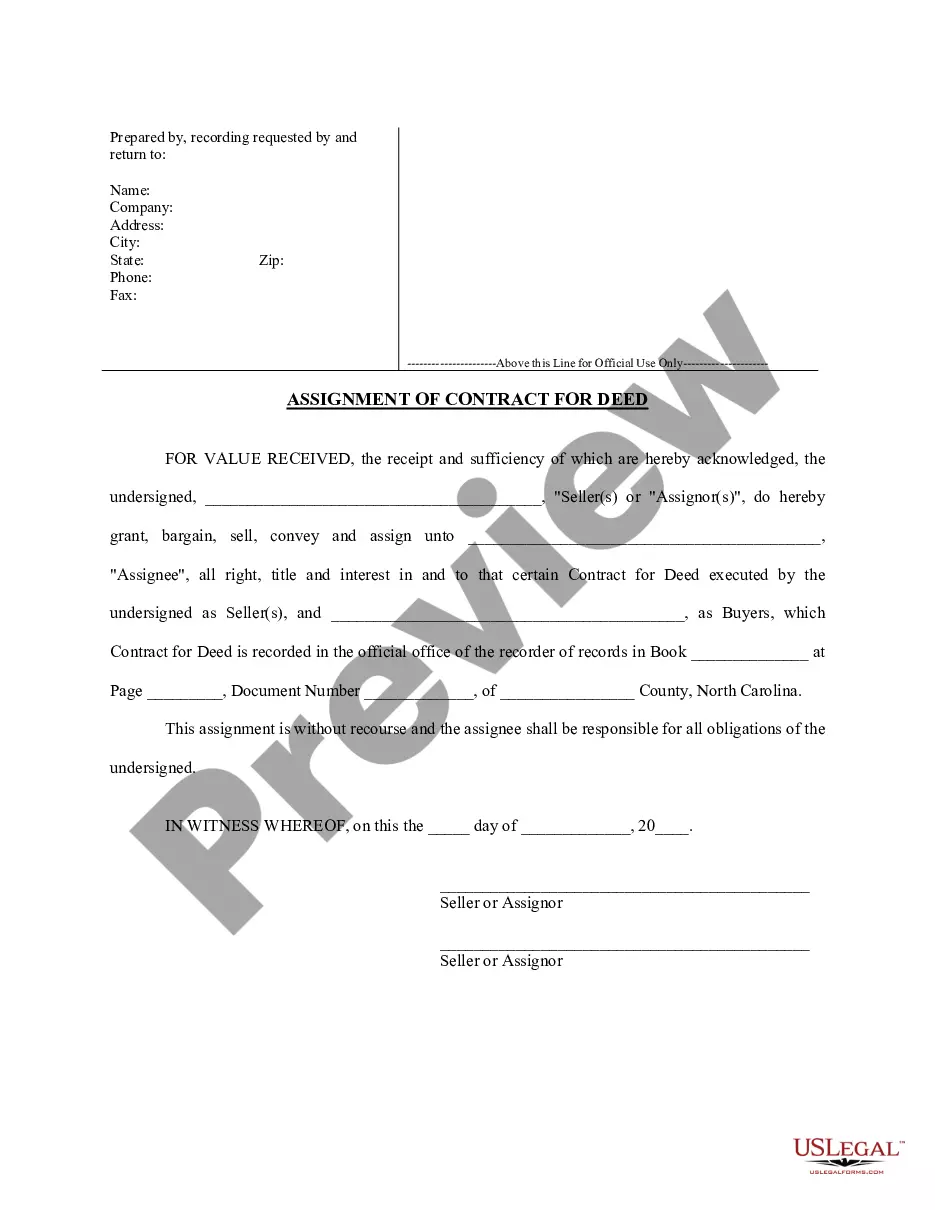

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Examples Of Business Personal Property In San Diego

Description

Form popularity

FAQ

In general, Business Personal Property is all property owned or leased by a business except: Real Property (land, buildings and other improvements), and. Business Inventory (items held for sale)

Business Personal Property is the assets of the business. Desks, chairs, file cabinets, computers, printers, copiers, phones, fire extinguishers, shelving, trash cans, cleaning supplies, decor, hand trucks, forklifts, and other machinery and equipment are all personal property assets and must be reported per ORS.

Personal Property is all property except real estate and can include business equipment, vessels, aircraft, vehicles and manufactured homes.

Factories and corporations are considered private property. The legal framework of a country or society defines some of the practical implications of private property. There are no expectations that these rules will define a rational and consistent model of economics or social system.

Equipment: Machinery, tools, computers, and other equipment necessary for business operations are generally covered under BPP insurance. Furniture: Office furniture, including desks, chairs, filing cabinets, and fixtures, is typically included in BPP coverage.

Business personal property insurance covers your real property, known as tangible assets, but not your intangible assets. Your tangible assets are items you can physically see or touch, such as a desk or computer. For these assets, their value is easily defined and can be covered by a business personal property policy.

Business personal property insurance on a BOP covers lost, damaged, or stolen property used to run your business. Examples include computers, office supplies, furniture, and inventory. This coverage is available even if you don't own a building.

Business Personal Property includes all supplies, equipment and any fixtures used in the operation of a business. Exempt from reporting are business inventory, application software and licensed vehicles (except Special Equipment (SE) tagged and off-road vehicles).

The California business property tax is calculated based on the assessed value of the property, as determined by local assessors. Currently, the state's business property tax is 1% of the assessed value of all taxable property.