Publication 783 With Scope In Cook

Category:

State:

Multi-State

County:

Cook

Control #:

US-00110

Format:

Word;

Rich Text

Instant download

Description

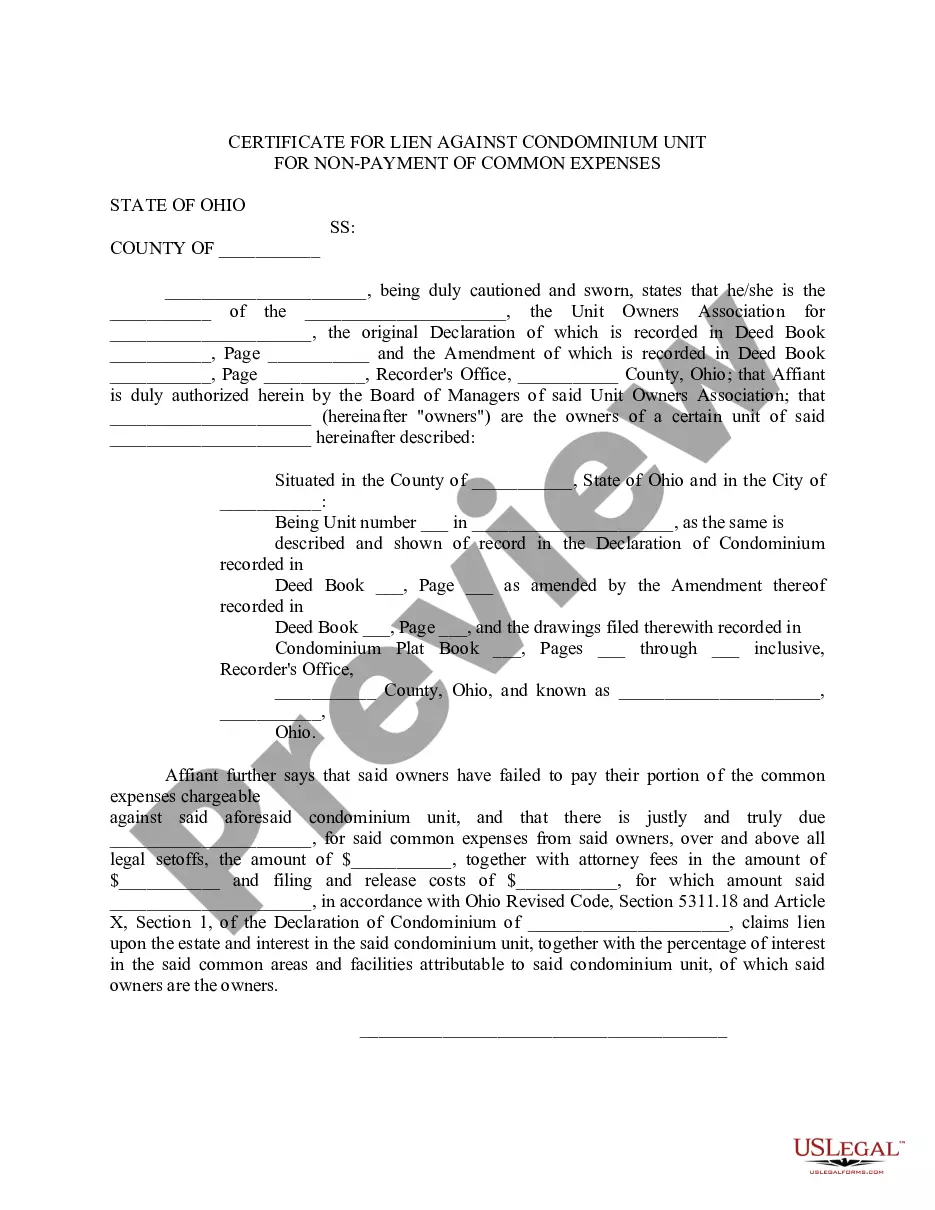

Publication 783 with scope in Cook is a vital form used in the process of applying for a Certificate of Discharge from Federal Tax Lien. This publication provides detailed instructions on submitting an application that includes necessary information such as the names and addresses of the applicant and taxpayer, a comprehensive property description, and any existing encumbrances. Key features of this publication include guidelines for appraising property values, detailing proposed costs and expenses, and instructions for providing additional information as required. The form is essential for various target audiences, including attorneys, partners, owners, associates, paralegals, and legal assistants, as it facilitates the legal process of discharging a tax lien, which can impact property transactions. Filling and editing instructions emphasize clarity, including the need for accurate legal descriptions and financial disclosures related to the taxpayer's obligations. The form also addresses scenarios of property sale and escrow arrangements, which are critical to ensuring compliance with tax regulations. By following the instructions in this publication, users can navigate the complexities of tax law and protect property rights effectively.

Free preview

Form popularity

FAQ

Proper handling of the notice of lien is extremely important. Generally the IRS can pursue collection of a tax liability up to 10 years from the date it was assessed. A Notice of Federal Tax Lien may be filed any time within that 10-year period.

For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release of Federal Tax Lien.