Form with which the board of directors of a corporation accepts the resignation of a corporate officer.

Corporation Personal Held For Sale In Travis

Description

Form popularity

FAQ

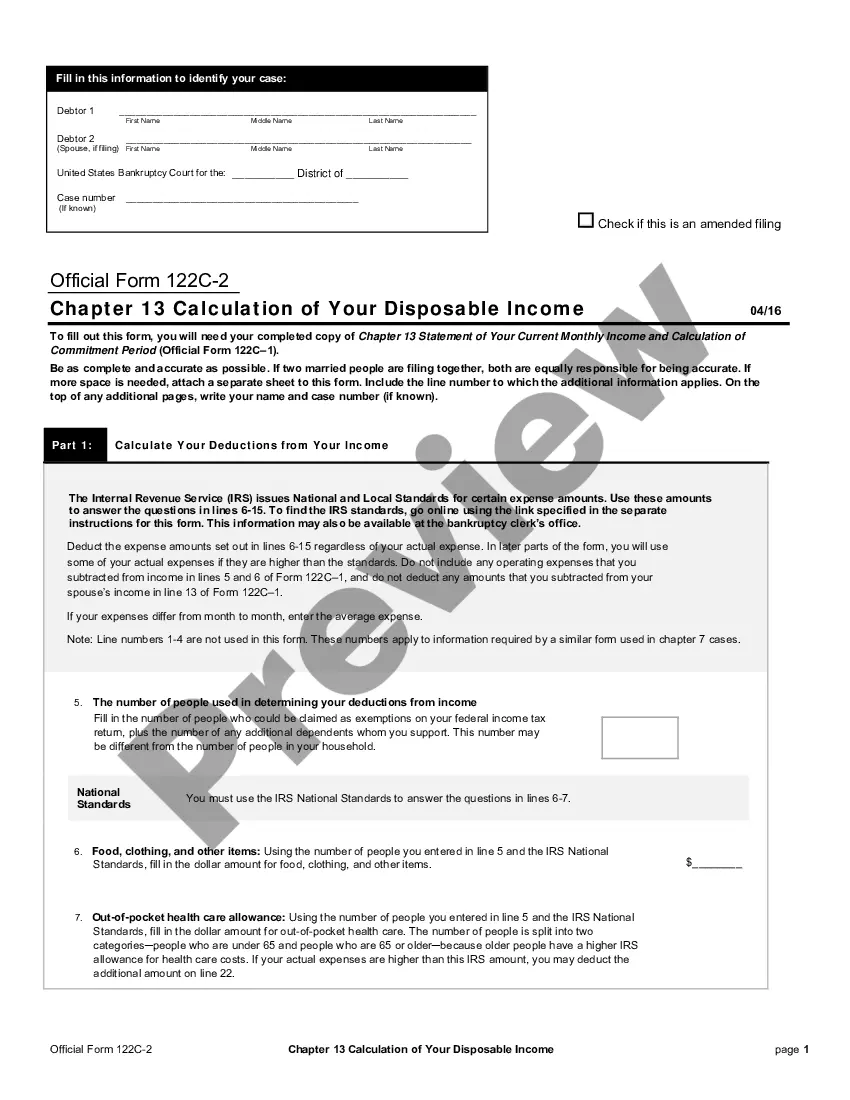

You should file these when you file your individual tax return. Form 4797, Sales of Business Property, for each year you sell or exchange property used in your business. Form 8594, Asset Acquisition Statement, if you sell your business.

You can report the sale of an S corp using IRS form 1120-S (U.S. Income Tax Return for an S Corporation) and Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.).

Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. The disposition of noncapital assets.

How to record disposal of assets Calculate the asset's depreciation amount. The first step is to ensure you have the accurate value of the asset recorded at the time of its disposal. Record the sale amount of the asset. Credit the asset. Remove all instances of the asset from other books. Confirm the accuracy of your work.

In this scenario, both the seller and buyer are required to submit Form 8594 (Asset Acquisition Statement) to the IRS to report the increase or decrease in value of the assets sold. An S corporation could hold a diverse array of assets, and each one needs to be allocated to a specific asset “class” on the IRS form.

In California, capital gains are taxed at the same rate as regular income. Any income you earn from the sale of your business will combine with your taxable income to yield your tax rate.

A rendition statement shall contain: (1) the name and address of the property owner; (2) a description of the property by type or category; (3) if the property is inventory, a description of each type of inventory and a general estimate of the quantity of each type of inventory; (4) the physical location or taxable ...

Personal property renditions (aka, personal property returns) require you to take a detailed inventory of your assets — everything from laptops and lamps to heavy machinery — across every location. As a result, one location can easily have tens of thousands of assets.

Fill in the business start date, sales tax permit number, and check any boxes that apply. If sold, please fill in the New Owners name. If moved, please fill in the new location address. Please check the box with the value that describes the property owned and used by the business.

To update your TCAD Mailing Address, you will need to contact TCAD directly to request this at traviscad. The Address Management Services office can only verify and notify TCAD of the Situs or physical Address.