This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deeds Of Trust In Arizona In Georgia

Description

Form popularity

FAQ

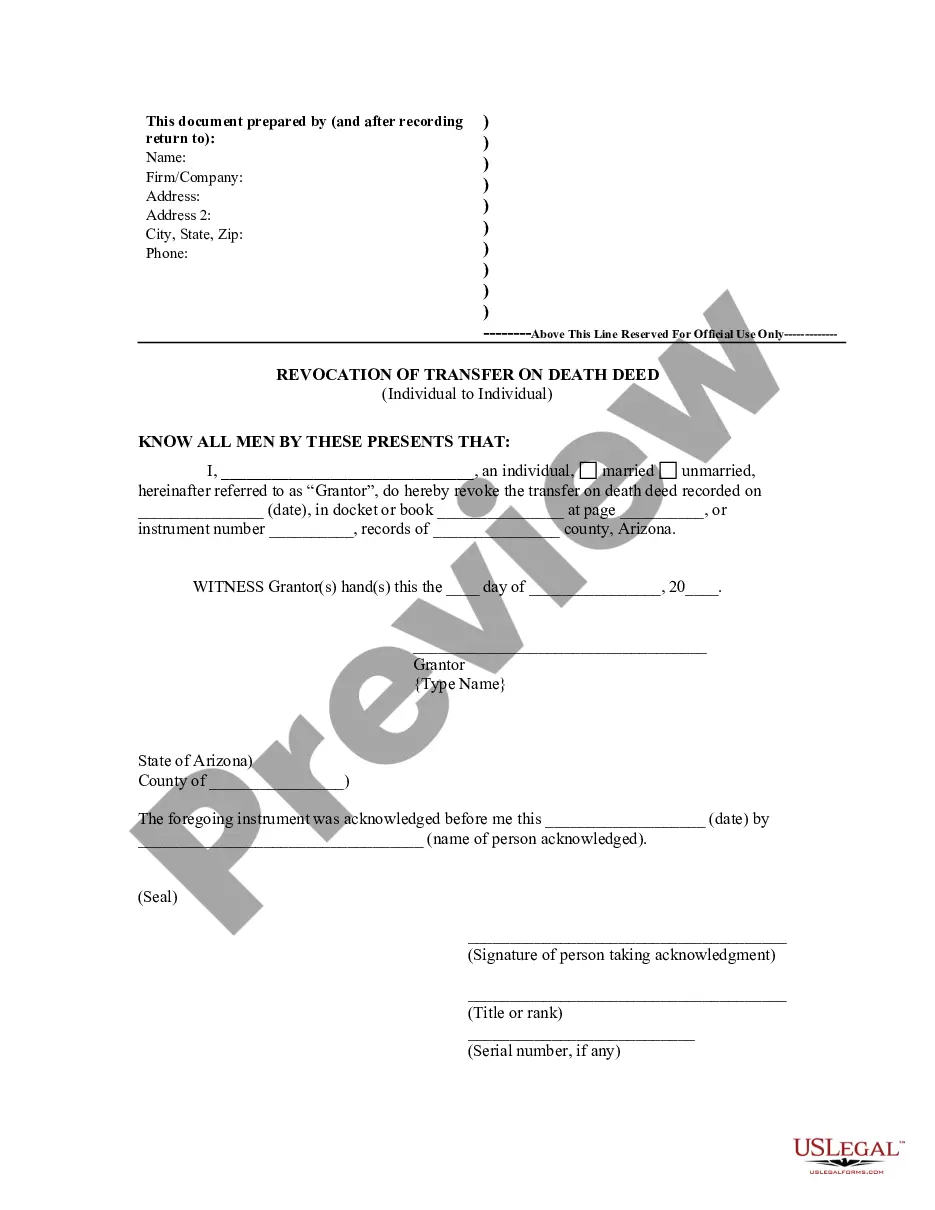

Transfer Your Home Into the Trust You must complete the deed transferring ownership of the property before a witness and a notary public and have the deed notarized. You must submit the deed and a PT-61 tax transfer document to the Superior court clerk in your county.

The grantor, or the current property owner, must sign the deed in the presence of a notary public. The grantor must also formally transfer the property from their name to the trust's name. This step solidifies the legal transfer and ensures that the living trust holds the property.

Deeds of Trust transactions will always involve three parties - there will be: The Beneficiary (lender) The Trustor (borrower) The Third Party Trustee (holds the legal title, often a title company)

A trust “moves” by switching its situs from one state to another. Typically speaking, a revocable trust is unaffected by this. However, you could change a revocable trust's situs by modifying it. If that is not an option, you can also revoke the trust and create a new one in the desired jurisdiction.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Arizona is a Mortgage state and Deed of Trust state.

A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust.

Arizona is a Mortgage state and Deed of Trust state.

In Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, Montana and South Dakota, the lender has the choice of either a mortgage or deed of trust. In any other state, you must have a mortgage.