Property Owned By A Business Is Called In San Jose

Description

Form popularity

FAQ

A business asset is an item of value owned by a company. Business assets span many categories. They can be physical, tangible goods, such as vehicles, real estate, computers, office furniture, and other fixtures, or intangible items, such as intellectual property.

Contact the Clerk of the Board at 299-5088, to receive a simple, one page appeal's application or to receive more information about the Assessment Appeals Board or the Value Hearing Officer.

What is business personal property? Business personal property is all property owned or leased by a business except real property. Business inventory is personal property but is 100 percent exempt from taxation.

Countywide Property Tax 1% Allocation. Proposition 13, the property tax limitation initiative, was approved by California voters in 1978. It limits the property tax rate to one percent of assessed value plus the rate necessary to fund local voter-approved debt.

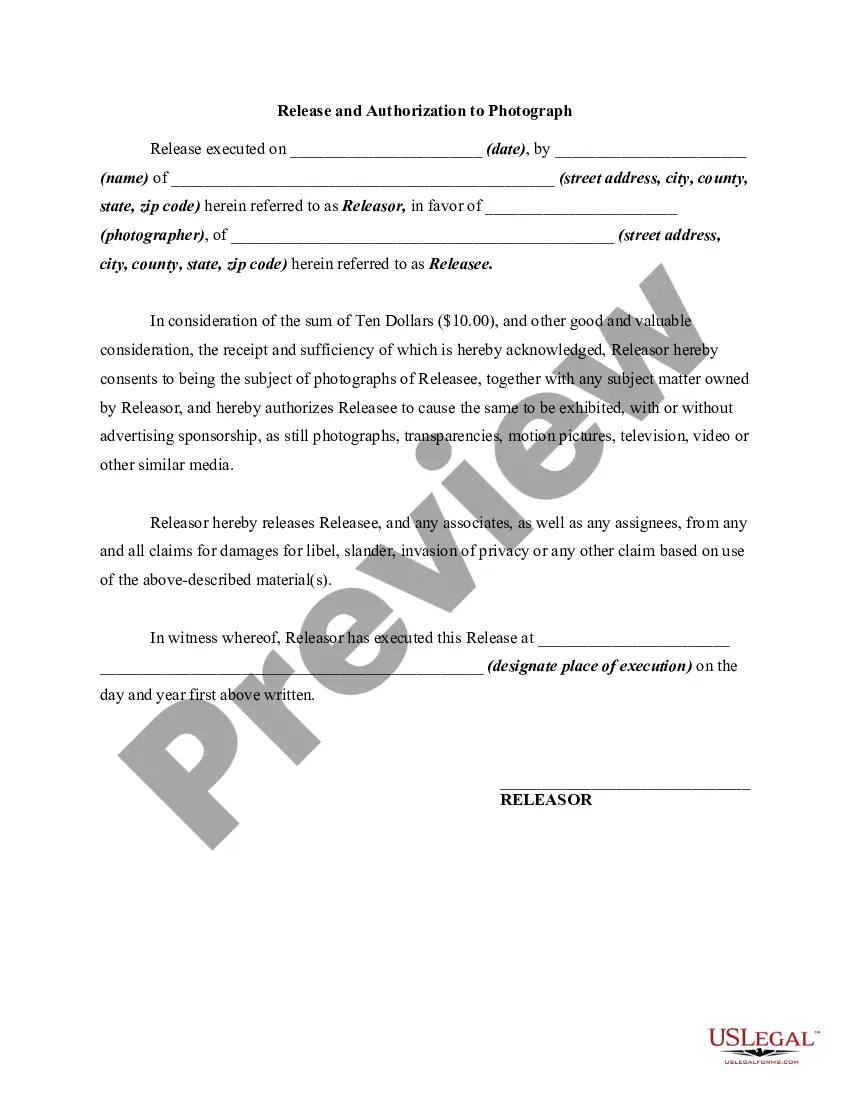

This form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on the tax lien date, and that you sign (under penalty of perjury) and return the statement to the Assessor's Office by the date cited on the ...

The California business property tax is calculated based on the assessed value of the property, as determined by local assessors. Currently, the state's business property tax is 1% of the assessed value of all taxable property.

To find out zoning information for your property you may do one of the following: Search by property address or Assessor's Parcel Number (APN) using our interactive map: MAP Santa Clara. Contact the Planning Division at 408-615-2450. or Planning@santaclaraca.

California state law prohibits the publishing of identifying information like a homeowner's name online without written permission from the owner. Property ownership information can be requested from the County Registrar-Recorder/County Clerk.