Letter Insurance Form For Submission In Middlesex

Description

Form popularity

FAQ

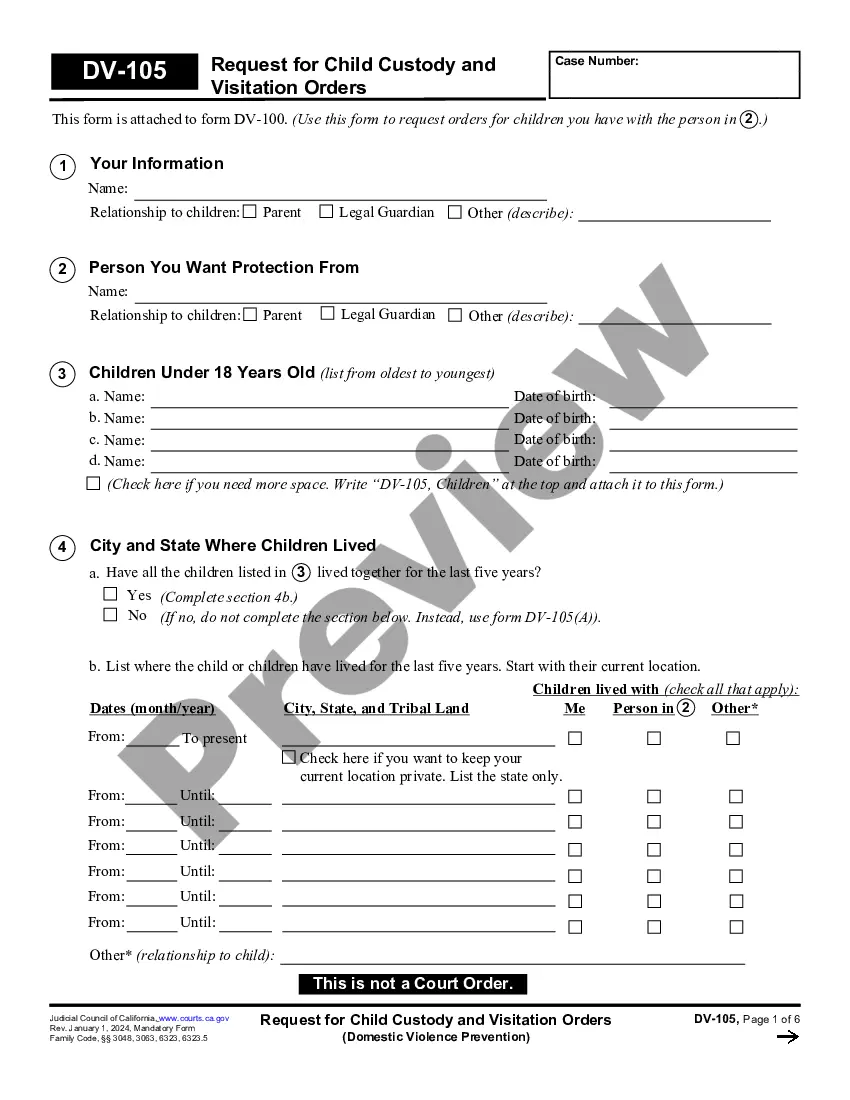

A health insurance claim form has two sections, i.e., Part A and Part B. While Part A is to be filled out by the policyholder, Part B is for the hospital. 2. In Part A of the form, you must fill out your name, residential address, policy number, email ID, phone number, medical history, details of hospitalisation, etc.

Ask your provider for the Provider Information or have them fill it out for you. Keep a copy of the form, claim details and receipts for your records. Send the claim as soon as possible, and as close to the date of service as possible. Complete a separate form for each claim.

Yes, you will want to call your insurance provider regardless of whose fault you believe it may be. Your insurance provider will be able to walk you through the next steps of filing a claim and finding out what your coverage does and does not cover.

Most insurance companies will allow you to file a claim online or through a mobile app, by phone with one of their agents, or by filling out a claims form and sending it to them via email or fax. It's your choice!

It's better if you file a third party claim directly with the other person's insurance. That will keep your insurance rates from rising (yes, your rates can rise if you file a claim with your own insurance even if you're not at fault.) You can't use a delay in processing the claim as an excuse to run up more expenses.

