Secured Debt Any With A Sinking Fund In San Bernardino

State:

Multi-State

County:

San Bernardino

Control #:

US-00181

Format:

Word;

Rich Text

Instant download

Description

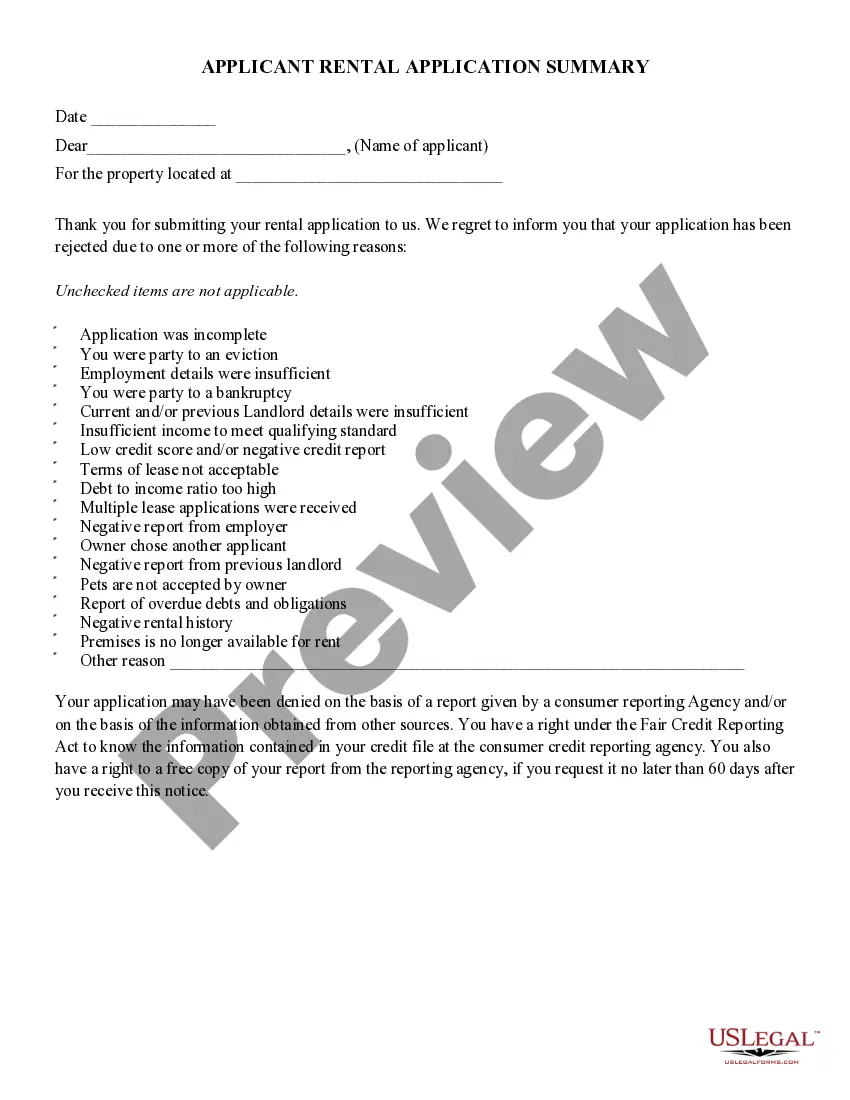

The Land Deed of Trust document outlines a secured debt arrangement involving a sinking fund in San Bernardino. It establishes a legal framework where the Debtor conveys property to a Trustee for the benefit of a Secured Party, providing security for repayment of their indebtedness through a Promissory Note. Key features include provisions for the payment structure, insurance coverage for the property, and the responsibilities of the Debtor regarding property maintenance and taxes. Filling instructions require users to provide specific details about the Debtor, Trustee, and Secured Party, as well as the financing amounts and terms. This form is particularly useful for real estate attorneys and legal professionals managing secured transactions, ensuring proper legal documentation for clients. It also aids partners, owners, and associates in understanding their obligations under the trust, while paralegals and legal assistants can utilize it to guarantee compliance with local laws in San Bernardino and assist in preparing and filing necessary documentation.

Free preview

Form popularity

FAQ

One of the biggest downsides of debt forgiveness is the impact it can have on your credit. You typically stop making payments to creditors so that you can save up for lump-sum settlements and that can seriously damage your credit.