Secure Debt Shall Forget The Day In San Diego

Description

Form popularity

FAQ

Electronic filing (e-Filing) for unlimited, limited, complex civil, unlawful detainers and small claims cases will start as optional with the anticipation of e-Filing being mandated for attorneys and represented parties effective September 1, 2021, unless there is an exemption.

The Small Claims Hearing When submitting evidence, you must complete form LASC CIV 278 and use LASC CIV 279 mailing labels. You will have to provide proof that the other parties were sent copies of your evidence. You can get this from the Post Office at the time you mail these forms.

If the judgment debtor owns real property, you may record an Abstract of Judgment with the County Recorder which will act as a lien against all real property owned by the judgment debtor in the county in which the lien is recorded. Complete an Abstract of Judgment (EJ-001)PDF and submit to the court to be issued.

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

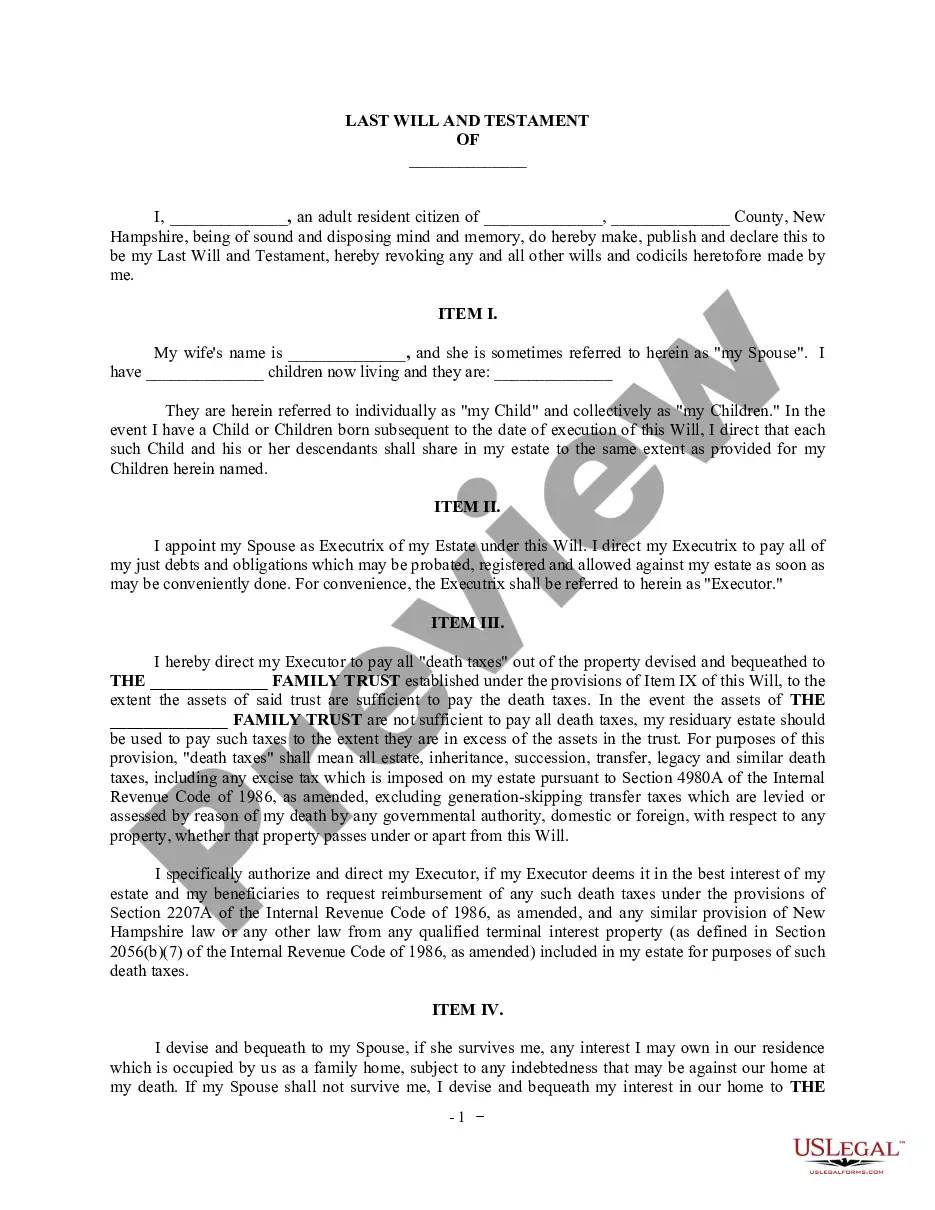

In many cases, a bankruptcy discharge can eliminate your personal responsibility for secured debt, so the lender can't sue you for unpaid amounts. However, the lien on the property doesn't automatically go away. The lender can still take back the collateral if you stop making payments.

