Secured Debt Any Formula In Maryland

Description

Form popularity

FAQ

Yes. There are time limits governing when a creditor can sue you for a debt. These laws are called the statute of limitations. In Maryland, the statute of limitations requires that a lawsuit be filed within three years for written contracts, and 3 years for open accounts, such as credit cards.

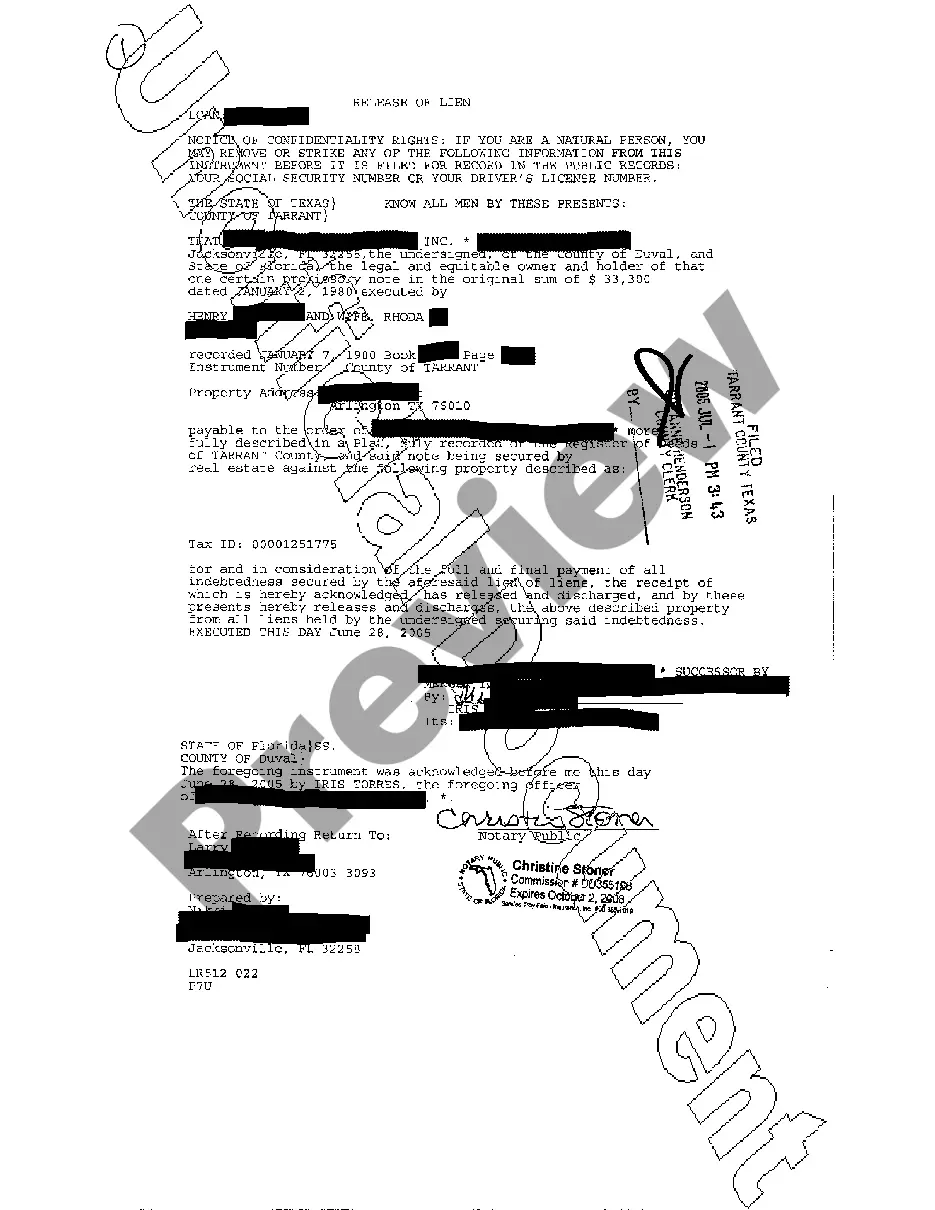

The filing should be made with the circuit court clerk for the county in which the real property is located.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials.

Also called a wage earner's plan, Chapter 13 enables individuals with regular income to develop a plan to repay all or part of their debts. Under Chapter 13, you work with the court on a repayment plan to make installments to creditors over 3 to 5 years.

If somebody wrongfully records a lien against your property, you can file a lawsuit for what's called “quiet title” to ask to have the court order that the lien be removed.

Subtract deductions; disposable earnings = $232.00. 30 x $7.25 (minimum wage) = $217.50. $232.00 - $217.50 = $14.50. Amount that can be garnished: $14.50 each week.

But generally, you have two courses of action. 1) Filing for an Exemption Can Help. Under Maryland law, you can file an injunction for exemption relief under certain circumstances to protect or “exempt” some or all of your wages. 2) Bankruptcy Can Stop Wage Garnishment in Maryland. 3) Recovering Garnishments.

Accounts Receivable It is not possible to “see and touch” an account receivable. Therefore, most lenders perfect a security interest in receivables by filing a financing statement.

Credit card debt is by far the most common type of unsecured debt. If you fail to make credit card payments, the card issuer cannot repossess the items you purchased.