All Business Purchase With Credit Card In San Diego

Description

Form popularity

FAQ

Yes, you can use your Employer Identification Number (EIN) instead of your Social Security Number (SSN) when applying for credit, but this typically applies to business credit applications.

Business owners and employees can use these cards to make purchases related to the business, making it easier to track and manage expenses. This simplifies record-keeping and accounting, helping businesses stay organized. Using a business credit card ensures a clear separation between personal and business expenses.

Whether you're operating from home or a storefront, office or industrial park, you'll need a Business Tax Certificate (sometimes referred to as a "Business License"). Business Tax Certificate applications are managed by HdL and are available online Opens a New Window. .

🔰 A business license is a type of paper issued to enterprises with conditional business lines; This type of paper is usually issued after the Business Registration Certificate.

Your business license number (sometimes called a company license number) can be found on your business license and is part of what allows you to legally operate. Your EIN (also called a tax ID) is a different number that the IRS uses to identify your business.

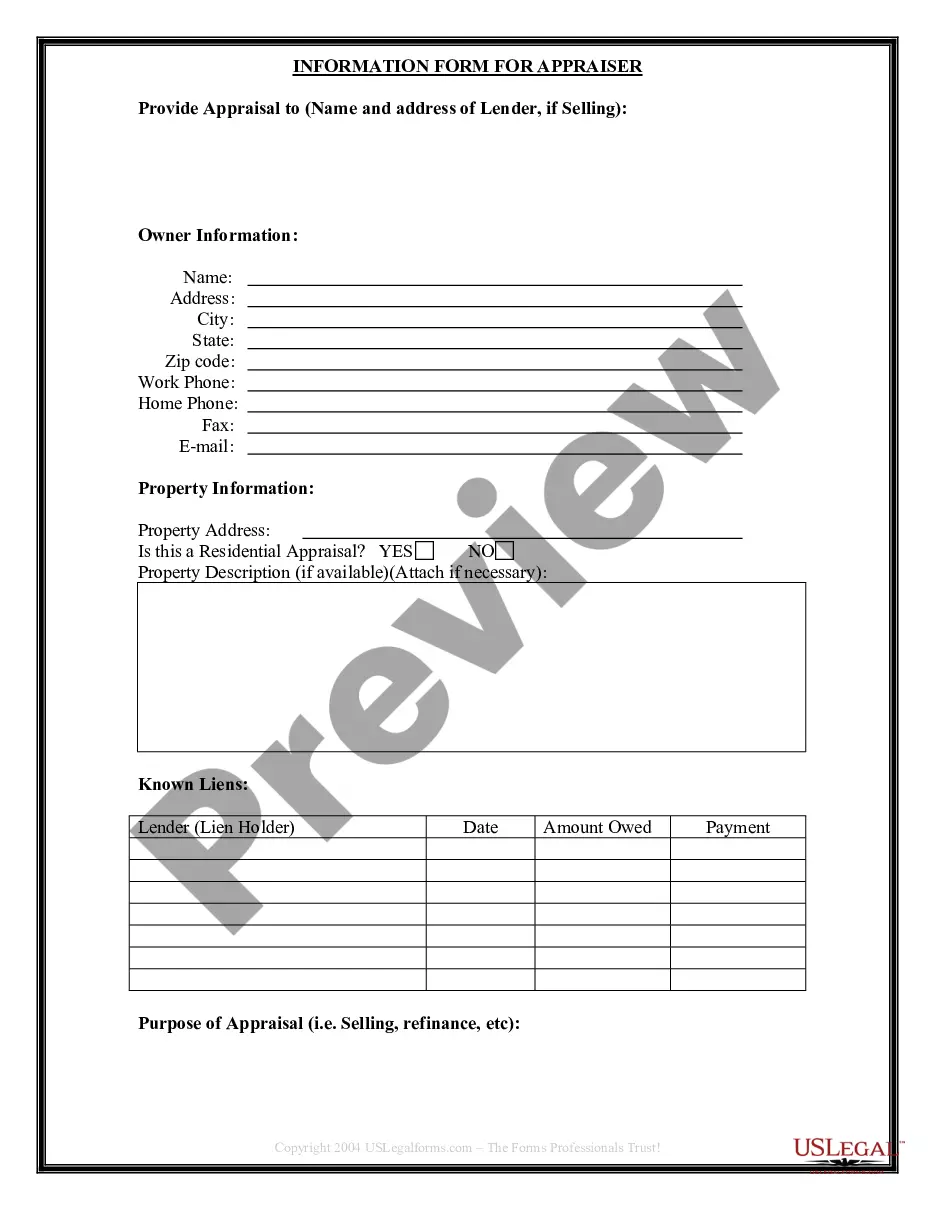

For more information on these statements or to request a Business Property Statement, please call the Assessor's Office at (858) 505-6100.

Business Licenses and DBAs (doing business as) are two separate things altogether. Business licenses are issued from the city you are in providing services to clients. Many times you must register in multiple cities if providing services to clients in cities other than the one in which you are based.

To obtain a Seller's Permit contact the CDTFA at (800) 400-7115, visit the CDTFA website for online registration information. You can also apply in person at 15015 Avenue of Science, suite 200, San Diego, CA 92128.

A seller's permit (also known as a sales tax license, retail license, sales and use tax permit, vendor's license, or sales tax permit) is a business license that allows you to collect sales tax on taxable goods and services you sell or lease, including properties if selling regularly.

If you're a small business owner and have been putting business expenses on your personal credit card, you may be wondering if you can transfer personal credit card debt to a business card. The answer is yes, you can. The process is very similar to balance transfers between personal cards.