Certificate Of Discharge Form With Withholding (form It-2104-e) In Bronx

Description

Form popularity

FAQ

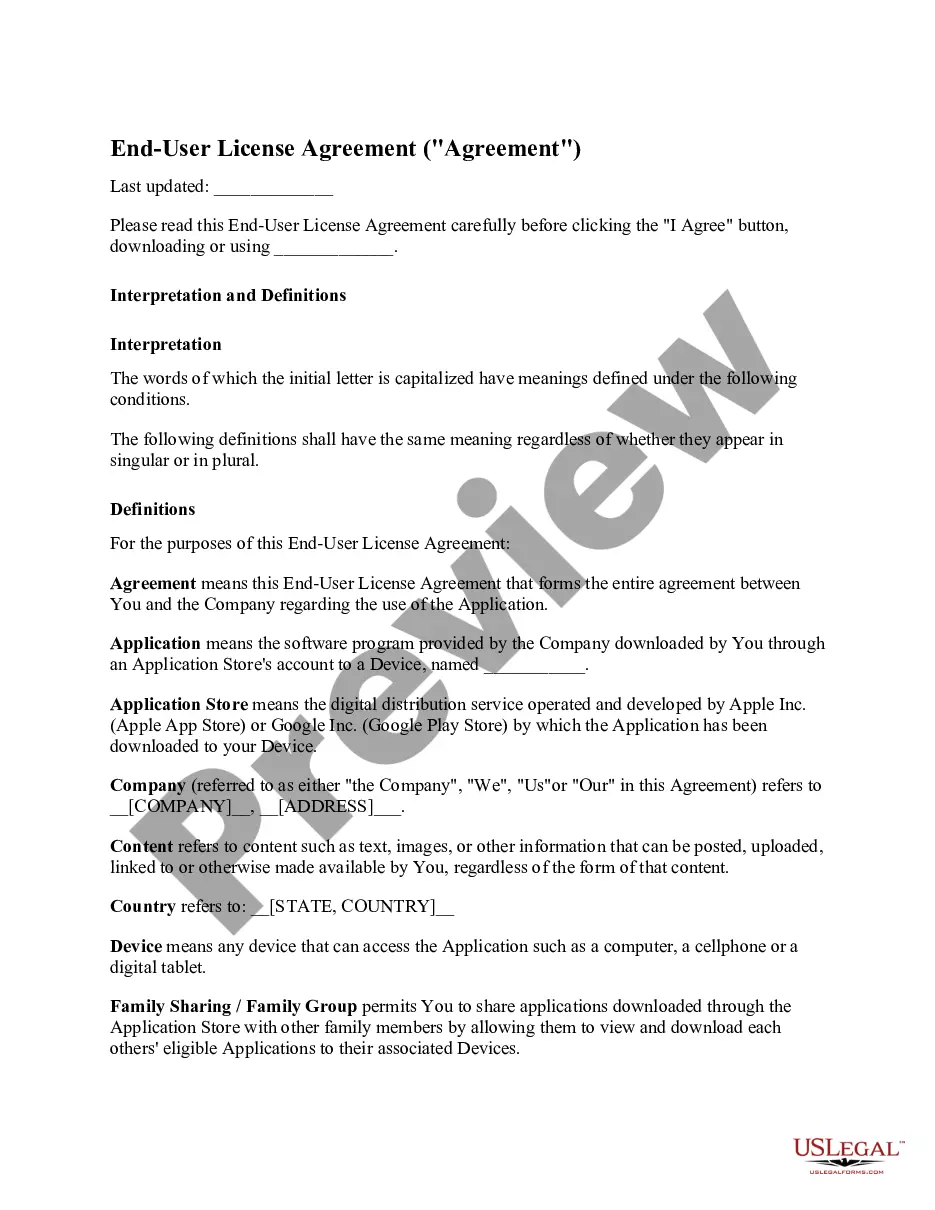

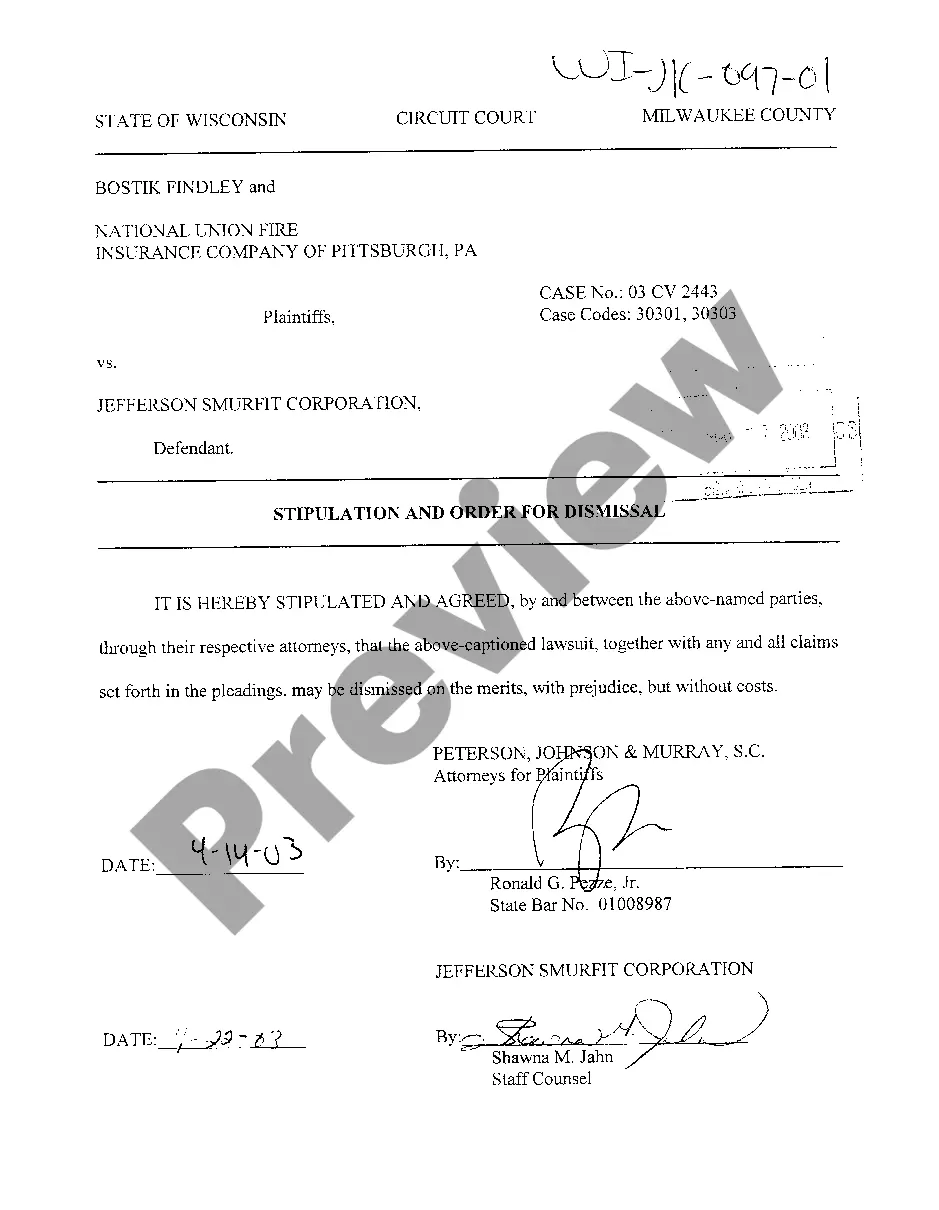

You cannot use Form IT-2104 to claim exemption from withholding. To claim exemption from income tax withholding, you must file one of the following with your employer: Form IT-2104-E, Certificate of Exemption from Withholding.

To claim exemption from income tax withholding, you must file one of the following with your employer: Form IT-2104-E, Certificate of Exemption from Withholding. Form IT-2104-IND, New York State Certificate of Exemption from Withholding.

Here's how to complete the form: Step 1: Provide Your Personal Information. Step 2: Specify Multiple Jobs or a Working Spouse. Multiple Jobs Worksheet. Step 3: Claim Dependents. Step 4: Make Additional Adjustments. Step 5: Sign and Date Your W-4.

How to fill out a W-4 form: Step-by-step Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

IT-2104.1 Nonresidence of New York State, City of New York or City of Yonkers Certificate. Employee certifies that they are not a resident of New York State, New York City or City of Yonkers for tax purposes.

New York recently released the 2024 IT-2104 (Employee's Withholding Allowance Certificate) and IT-2104-E (Certificate of Exemption from Withholding). A QR code has been added to the bottom of the IT-2104.

Here's a five-step guide on how to fill out your W-4. Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

In order to claim exemption from state income tax withholding, employees must submit a W-4 or DE-4 certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

Submit new W-4 and IT-2104-E forms annually To continue to claim full exemption, you need to submit new forms annually before the following deadlines: For federal taxes submit a new W-4 form by February 16. For state and city taxes submit a new IT-2104-E form by April 30.