Share personal stories or anecdotes that illustrate the impact the donations will have. Quantify the need and how the donations will be used. Convey gratitude and appreciation for any

Some examples of contribution statements are: “wrote entire original draft”; “contributed to methodology design”; “provided animals for experiments”.

It's required that nonprofits report in-kind donations separately within their financial statements. This means you should record in-kind donations in a separate revenue account within your chart of accounts.

You can utilize an excel document or another method as long you can easily categorize the following information to prepare nonprofit accounting for stock donations: The date on which you received the donation. The symbol for the donated stock (also called the "ticker") The stock's value on your receipt date.