This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Change Deed Trust With Employees In California

Description

Form popularity

FAQ

Here is the rough outline: Select the trust that is best suited to your needs, such as a revocable living trust. Draft a trust deed and have it notarized so that it is legally binding. Record the deed at the county recorder's office. Notify the relevant parties, such as your mortgage lender and insurance provider.

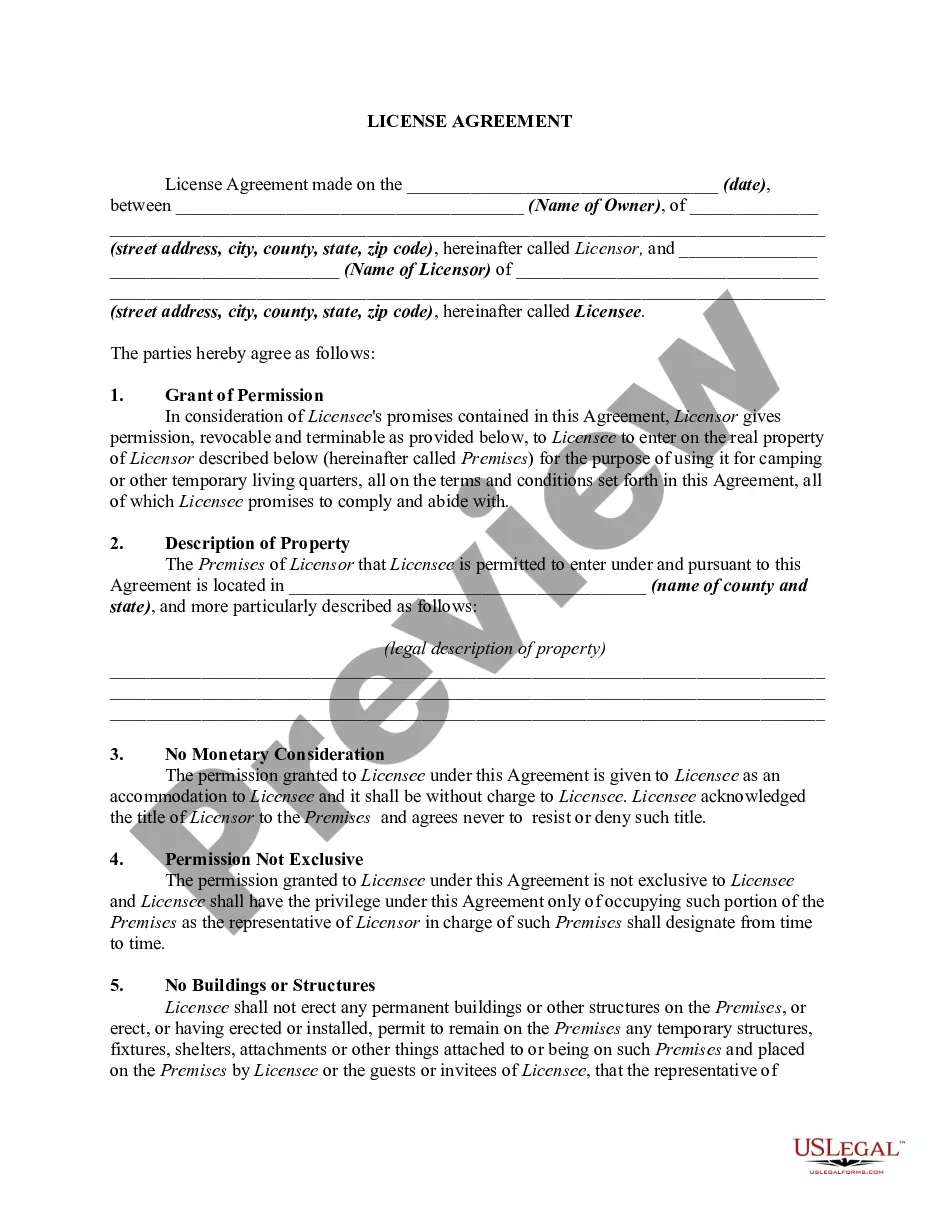

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another.

The law says that if all beneficiaries consent, they can petition the Court to change or end the trust. The Court will consider: if the trust must continue in order to carry out the purpose of the trust. if the reason for changing or ending the trust outweighs the interest in carrying out the purpose of the trust.

