Blank Deed Of Trust Withdrawal In Collin

Description

Form popularity

FAQ

Through a deed of release of mortgage, also called a release of deed of trust, the lender agrees to remove the deed of trust, which is the document containing all of the mortgage's terms and conditions that is filed at the beginning of the mortgage process.

Through a deed of release of mortgage, also called a release of deed of trust, the lender agrees to remove the deed of trust, which is the document containing all of the mortgage's terms and conditions that is filed at the beginning of the mortgage process.

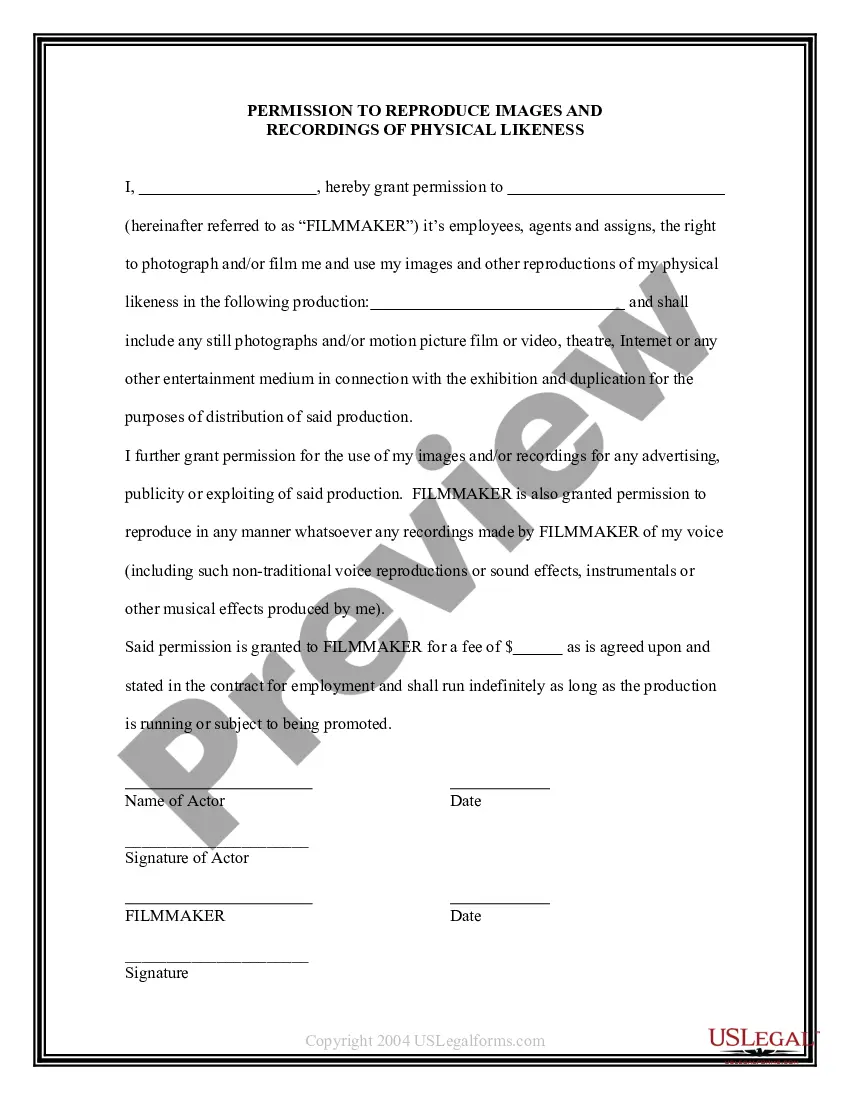

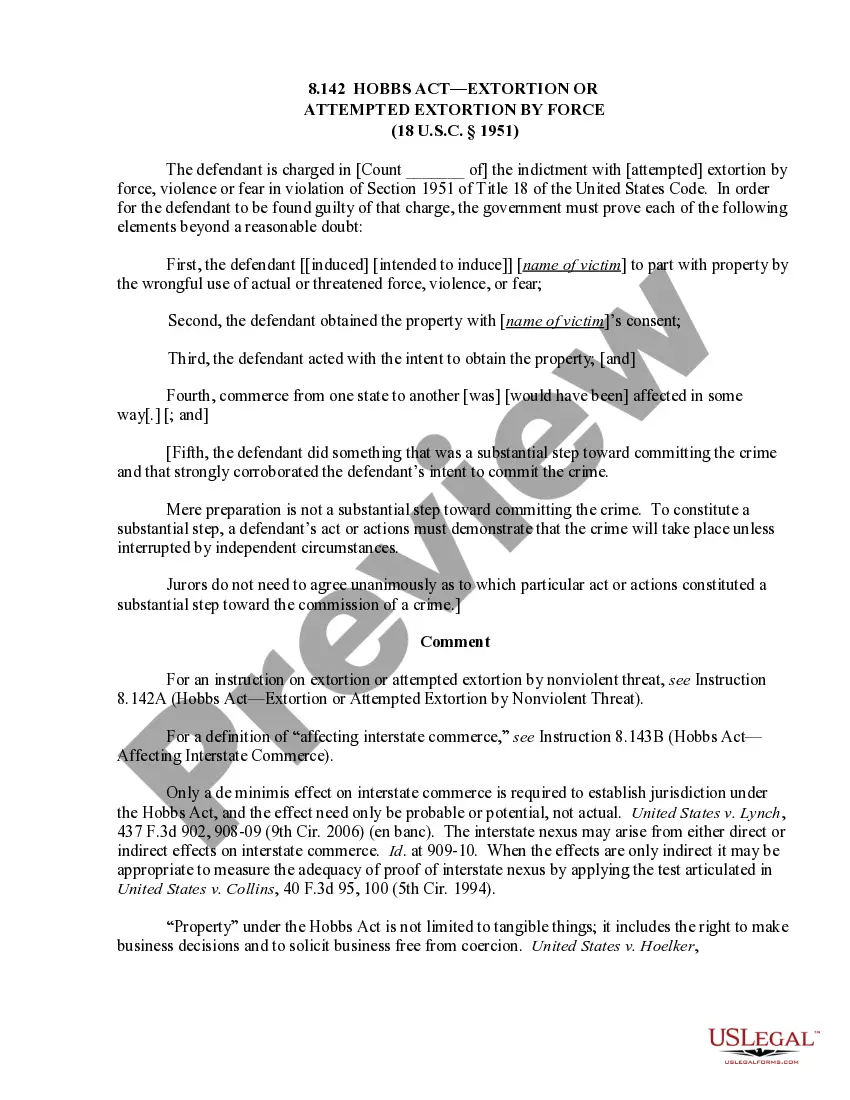

Requirements for Release of Deed of Trust Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

Requirements for Release of Deed of Trust Accurate Information: The release must include precise details of the original deed of trust, including recording information and property description. Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

