Personal Property And Securities Act In Riverside

Description

Form popularity

FAQ

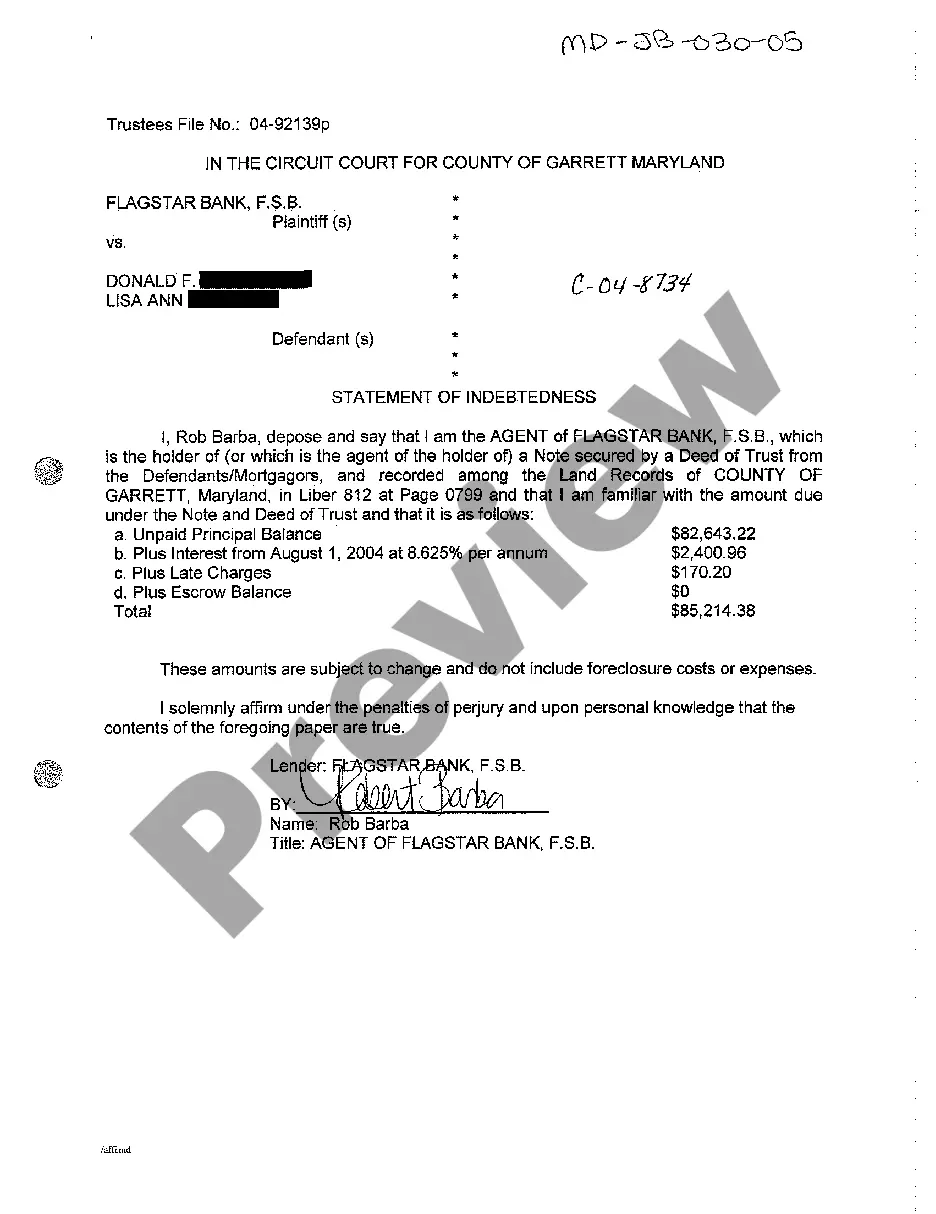

On the secured tax roll, the first installment is due November 1 and delinquent on December 10, and the second installment is due on February 1 and delinquent on April 10. Taxpayers have the option of paying both installments when the first installment is due. Penalties will not be waived due to not receiving a bill.

If there are any remaining unpaid property taxes, and if you did not receive an Annual Secured Property Tax Bill from either the previous owner or the Treasurer and Tax Collector, you may request a copy by visiting ttc.lacounty/request-duplicate-bill.

Other types of intangible personal property include life insurance contracts, securities investments, royalty agreements, and partnership interests.

Machinery, equipment, tools, furniture, fixtures, and leasehold improvements held or used in connection with a trade or business are taxable. In addition, most boats, aircraft and mobile homes are also taxable. Supplies on hand, demonstration equipment, and construction in-progress are also assessable.

If the change of ownership or new construction occurs between January 1 and May 31, a second supplemental assessment will be required for the next fiscal year (July 1 - June 30). If two assessments are required, two separate bills will be issued.

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings. These are considered to be real property.

Riverside Superior Court Local Rule 3116 provides: Unless otherwise specified in the Order to Show Cause, any response in opposition to an Order to Show Case (a) shall be in the form of a written declaration and (b) shall be filed no less than four court days before the hearing on the Order to Show Cause.

Under Article XIII, Section I of the California Constitution, all property is taxable unless it is exempt. Each year Personal Property is reassessed as of lien date, January 1st. Personal Property is all property except real estate and can include business equipment, vessels, aircraft, vehicles and manufactured homes.

Personal-use property is not purchased with the primary intent of making a profit, nor do you use it for business or rental purposes.

Every property owner in the State of California is entitled to and has Proposition 13.