Personal Assets With Examples In Nassau

Description

Form popularity

FAQ

Section 207.20 - Inventory of assets (a) The fiduciary or the attorney of record shall furnish the court with an Inventory of Assets form which identifies the following: (1) those assets that either were owned by the decedent individually, including those in which the decedent had a partial interest, or were payable or ...

How Long Does it Take to Become Executor of a New York Estate? The short answer: 2 to 6 months. Typically 3 months. In the best-case scenario, getting your letters testamentary will take just 2 months.

If there is no Will, an Intestate Administration proceeding is filed. The court will then appoint an Administrator and he or she will have all of the powers of an Executor.

With a valid will, an executor is designated to handle the probate process, but without a will, instead of an executor, an administrator gets appointed. In New York, the closest living relative of your loved one will have to file for estate administration. This usually falls to the spouse or an adult child.

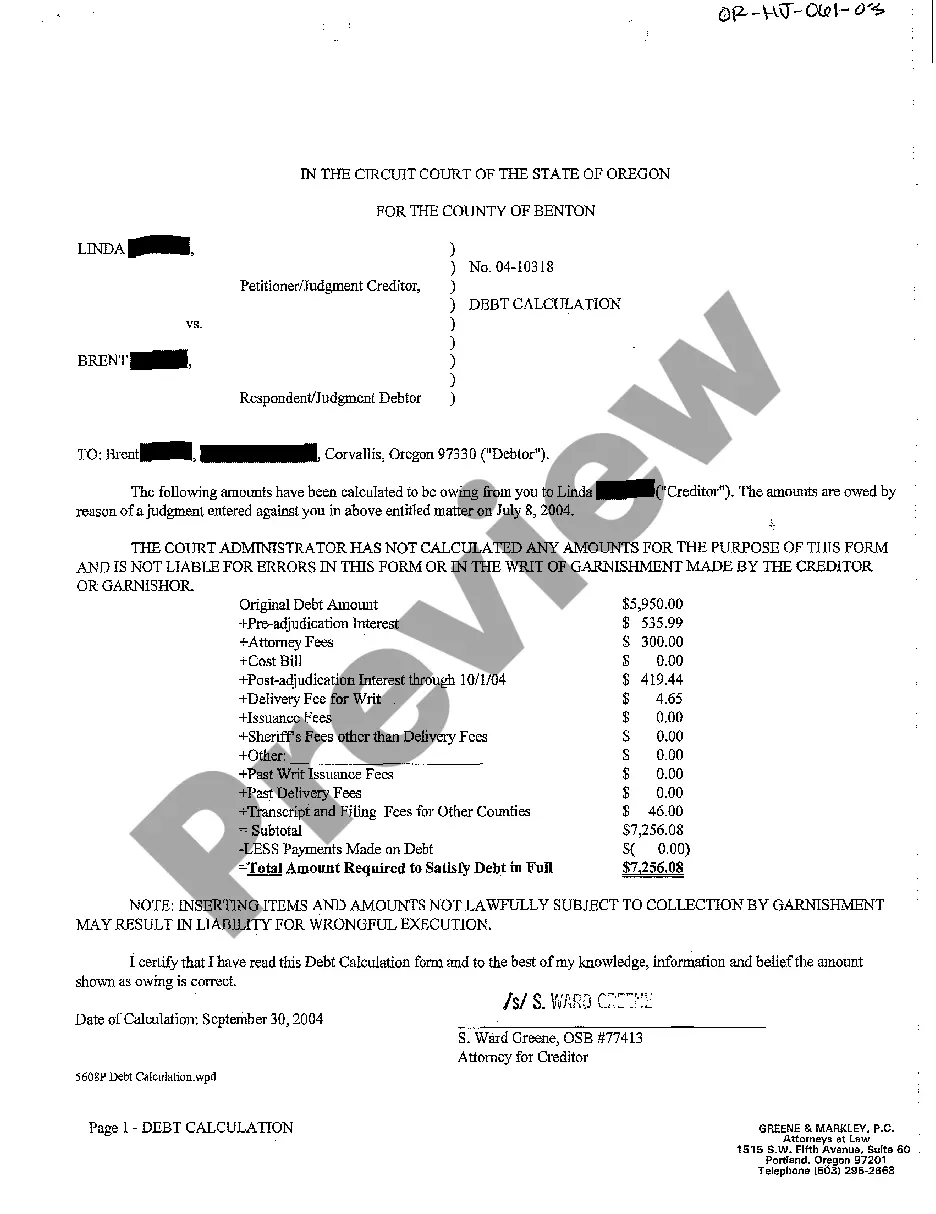

Personal Property Execution If a Judgment Creditor knows that the Judgment Debtor owns a car, truck, motorcycle or other personal property of significant value, the Judgment Creditor may file a Property Execution.

How Long Are Judgments Valid in New York? Judgments are valid for 20 years and may be extended once for an additional period of 10 years. To extend a judgment for an extra ten (10) years, the Judgment Creditor must make written application to the court that issued the original judgment.

What kind of tax exemptions are there and when do I file? Homeowners may be eligible to receive a Senior Citizens, Veterans, Disability/Limited Income, STAR, Home Improvement and/or Volunteer Firefighter/Ambulance Personnel exemption. Applications are accepted by the Nassau County Department of Assessment year-round.

Citizens of The Bahamas are exempt from real property tax on vacant land and on property in the Family Islands. However, all commercial and residential property on New Providence are taxable unless the residential property is owner-occupied and is valued less than $250,000.

All Tangible Personal Property accounts are eligible to receive up to a $25,000 exemption if a Tangible Personal Property return (DR-405) has been timely filed with the Property Appraiser. All new businesses are required to file this return in order to receive the exemption.

Tangible personal property (TPP) is all goods, property other than real estate, and other articles of value that the owner can physically possess and has intrinsic value. Inventory, household goods, and some vehicular items are excluded.