Below are steps to transfer real property out of a trust: Obtain the Death Certificate. Appraise the Property. Prepare an Affidavit of Death. Notify the County Assessor. Prepare a Trustee's Grant Deed. Address Outstanding Liabilities. Notify Relevant Parties.

To amend a living trust in California, you'll need to create a written amendment document that clearly states the changes you want to make to your trust. Amending your trust allows you to update beneficiaries, change asset distributions, or modify trustee appointments without having to create an entirely new trust.

To amend a living trust in California, you'll need to create a written amendment document that clearly states the changes you want to make to your trust. Amending your trust allows you to update beneficiaries, change asset distributions, or modify trustee appointments without having to create an entirely new trust.

You can amend it yourself. There should be provisions for doing so in the trust document. It's usually as simple as you write down the changes, and all grantors or trustees sign it.

The trustee must prepare a new deed to transfer the property from the trust to the beneficiary. This deed must be properly drafted and include all necessary information, such as the legal description of the property and the names of the trustee and beneficiary.

For example, if Joint Tenant B transfers his share of real property into a trust for the benefit of A, then B becomes Original Transferor: If A dies and property passes to B, the property avoids reassessment since B is Original Transferor.

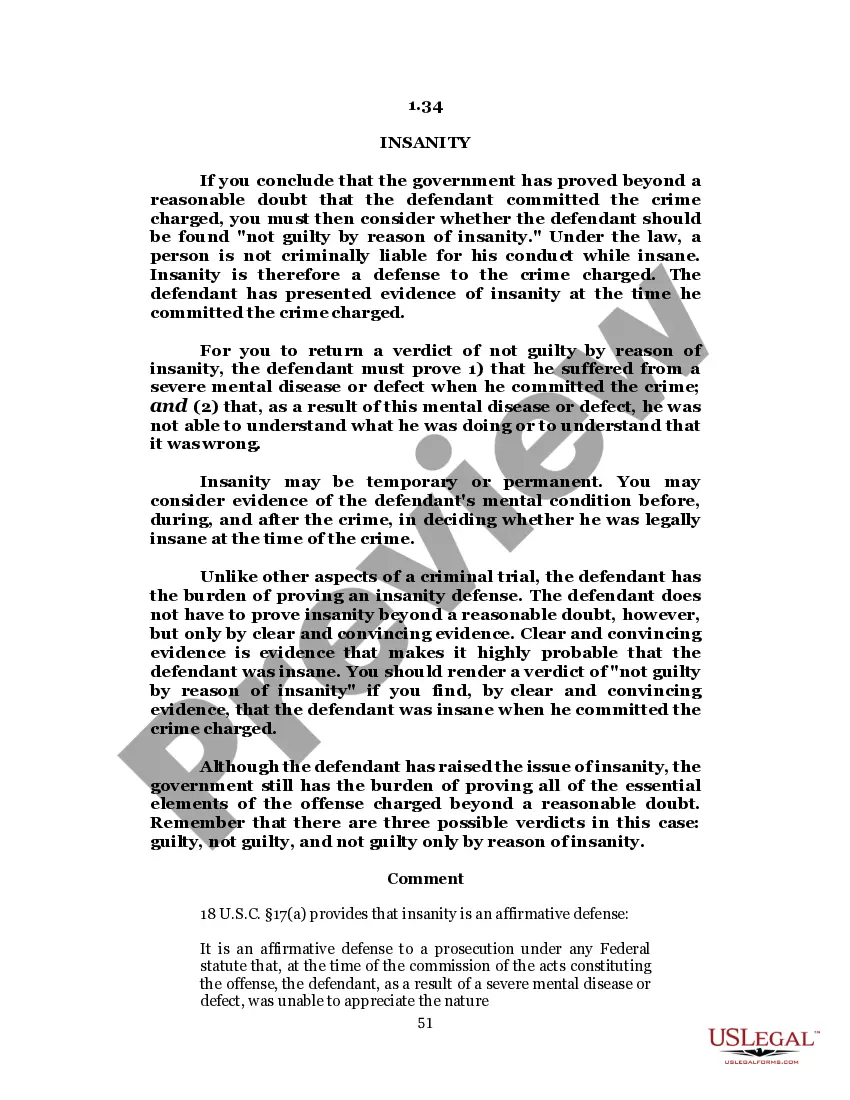

There are two main reasons a deed of trust may be considered invalid: (1) lack of required formalities in executing the deed of trust, or (2) there is some fact outside execution that makes the deed of trust invalid.