Security Debt Shall Forgiveness In Pennsylvania

Description

Form popularity

FAQ

What Is Tax Forgiveness? True tax forgiveness comes in the form of credits against the back taxes. These credits can reduce some or all of your tax liability. To qualify, you must make certain the IRS takes into account your taxable and non-taxable income, as well as your family size and specific financial situation.

If the COD relates to a personal, nonbusiness debt, such as personal credit card debt, then the COD is not taxable for Pennsylvania personal income tax purposes. If the debt forgiveness was related to business, profession or farm income in the past, then the income is reported in that class of income.

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. For example, a family of four (couple with two dependent children) can earn up to $34,250 and qualify for Tax Forgiveness.

The maximum credit will be $1,050 (one child/dependent) or $2,100 (two or more children/dependents) The credit cap phases down as income levels increase. The minimum credit will be $600 (one child/dependent) or $1,200 (two or more children/dependents), provided expenses are at least $3,000 per child/dependent.

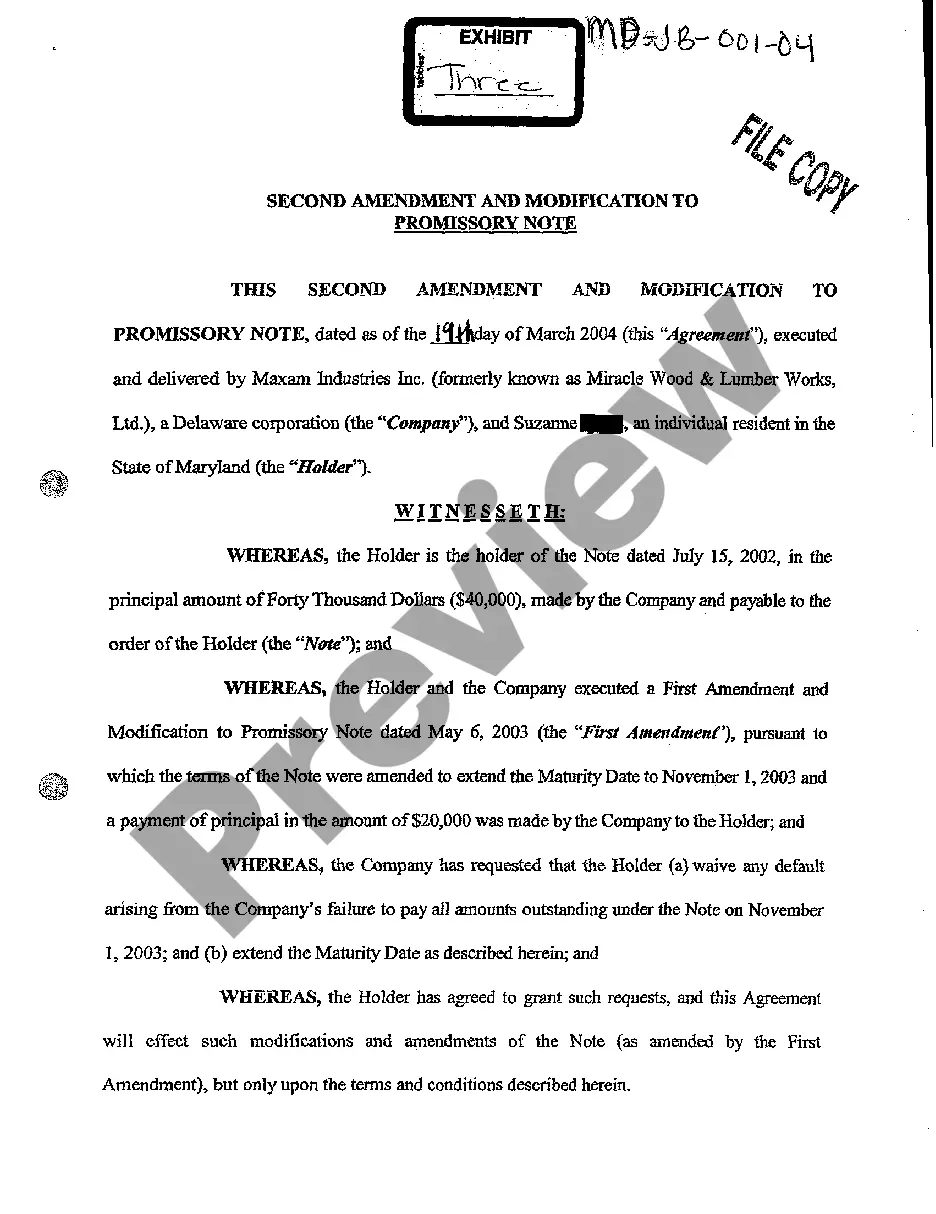

Key takeaways You will receive a 1099-C Cancelation of Debt form if a lender forgives more than $600 of taxable debt. You must include the amount of canceled debt on your federal tax return as a part of your taxable income.

If the COD relates to a personal, nonbusiness debt, such as personal credit card debt, then the COD is not taxable for Pennsylvania personal income tax purposes. If the debt forgiveness was related to business, profession or farm income in the past, then the income is reported in that class of income.

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. For example, a family of four (couple with two dependent children) can earn up to $34,250 and qualify for Tax Forgiveness.

Sole proprietors having net income (loss) from the operation of a business or profession other than a farm must file PA-40 Schedule C. If a taxpayer had more than one business or if a taxpayer and spouse each had separate businesses, submit a separate PA-40 Schedule C for each business.

You, and your spouse if applicable, are eligible if all of the following apply: You're subject to Pennsylvania personal income tax. You and/or your spouse are liable for Pennsylvania tax on your income (or would be liable if you earned, received, or realized Pennsylvania taxable income).

There are a number of reasons why your Pennsylvania state refund may be delayed, including the following: If the department needs to verify information reported on your return or request. additional information, the process will take longer. If you have math errors on your tax return or have other adjustments.