Arrendamiento Bienes Without In Illinois

Description

Form popularity

FAQ

In order to qualify for a property tax exemption, your organization must be exclusively beneficent and charitable, religious, educational, or governmental and own the property that is used exclusively for charitable, religious, educational, or governmental purposes and not leased or used for profit.

Property tax exemptions are provided for owners with the following situations: Homeowner Exemption. Senior Citizen Exemption. Senior Freeze Exemption. Longtime Homeowner Exemption. Home Improvement Exemption. Returning Veterans' Exemption. Disabled Veterans' Exemption. Disabled Persons' Exemption.

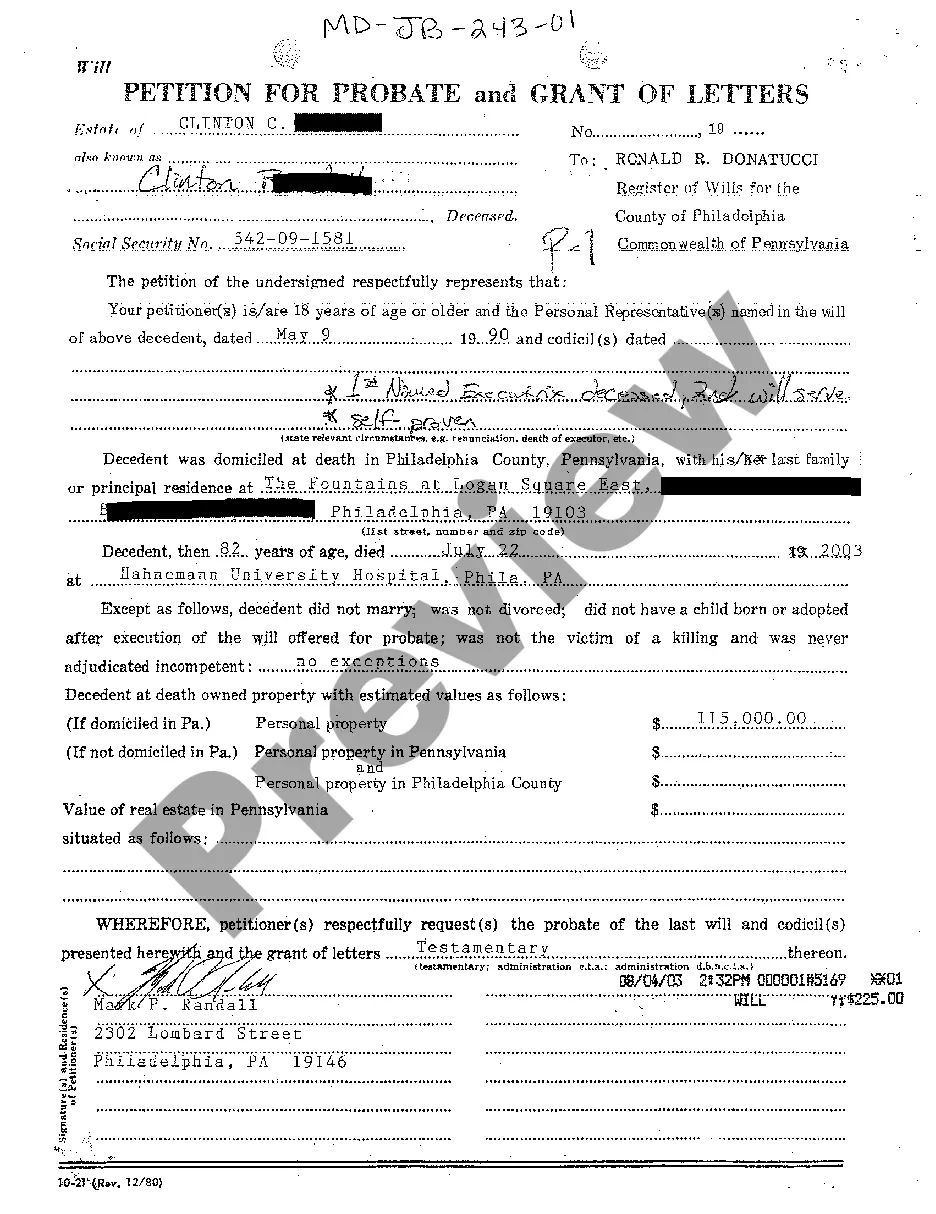

Using the affidavit is simple. Once you've completed it, you don't need to file it with the court. You just give a copy of it to the companies or people holding the property you are seeking to transfer. This will notify them that they can release the property to you.

If you are renting month-to-month, you are entitled to a 30-day written notice. Leases running year-to-year require a 60-day written notice. YOUR LANDLORD DOES NOT HAVE TO GIVE YOU ANY REASON FOR TERMINATING THE LEASE.

This annual exemption is available for property that is occupied as a residence by a person 65 years of age or older who is liable for paying real estate taxes on the property and is an owner of record of the property or has a legal or equitable interest therein as evidenced by a written instrument, except for a ...

Senior Citizen Homestead Exemption – Homeowners age 65 or older and living in their own home could be entitled to an additional homestead exemption. The homeowner should sign up for this exemption during the year in which he or she will turn 65. You will receive a renewal every year around January 1st.

To file online, use a tax professional or tax preparation software. All you need is a valid Illinois driver's license or an Illinois identification card. The information you enter must match exactly what is on your card.

Form 1023 is the IRS form used for your organization to apply for income tax-exempt status. The Form 1023 is complex, and you should seek the assistance of an attorney or tax professional to complete it. You can find more information on Form 1023 from the IRS website.