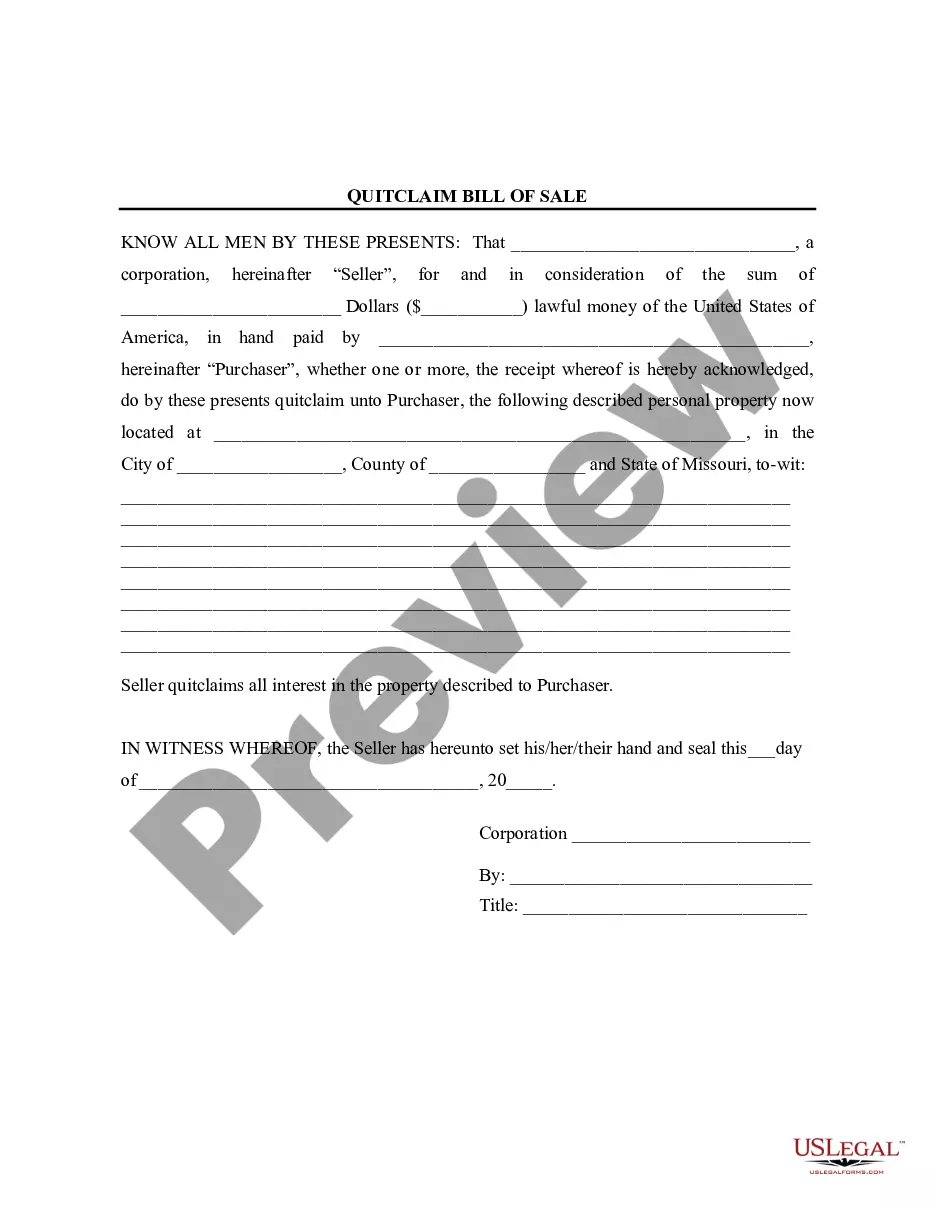

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Bill Sales Format Printable With Gst In Santa Clara

Description

Form popularity

FAQ

Manual Online Upload of Invoice on GSTN Step 1: Login to your GST account. GST Login. Step 2: Select the month for which you wish to upload GST invoices. Select Filing Month. Step 3: Select GSTR-1 Return and Click on Prepare Online. Step 4: Upload B2B Invoice Details. Step 5: Upload B2C Large Invoice Details.

GST invoice is a bill or receipt of items sent or services that a seller or service provider offers to a customer. It specifically lists out the services/products, along with the total amount due. One can check a GST invoice to determine said product or service prices before CGST and SGST are levied on them.

Step 1: Open Microsoft Excel, Microsoft Word or an invoicing software for creating a GST invoice. Step 2: Similarly, add tables as you added in Word or Excel ing to your requirements. Step 3: Provide the company details, including the pincode, address, name of the business, GSTIN, and email.

Fill out your bill of sale template online with ! is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

States Not Requiring Notarization Most states, including California, Texas, and Florida, do not require notarization for a bill of sale to be valid. In California, a bill of sale serves as proof of ownership transfer without the need for notarization.

How to Create a GST Invoice? STEP 1: Select the option 'Invoice' (built-in every accounting/GST software) ... STEP 2: Feed-in Date of Invoice. STEP 3: Choose the debtor/customer from the list. STEP 4: Choose the Place of Supply. STEP 5: Feed-in the details of goods or services. STEP 6: Click to Create GST Invoice:

While recording a sales voucher in Item Invoice mode, In the Party A/c name, select the unregistered customer ledger. Enter the stock item details. Name of Item – Select the stock item. Select the appropriate GST ledger based on the Place of Supply. As always, press Ctrl+A to save the sales voucher.

Filing sales tax online is generally recommended, but businesses may also submit the State, Local, and District Sales and Use Tax Return paper form (CDTFA-401-A).