Personal Property Document With No Class Life In Alameda

Description

Form popularity

FAQ

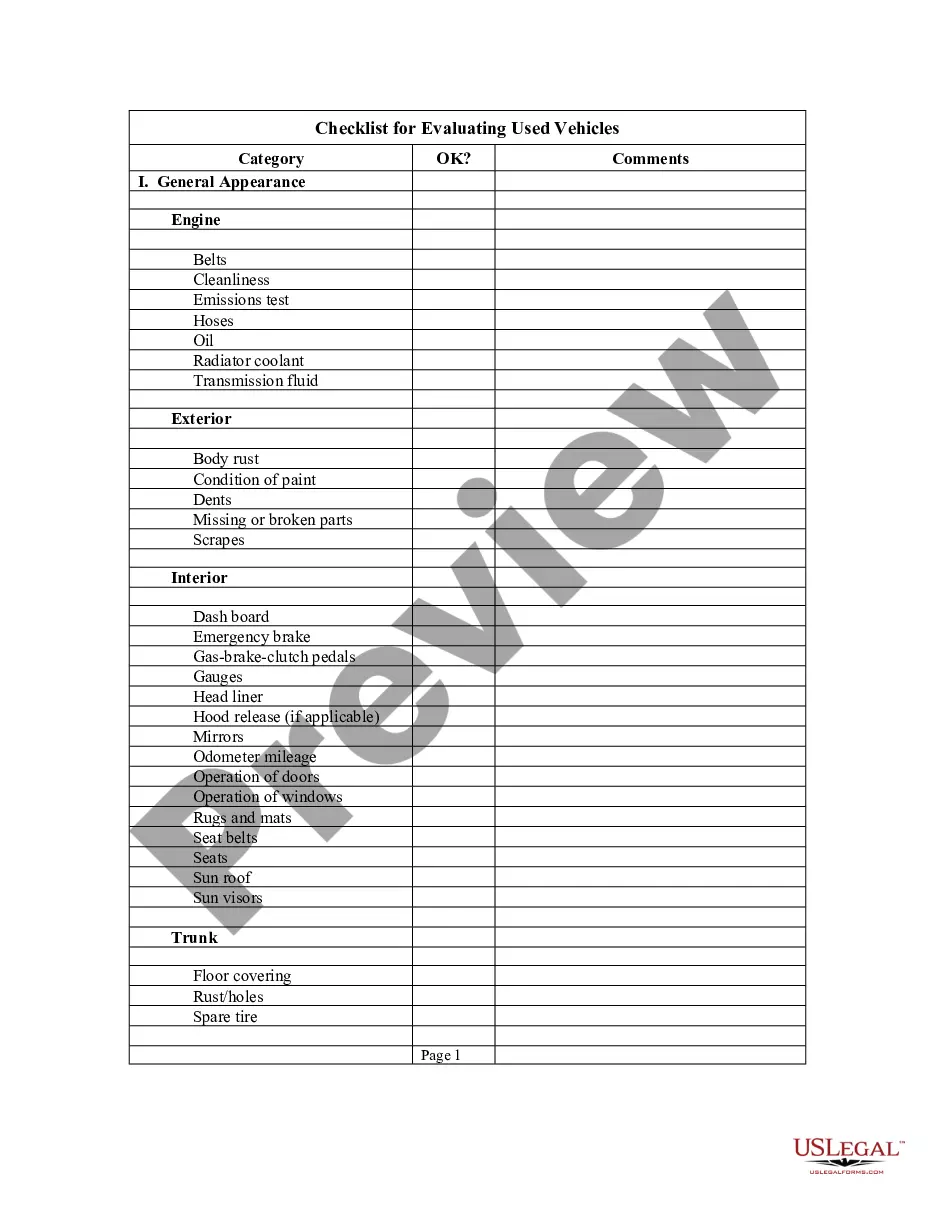

Under Article XIII, Section I of the California Constitution, all property is taxable unless it is exempt. Each year Personal Property is reassessed as of lien date, January 1st. Personal Property is all property except real estate and can include business equipment, vessels, aircraft, vehicles and manufactured homes.

Unsecured property taxes are those whose payment is not secured by the property being taxed. Property typically taxed on the unsecured roll may include boats, airplanes, office furniture, machinery, etc.

The Form 571L or 571A constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled or managed on the tax lien date. The form is approved by the State Board of Equalization (BOE) but forms are administered by the county.

(Art XIII Sec 3 of the CA Constitution, Rev & Tax 218). How do I qualify for the Homeowners' Exemption? To obtain the exemption for a property, you must be its owner or co-owner (or a purchaser named in a contract of sale), and you must live in the property as your principal place of residence.

Proposition 13 allows a transfer of primary resident between parent and child without reassessing the tax base of the home. To get the benefit, you filed the appropriate form with your county assessor's office after you prepared and filed the deed transferring the property from a parent to a child.

Personal Exemptions The personal exemption credits increase for 2024 to $149 (formerly, $144 for 2023) for single taxpayers, married taxpayers filing separately, and heads of households and to $298 (formerly, $288 for 2023) for married taxpayers filing jointly and surviving spouses.