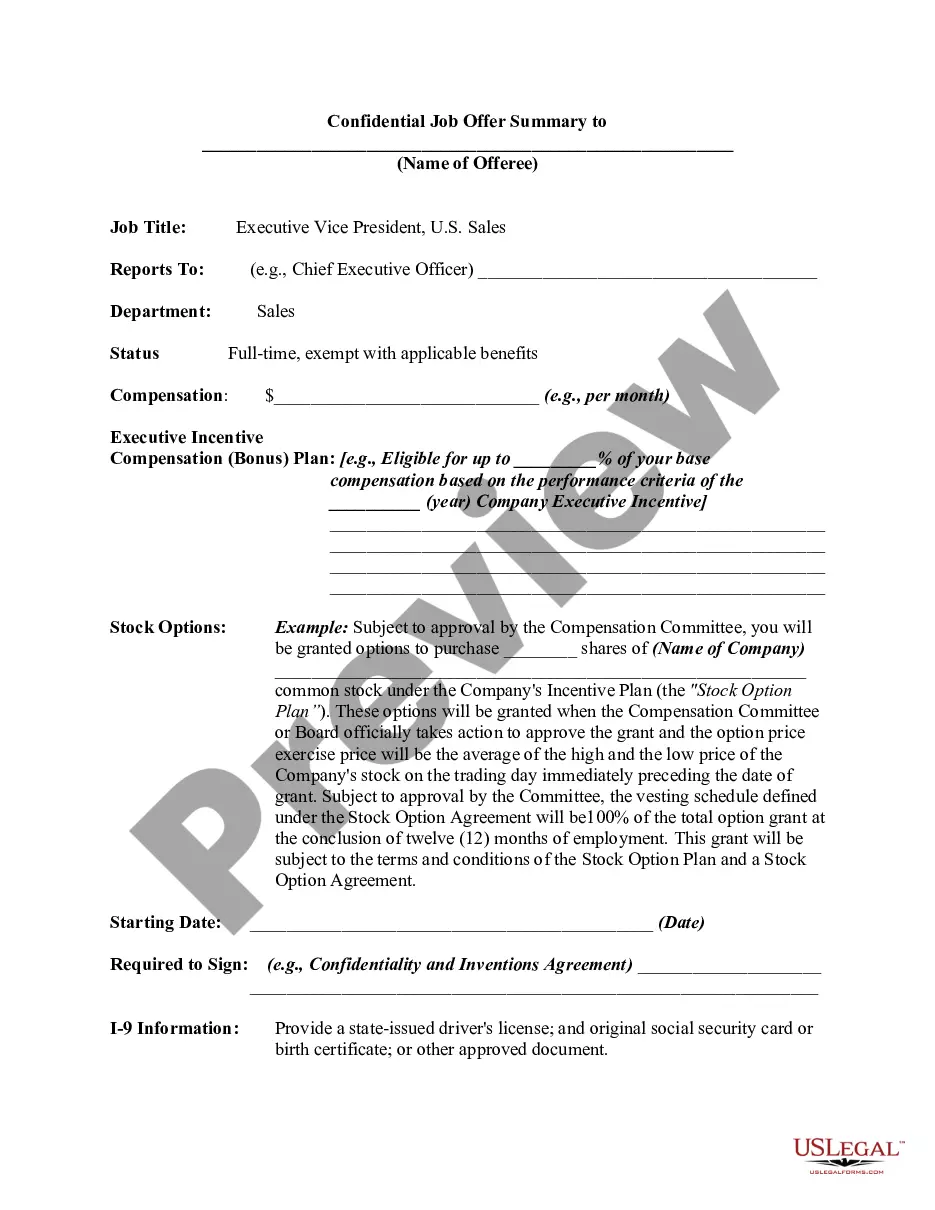

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

The appropriate person must sign the document, and that person's signature must be notarized (i.e., Release, Deed of Trust, Deed, etc.). A Release issued by the Internal Revenue Service is not required to be notarized. The document must include legal descriptions when applicable.

Processing a Release of Deed of Trust Execution: The lender or authorized agent signs the release, and it is notarized as required. Recording: The release is submitted to the county recorder's office for official recording, making it part of the public record.

If you need help finding a item not listed, please call (972) 548-4100 (McKinney) or (972) 424-1460 (Metro). For a full listing of departments please see the Department Directory. You can use the search box to filter services and find what you are looking for quickly.

County Officials NamePosition Stacey Kemp County Clerk Steve Asher Constable, Precinct 4 Susan Fletcher Commissioner, Precinct 1 Tim Nolan GIS/Rural Addressing59 more rows

If the project is located in Collin county, then yes, you will want to record your lien with the Collin County, Texas Clerk's office.