More on our best debt relief companies AvailabilityLower monthly payments by Americor 49 states 40% or more National Debt Relief 47 states Up to 50% less than your monthly credit card payments. Freedom Debt Relief 42 states Up to 30% New Era Debt Solutions 47 states 50% or more3 more rows

Sure, bankruptcy will likely harm your credit score and ability to borrow in the near term, but as a last resort, it's often an effective way to get out of overwhelming credit card debt. You may be able to get your debt 100% forgiven through bankruptcy, giving you the ability to restart on a clean financial slate.

Here are strategies and tips for getting out of debt faster. Add Up All Your Debt. Adjust Your Budget. Use a Debt Repayment Strategy. Look for Additional Income. Consider Credit Counseling. Consider Consolidating Your Debt. Don't Forget About Debt in Collections. Stay Accountable.

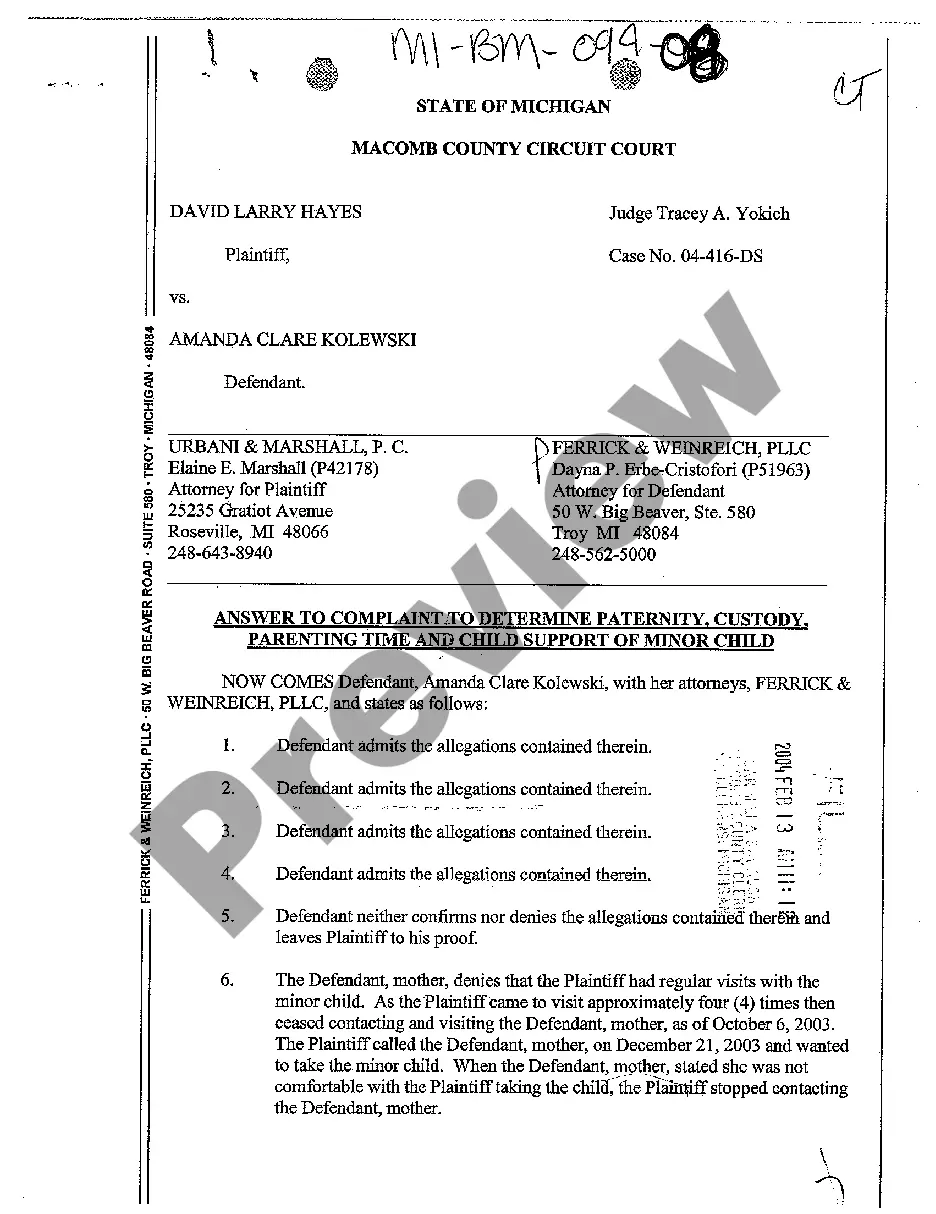

Follow these steps to respond to a debt collection case in California Answer each claim listed in the complaint. Assert your affirmative defenses. File the Answer with the court and serve the plaintiff.

Prepare your response, which is called an "Answer." In your Answer, you must address each allegation in the complaint and state your defenses. You can find templates for Answers online or at the court clerk's office. 4. File your Answer with the court by the deadline stated in the summons.