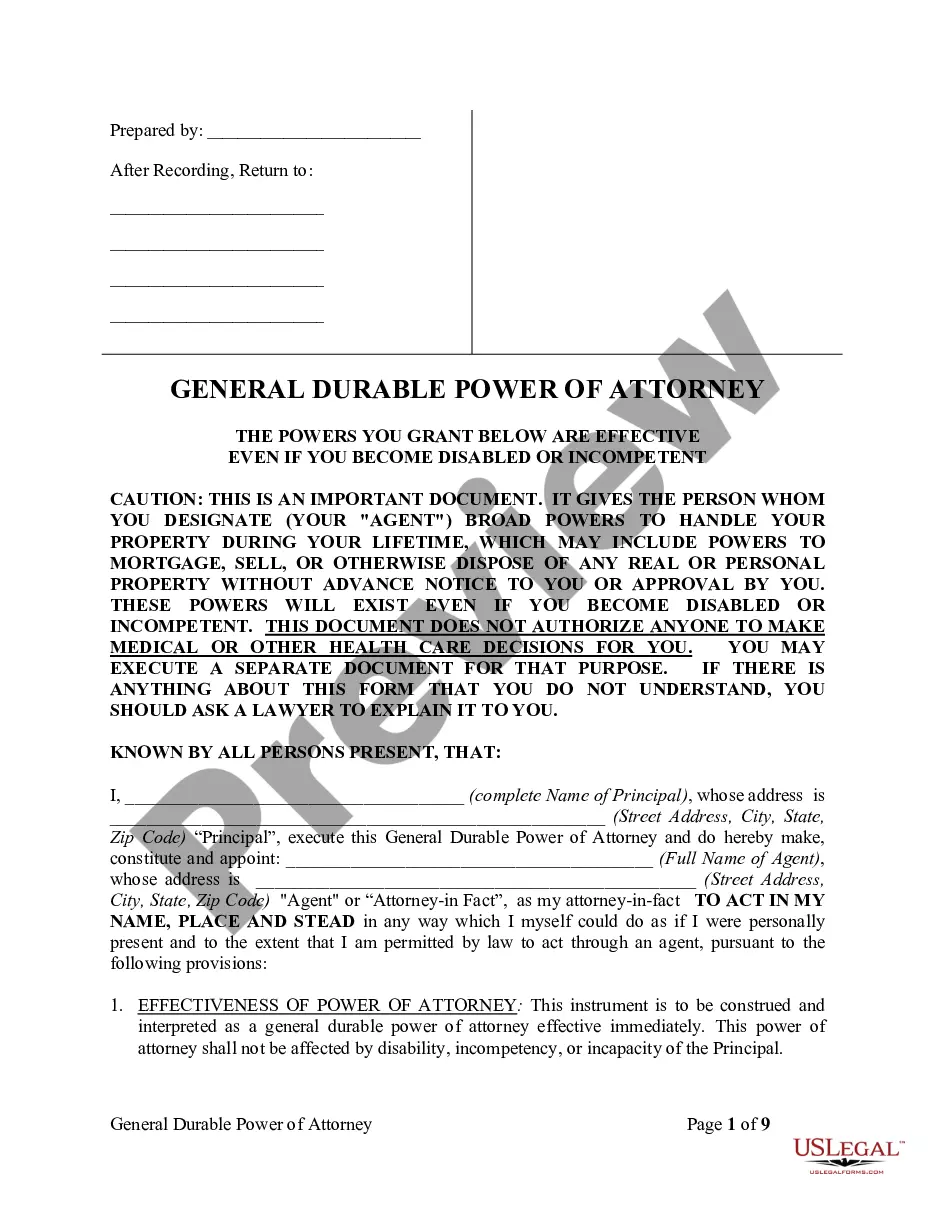

Typical sections of a claim form: Personal information like your name, address and date of birth. Insurance information such as a policy and group number. Reason for your visit including background information about your condition. Provider information including the doctor's name and address.

Auto Insurance Call your insurance professional as soon as possible — even from the scene of the accident—regardless of who is at fault. Use a mobile app to jumpstart your claim. Find out what documents are needed to support your claim. Understand the timing of your claim.

Insurance companies typically write policies on certain forms, ing to the Insurance Information Institute (III). The type of home you live in will help determine the coverage and policy form you have. For example, a renter's policy form will be different than a homeowner's.

Every time an insurance policy is approved, the policyholder is issued a certificate of insurance. This insurance document contains a summary of the insurance policy as well as details of the holder of that policy.

Start with Personal and Insurance Company Details: Begin your letter by writing your personal information (name, address, contact number) and today's date at the top. Below your details, write the insurance company's name, the address of their claims department, and your adjuster's name if known.