Property Owned By A Business Is Called In Florida

Description

Form popularity

FAQ

A business asset is an item of value owned by a company. Business assets span many categories. They can be physical, tangible goods, such as vehicles, real estate, computers, office furniture, and other fixtures, or intangible items, such as intellectual property.

Disadvantages of forming a real estate LLC Despite the advantages, there are some drawbacks to forming an LLC for real estate investment, including formation and ongoing costs, mortgage difficulties, and limited liability protection.

Deductible expenses for business use of your home include the business portion of real estate taxes, mortgage interest, rent, casualty losses, utilities, insurance, depreciation, maintenance, and repairs.

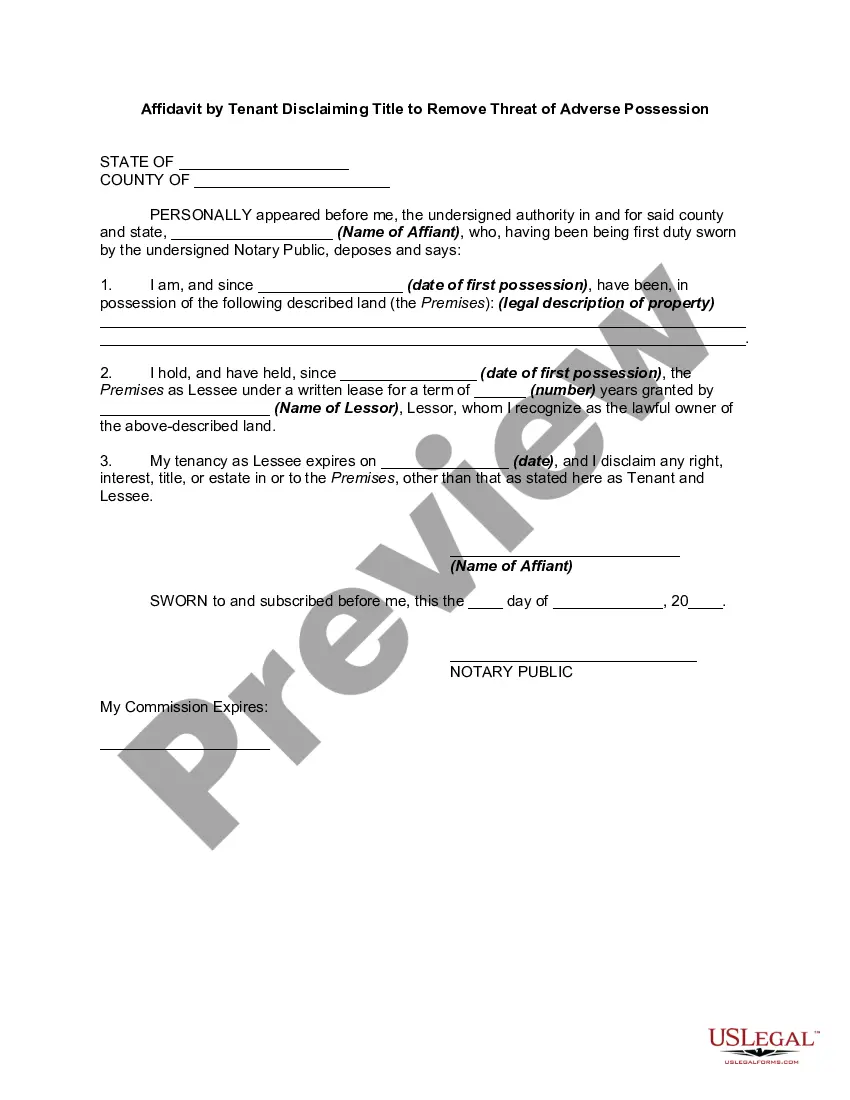

Follow these steps to transfer property to LLC business structures. Make sure your LLC is registered. Review the property title and LLC operating agreement. Draft a deed of transfer. Notarize and file the deed. Notify your mortgage company. Update tax records. Transfer utilities and insurance. Plan for tax complications.

Real estate owned by certain religious, charitable or educational entities that are used for religious, charitable or educational purposes is exempt from property taxation. An exemption must be applied for through the Property Appraiser's office. The exemption is not automatic.

Florida Tangible Personal Property Tax Tangible Personal Property Tax is an ad valorem tax assessed against the furniture, fixtures and equipment located in businesses and rental property. Ad valorem is a Latin phrase meaning “ing to worth”.

Business Property means property on which a business is conducted, property rented in whole or in part to others, or held for rental.

Commercial property, also called commercial real estate, investment property or income property, is real estate (buildings or land) intended to generate a profit, either from capital gains or rental income.

Commercial real estate (CRE) covers a diverse range of asset types and is defined as property used specifically for business purposes. The primary role of a commercial property is to generate revenue through capital gain or rental income.