Business Tangible Personal Property Form For Virginia In Alameda

Description

Form popularity

FAQ

File Form 763, the nonresident return, to report the Virginia source income received as a nonresident. Generally, nonresidents with income from Virginia sources must file a Virginia return if their income is at or above the filing threshold.

The aggregate of all tangible personal property owned by any person, firm, association, unincorporated company, or corporation which is leased by such owner to any agency or political subdivision of the federal, state or local governments shall be subject to local taxation. Code 1950, § 58-831.1; 1960, c. 239; 1975, c.

Tax Rate. The tax rate for all personal property (other than machinery and tools) is $3.40 per $100 of value. The tax rate for machinery and tools is $0.80 per $100 of value. Only specific businesses qualify for the machinery and tools rate.

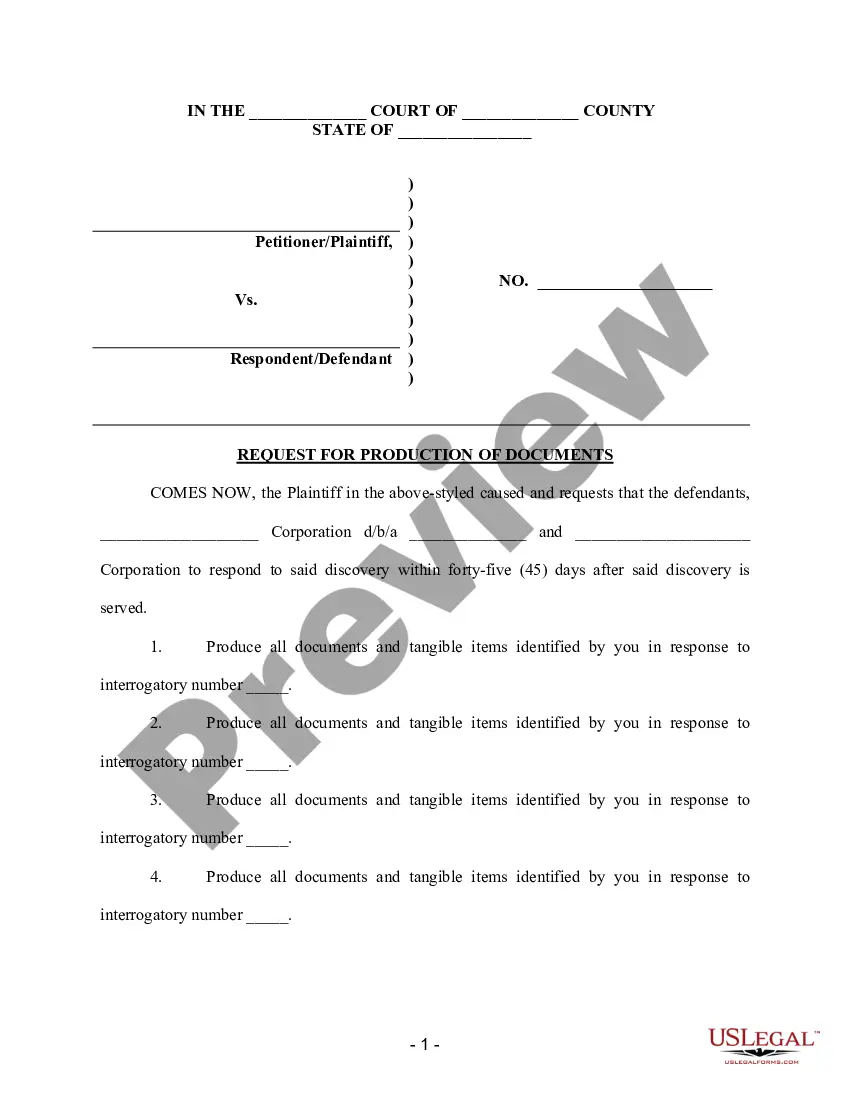

Form 762 is used by taxpayers to report tax information. It should be filled out and submitted to the Tax Department.

Form 870—Waiver of Restrictions on Assessment and Collection of Deficiency in Tax and Acceptance of Overassessment | Secondary Sources | Westlaw.

You can request forms and instructions from the Virginia Department of Taxation's Forms Department by calling 804-440-2541.

PBGC Form 707-Designation of Beneficiary for Benefits Owed at Death. Page 1. Designation of Beneficiary for. Benefits Owed at Death. (Currently Receiving Pension Benefits)

Schedule K-3 (Form 1065) reports items of international tax relevance from the operation of a partnership. You must include this information on your tax or information returns, if applicable. See separate parts for specific instructions. You only need to use the schedules that are applicable to you.

To file your annual income tax return, you will need to use Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), to report any income or loss from a business you operated or profession you practiced as a sole proprietor, or gig work performed.

There is no minimum income you have to meet before your small corporation is taxed. Every dollar it earns (after deductions and credits are factored in) will be taxed at 21%. Corporate tax rates also apply to limited liability companies (LLCs) who have elected to be taxed as corporations.