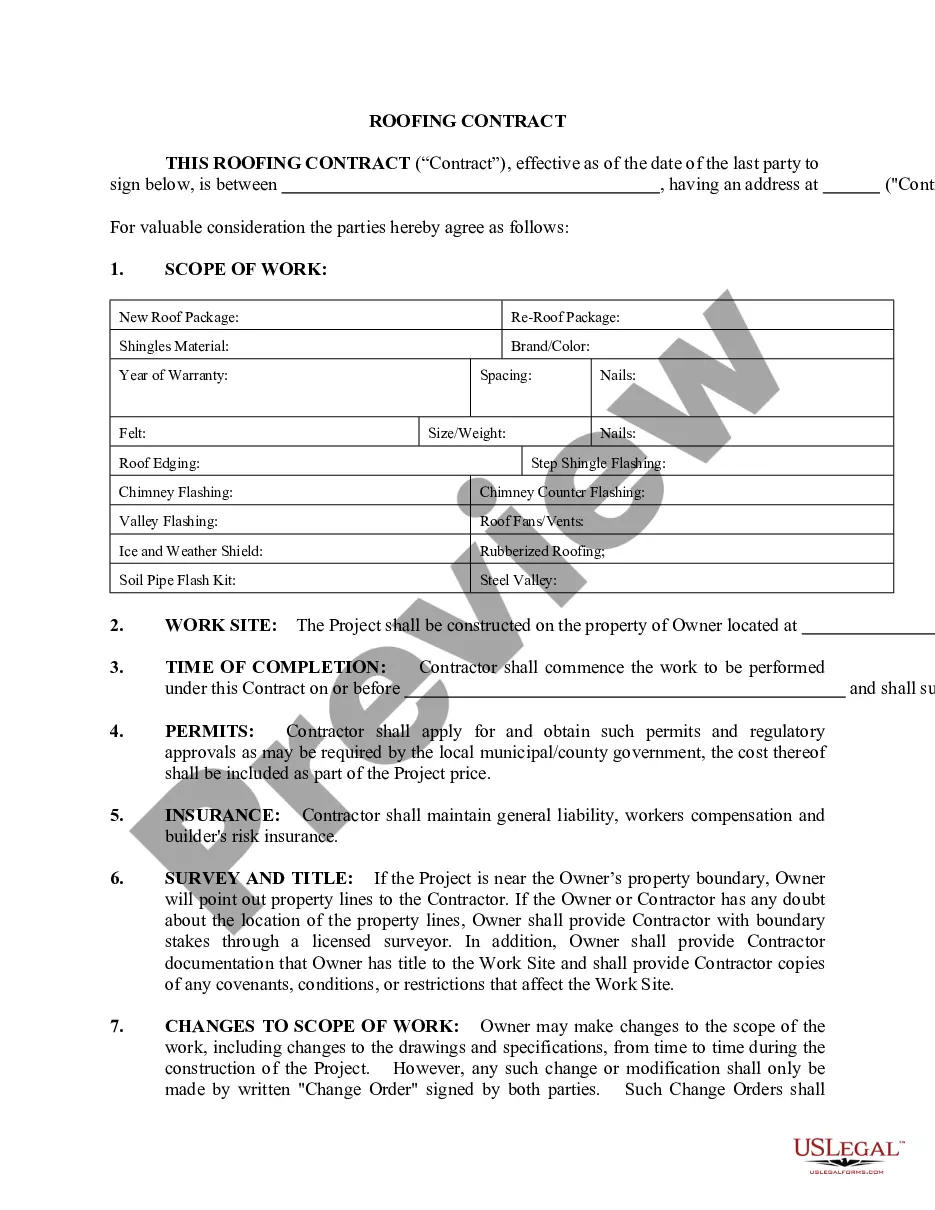

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Blank Bill Of Sale Form With Payment Plan In Ohio

Description

Form popularity

FAQ

Get a bill of sale from a regulatory agency. Many government agencies, like the Department of Motor Vehicles, for instance, offer bill of sale forms for public use. Using a form directly from a government agency ensures that you have all of the information required for your state.

A regular bill of sale does not require notarization but still serves as proof of the transaction.

The buyer and seller must also sign a bill of sale and have it notarized. This is to protect buyers from unknowingly buying a vehicle that is unlikely to be fully insurable and may be dangerous.

If the seller withholds information from the buyer, or misrepresents the value of an item, this may render a bill of sale null and void.

Writing a state of Ohio bill of sale is a simple process. Start by using our easy-to-use, customizable template. Provide the legal names, addresses, and contact information of both the buyer and the seller. Describe the item being sold, including the make, model, year, color, and any unique identifiers.

A bill of sale does not have to be digital to be considered valid. Both handwritten and digital formats are generally acceptable, as long as all necessary information is listed and you have the consent of both parties.

The buyer and seller must also sign a bill of sale and have it notarized. This is to protect buyers from unknowingly buying a vehicle that is unlikely to be fully insurable and may be dangerous.

Many states don't mandate notarization for bills of sale. States like California, Texas, Florida, Ohio, and New York allow transactions without a notarized document. In these states, a signed bill of sale is often sufficient for legal purposes, provided it includes all required information.