Movable Property Form In Railway In Travis

Description

Form popularity

FAQ

How would the changes affect senior homeowners and those with disabilities? In addition to the new $100,000 exemption, Texas homesteaders with disabilities and those 65 and older will continue to qualify for the extra $10,000 exemption they are already allowed to receive — for a total exemption of $110,000.

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings.

In addition to the senior freeze tax, Texas also allows senior homeowners to defer their property taxes until their estates are settled after their death. To qualify for this program, the homeowner must be 65 years or older, have a limited income, and own and occupy the home as their primary residence.

Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption for school district taxes, in addition to the $40,000 exemption for all homeowners.

Ing to the Comptroller, there is no provision for the cessation of property taxes at any stage. However, there is a Texas property tax exemption for people over the age of 65, which offers temporary tax relief for seniors. At the age of 65, seniors can apply for an exemption from Texas property taxes.

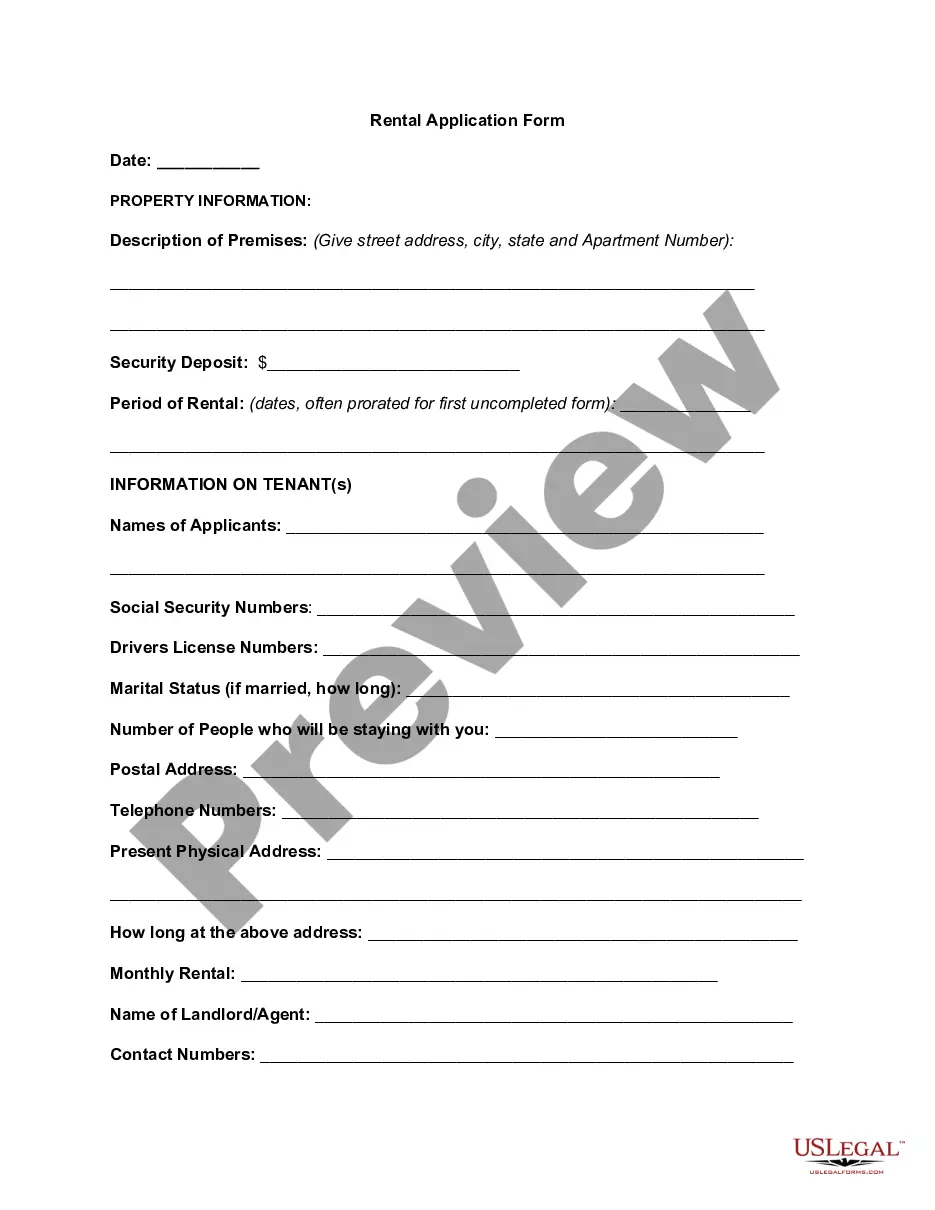

Fill in the business start date, sales tax permit number, and check any boxes that apply. If sold, please fill in the New Owners name. If moved, please fill in the new location address. Please check the box with the value that describes the property owned and used by the business.

Real property is land and anything attached to it, while personal property refers to movable items. For example, a house on a plot of land is real property, while the furniture inside is personal property.

Movable Property Examples Movable assets examples are everything that can be transported from one place to another, including: Vehicles, electronic devices, jewellery, books, timber, etc. Mango trees once cut and sold for timber purposes are also classified under the movable property section.

Movable Property Examples Movable assets examples are everything that can be transported from one place to another, including: Vehicles, electronic devices, jewellery, books, timber, etc. Mango trees once cut and sold for timber purposes are also classified under the movable property section.

In civil law systems, personal property is often called movable property or movables—any property that can be moved from one location to another. Personal property can be understood in comparison to real estate, immovable property or real property (such as land and buildings).