Donation Letter With Tax Id Number In Clark

Description

Form popularity

FAQ

Yes, you can receive a donation without be a nonprofit. In the United States and many other nations, there are tax benefits to the donor when donating toward a certified nonprofit. Regardless of your nonprofit status, someone can give you a donati...

All businesses are required to have an Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN). Even though nonprofit organizations don't conduct business in the traditional sense, they do employee staff. Therefore, the IRS considers them a business entity and requires them to get an EIN.

Schedule A (Form 1040) required. Generally, to deduct a charitable contribution, you must itemize deductions on Schedule A (Form 1040). The amount of your deduction may be limited if certain rules and limits explained in this publication apply to you.

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

A federal tax ID number is not required if you are self-employed, operate a sole proprietorship, or own a limited liability company (LLC) with no employees. In those situations, you would simply use your own Social Security number (SSN) as a tax ID.

Here are some ideas for wording that can be used while asking for donations: Make a donation. Join the fight! Give to <nonprofit/cause> Impact the lives of <beneficiaries> today. Take action! Help educate a child! / Help <blank> today! Stop Injustice. Fight now!

How to Write a Letter of Intent to Donate Step 1 – Provide Your Contact Information. Step 2 – State the Effective Date. Step 3 – Identify the Donor and Recipient. Step 4 – Describe the Donation. Step 5 – Outline Donation Conditions. Step 6 – Set an Acceptance Deadline. Step 7 – Discuss Recognition.

Here are some tips for writing an effective donation request letter to friends and family: Make the purpose clear upfront. State the cause or organization you're raising funds for directly in the opening paragraph. Establish a personal connection. Use a conversational tone.

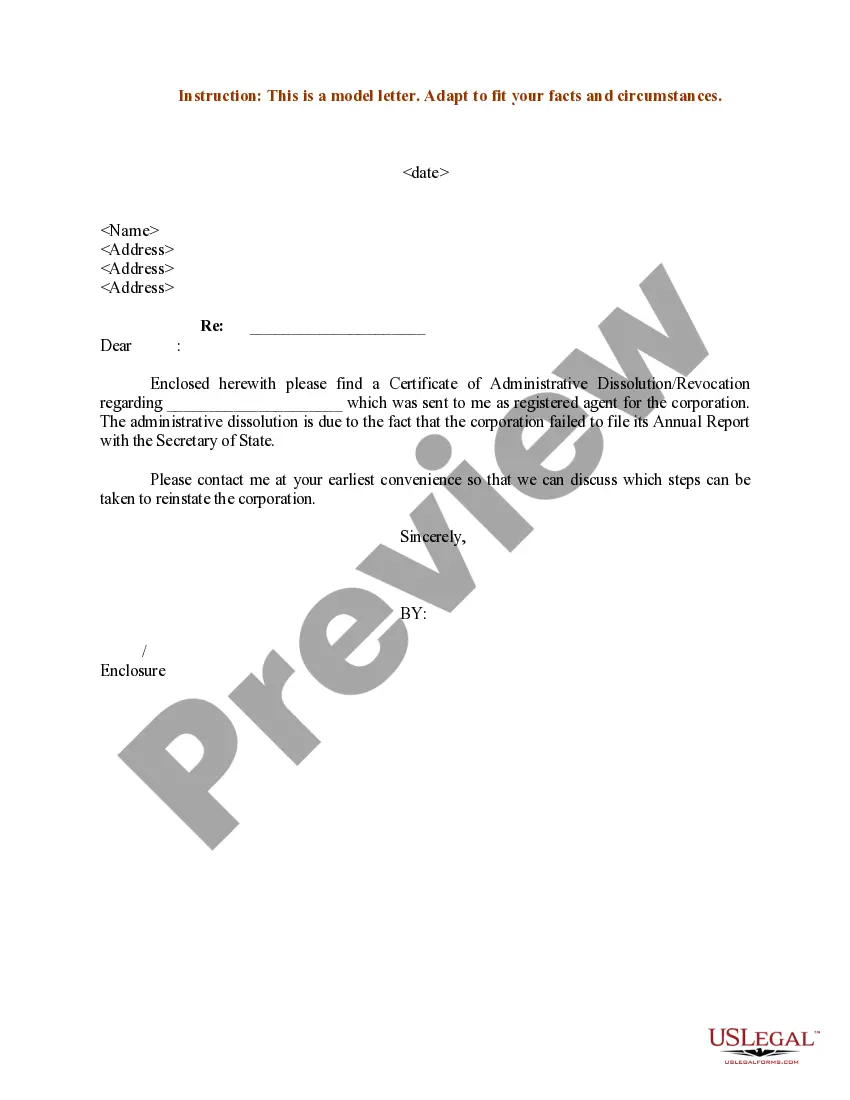

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case.

However, you should be able to provide a bank record (bank statement, credit card statement, canceled check or a payroll deduction record) to claim the tax deduction. Written records, like check registers or personal notations, from the donor aren't enough proof. The records should show the: Organization's name.